We make up a weekly medium-term trade list based on CFTC reports and technical analysis.

The table below provides a description of the technical condition of the market on the most popular financial instruments, as well as information on the large speculators’ actions according to the last COT reports and the previous period.

If you want to use CFTC reports in your trading practice, you should understand that for an objective assessment of the situation it’s not enough to know the data of the last report. The dynamic is more important, in other words, comparing the statistics of large speculators’ actions in the current period with the previous one, so we publish both values in the table.

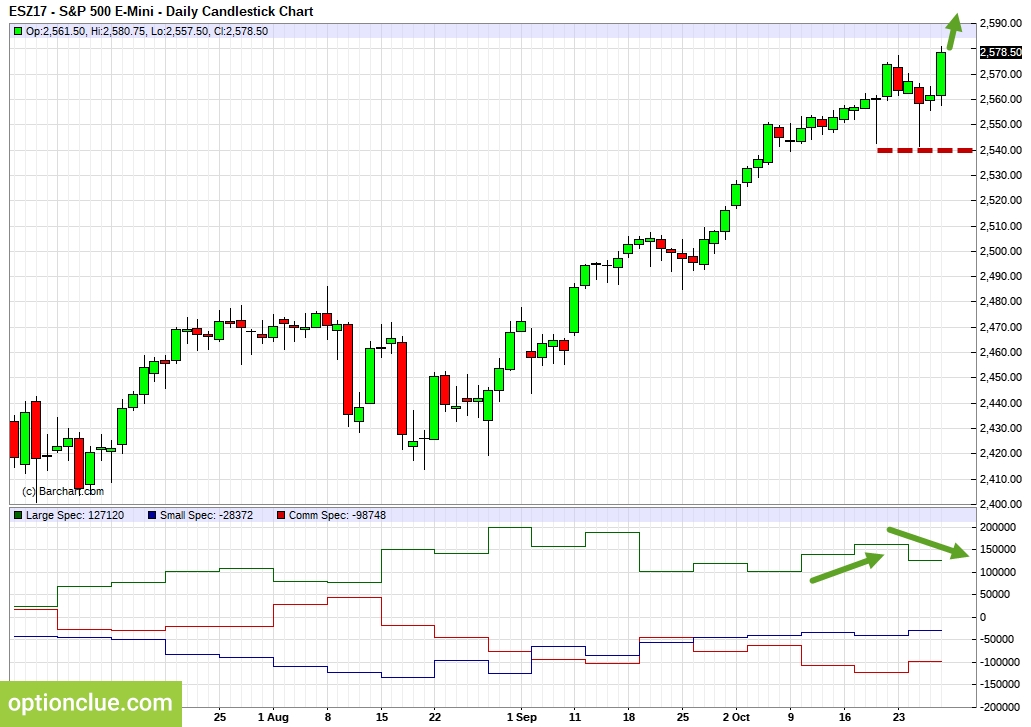

E-Mini S&P 500 (ESZ17)

The trend is bullish, the correction came to an end last week, the impulse wave develops. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of October 25-26.

COT net position indicator reversed, large speculators are selling and the professionals’ opinion doesn’t correspond to the market technical picture and it makes sense to reduce the position size when an entry point appears in the trend direction.

