Dow Is Back In Positive Territory For 2018

US stock indices added to previous session gains on Monday led by banking shares. The S&P 500 gained 0.9% to 2784.17, the Dow Jones Industrial Average rallied 1.3% to 24776.59 closing above the 50-day moving average. The NASDAQ Composite index rose 0.9% to 7756.20. The dollar rebounded: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up 0.06% to 94.066 and is higher currently. Stock index futures indicate higher openings today.

Treasury yields rose on the Federal Reserve data consumer borrowing expanded in May with total consumer credit increasing $24.6 billion to $3.9 trillion, up 7.6%. This is the fastest pace of credit growth since November.

FTSE 100 Leads European indices

European stocks advanced fifth straight session on Monday. The GBP/USD turned lower while EURUSD continued its climb and both pairs are moving higher currently. The Stoxx Europe 600 index rose 0.6%. The DAX 30 gained 0.4% to 12543.89 and France’s CAC 40 added 0.4%. UK’s FTSE 100 rose 0.9% to 7687.99. Indices opened 0.1% - 0.2% higher today.

Pound ended lower after sudden resignation Sunday night of David Davis, who led the UK’s Brexit discussions with the European Union. UK’s foreign minister quit too after Brexit minister David Davis’s resignation in protest at May’s plans to keep close trade ties with the European Union after Britain leaves the bloc.

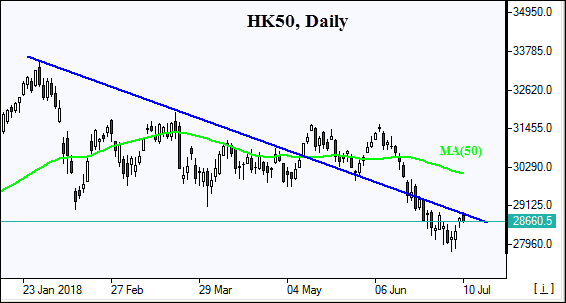

Asian Indices Mixed

Asian stock indices are mostly higher today. Nikkei gained 0.7% to 22196.89 as yen climb against the dollar continued. Chinese stocks are advancing after report China's consumer inflation picked up in June: the Shanghai Composite Index is up 0.4% and Hong Kong’s Hang Seng Index is 0.4% higher. Australia’s ASX All Ordinaries Index is down 0.4% as the Australian dollar continues its march higher against the greenback.

Brent Up On Shortage Concerns

Brent futures prices are higher today on potential supply shortages concerns after reports hundreds of oil workers in Norway were set to strike later in the day. Prices ended higher Monday over Libya and Venezuela disruptions concerns. September Brent crude settled 1.2% higher at $78.07 a barrel on Monday.