Breakout

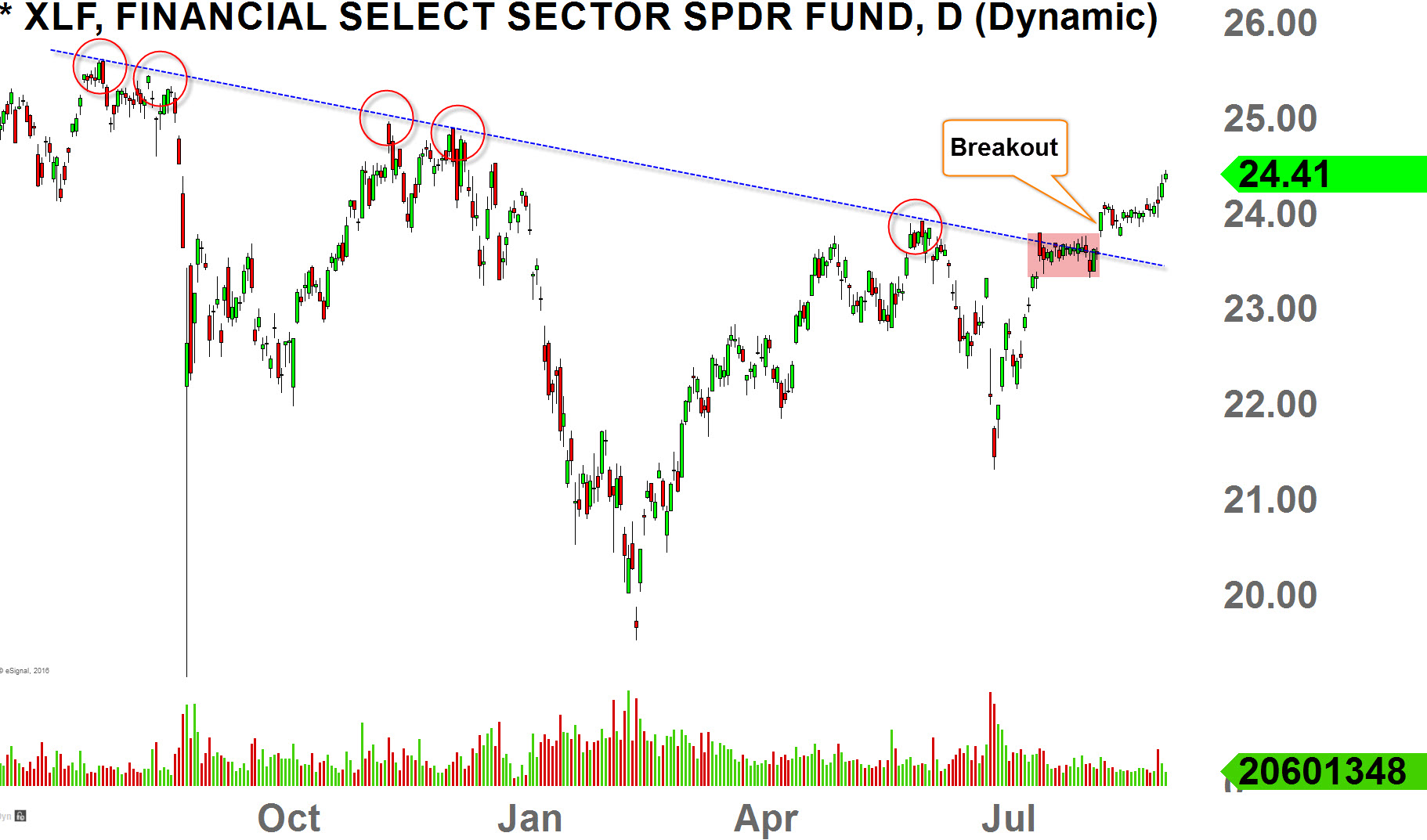

Financial Select Sector SPDR (NYSE:XLF) has been in intense scrutiny because compare to the rest of the market, this sector was struggling, thus many analysts been fearful in the overall market as well.

As a general rule (not an absolute) and in all perspective, you do want to see the banks (XLF) do well before we can say that the overall market is healthy; however we can't completely dispute the fact that the major indices price-action has been showing great strength.

As the overall market recovers from the sideways market or correctional phases, certain sectors can lag and not able to follow the major indices movement such as S&P 500, Dow Jones Industrial, NASDAQ Composite, Wilshire 5000 indices which printed all-time-high records, but the banks (XLF) are still pretty far from the July-2015 high at $25.60ish (as XLF is currently trading at $24.40ish).

Let's look at the few charts and analyze & examine what happened in July & August.

Getting Ready

As we look at the daily-chart above, we can see that XLF has been really struggling to get above the falling-resistance line (blue dotted) since the July of last year.

This was a cautionary signal in this sector as the price-action started to cultivate a downtrend.

After the Brexit panic in early July of this year, things looked really gloomy especially in this sector, while many were calling the major market crash.