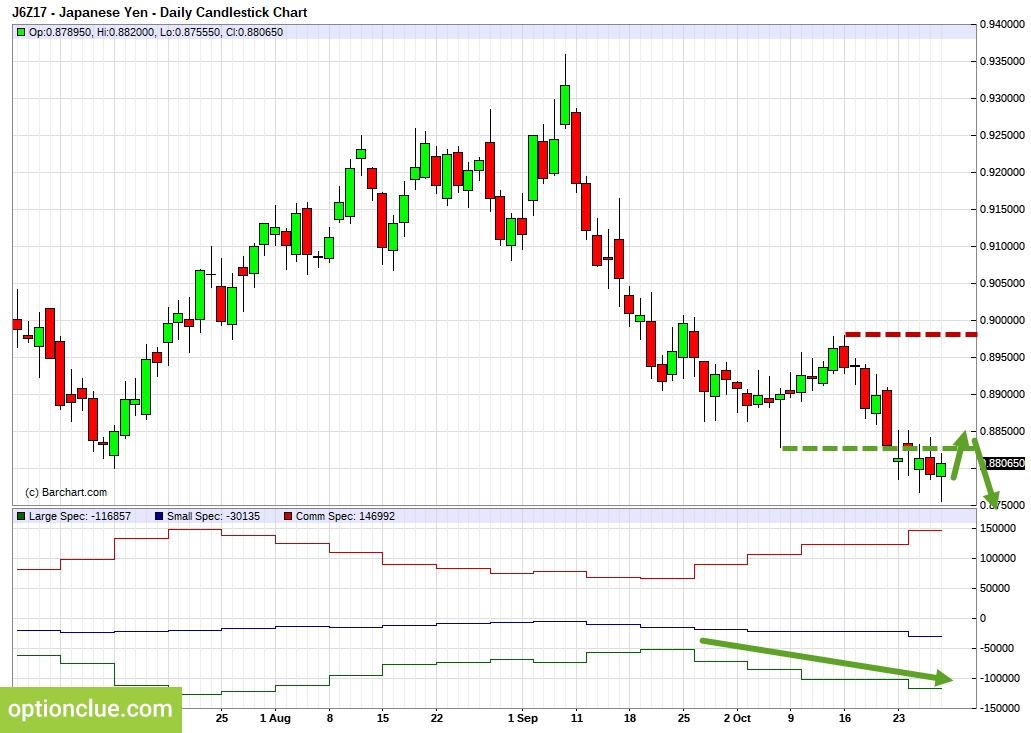

The resistance level was broken on the Daily timeframe on Monday, the trend is upward now, the impulse wave develops. A pullback buying opportunity on the Daily timeframe will appear after a correction formation.

Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of October 19-20. COT net position indicator increased but didn’t reverse and the major players’ opinion doesn’t correspond to the market technical picture.

Euro (EUR/USD)

The support level was broken on the Daily timeframe on Thursday and the trend changed. The trend is bearish, the impulse wave develops, a pullback entry point will appear after the correction formation on the Daily timeframe. Large speculators are selling and the professionals’ opinion corresponds to the market technical picture.

Swiss Franc (USD/CHF)

The trend is bullish (for USD/CHF), the impulse wave develops. A pullback entry point on the Daily timeframe will appear after the correction formation. Large speculators go on selling franc and the professionals’ opinion corresponds to the market technical picture.

British Pound (GBP/USD)

The market is in the triangle on the Daily timeframe. Before the fact of the nearest support or resistance levels breakout new medium-term positions look unattractive.

Previously opened short positions will remain relevant until the market is below the resistance level on the Daily timeframe, the highs of October 25-26. At the same time large speculators go on selling franc and the probability of breaking through the triangle down is high.

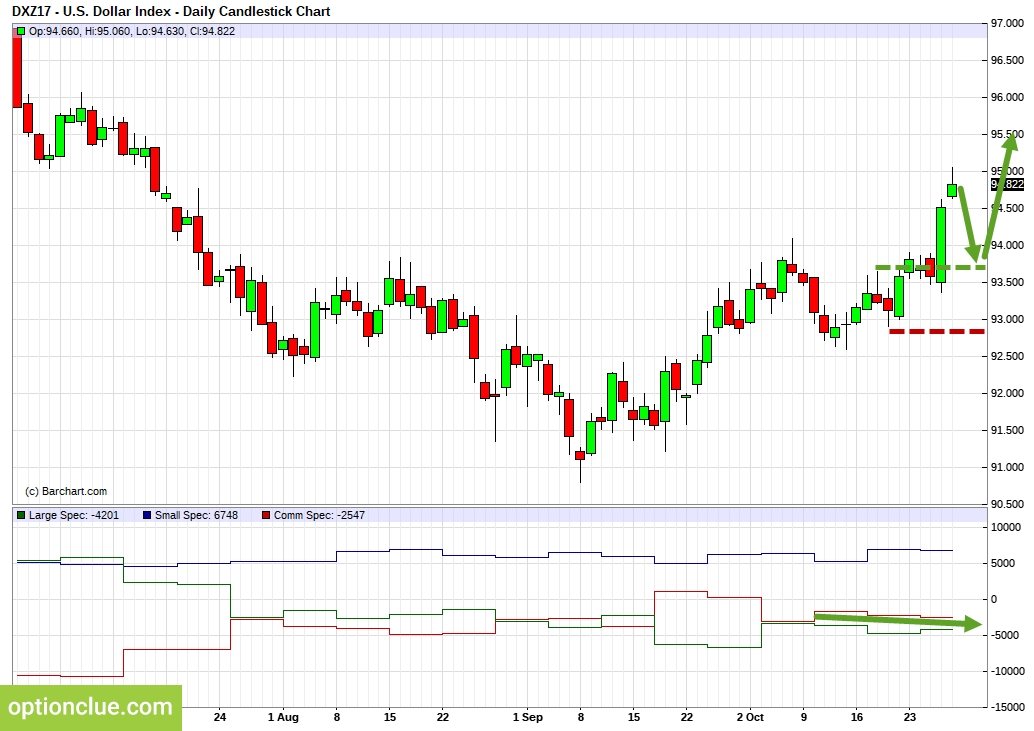

Japanese Yen (USD/JPY)

The Daily trend is bullish (for USD/JPY), the impulse wave develops. A pullback buying opportunity will appear after its completion and a new full-fledged correction formation. USD/JPY long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of October 13-16.

Large speculators continue to maintain the trend and sell Yen and the professionals’ opinion corresponds to the market technical picture.

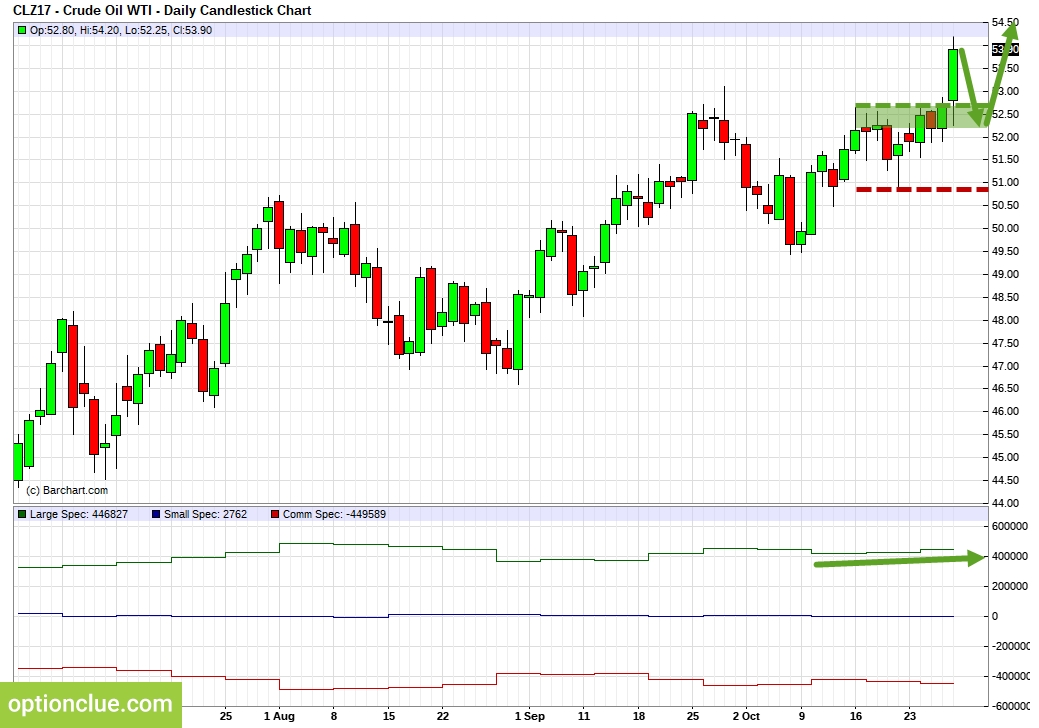

WTI Crude Oil (CLZ17)

The Daily trend is bullish, the impulse wave develops. Long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of October 19-20. COT net position indicator reversed, large speculators are buying and the professionals’ opinion corresponds to the Daily trend direction.

Canadian Dollar (USD/CAD)

The Daily trend is bullish (for USD/CAD), the impulse wave develops. USD/CAD pullback buying opportunity will appear after a full-fledged correction formation on the Daily timeframe. USD/CAD long positions will remain relevant until the market is above the nearest support level on the Daily timeframe, the lows of October 18-19.

Large speculators are selling Canadian Dollar and the professionals’ opinion corresponds to the market technical picture now.

Gold (XAU/USD)

The Daily trend is bearish, the impulse wave develops. Short positions will remain relevant until the market is below the highs of October 13-17. Large speculators continue to maintain the trend and the professionals’ opinion corresponds to the market technical picture.

Silver (XAG/USD)

The support level was broken on the Daily timeframe on Thursday and the trend changed. The trend is bearish, the impulse wave develops, a pullback entry point will appear after the correction formation on the Daily timeframe. Large speculators go on buying and the professionals’ opinion doesn’t correspond to the market technical picture. Position size reduction when an entry point appears in the trend direction can be a good idea.

Australian Dollar (AUD/USD)

The support level was broken on the Daily timeframe on Monday, the trend is downward now, the impulse wave develops. Short positions will remain relevant until the market is below the highs of October 19-20. A pullback entry point will appear after a correction formation.

Large speculators go on selling and the professionals’ opinion corresponds to the market technical picture.

New Zealand Dollar (NZD/USD)

The Daily trend is bearish, the impulse wave develops. Short positions will remain relevant until the market is below the highs of October 13-17. Large speculators continue to maintain the trend and the major players’ opinion corresponds to the market technical picture.

Russian ruble (USD/RUB)

The Daily trend is bearish (for USD/RUB), the market is in the correction. A pullback selling opportunity will appear after the correction completion. USD/RUB short positions will remain relevant until the market is below the highs of October 6-10. Large speculators continue to buy Ruble and the professionals’ opinion corresponds to the market technical picture.

Conclusions

In terms of medium-term trading, financial instruments with the correction close to completion on the Daily timeframe and with potentially the most promising risk-reward ratio are USD/RUB, EUR/JPY.

In the near future EUR/CHF, GBP/JPY, EUR/AUD, CAD/CHF can become noteworthy depending on the market correction depth.

Other financial instruments in the trade list may be also interesting, but in these markets pullback signals on the Daily timeframe are likely to occur no earlier than a week.

Good luck in trading!