But I have to say the banks were definitely in a dire situation with that prominent resistance holding this thing down. In early August, buyers finally managed to break above this prominent falling-resistance, and breakout of this bondage.

This is exactly what I mean by "certain sectors can lag". Isn't that interesting while the major index like S&P 500 has been pretty much moving sideways for about two months, Financial Sector (XLF) has been thriving.

Let's get little bit more technical with the chart below.

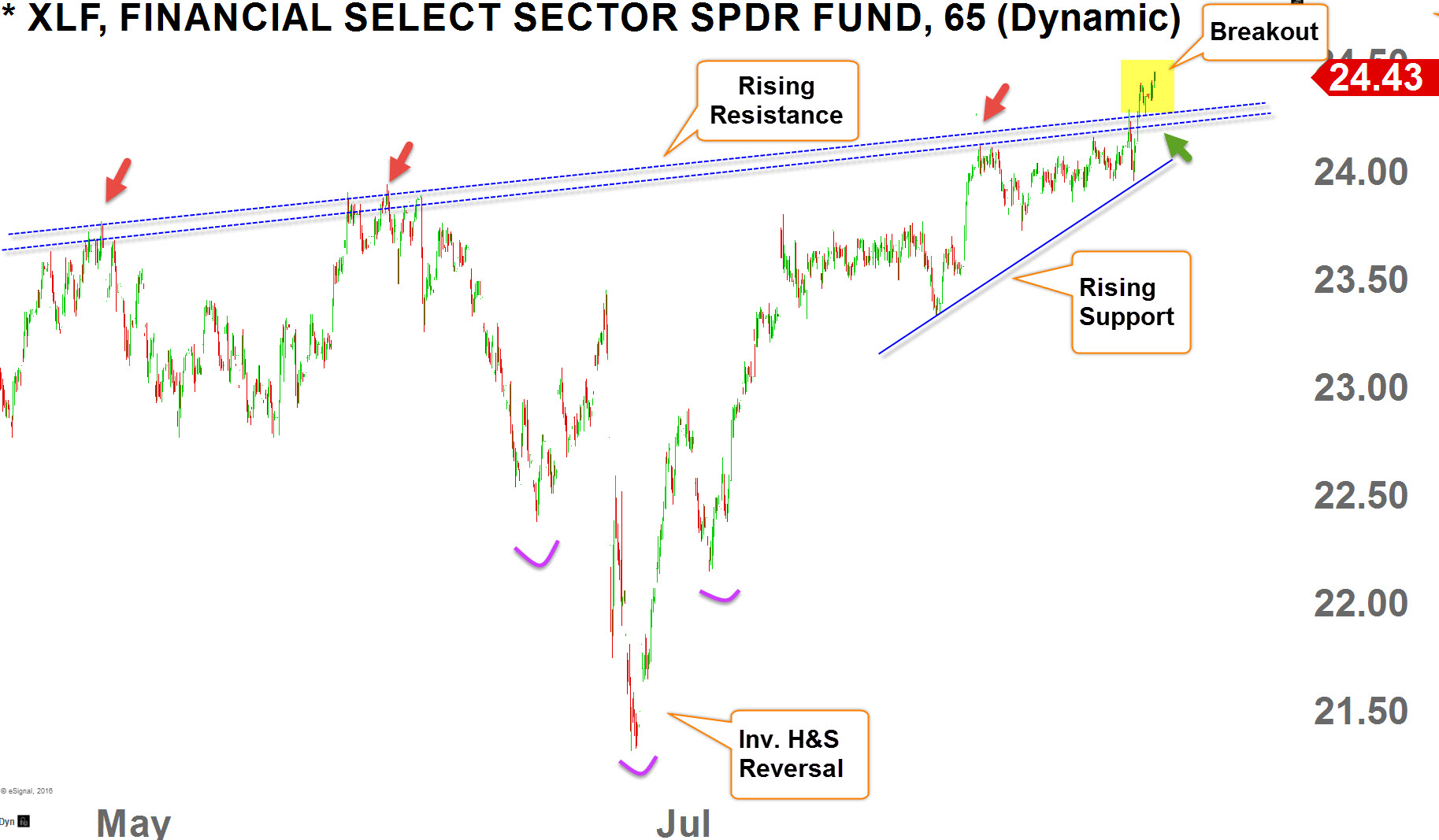

For Higher

In early July, we have formed and confirmed Inv. H&S reversal pattern, and from that move XLF has been cultivating higher-highs and higher-lows ever since.

With the recent price-action breaking out above the "Rising Resistance", the sentiment of this sector is bullish as long as it stays above $24ish.

Again, while the major indices were moving sideways last few months, the banks (XLF) has been thriving; I think the banks are playing catch up while the indices are staying put.

I believe the banks (XLF) is now ready to climb higher (with ups and downs in the minor- to intermediate-term), and print new highs well-above the July-2015 high.