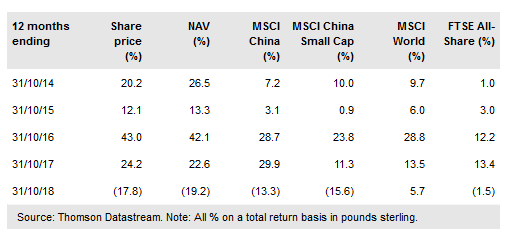

Fidelity China Special Situations (LON:FCSS) aims to provide an attractive way for investors to gain exposure to the faster-growing areas of the Chinese economy, with China’s growing economic influence raising its importance within a balanced portfolio. FCSS’s longer-term performance has been strong – its NAV total return is ahead of the MSCI China index over five years and since its launch in 2010 – but returns are negative over one year, reflecting the Chinese stock market downturn. While market sentiment has suffered due to the US-China trade dispute, earnings forecasts have been largely unaffected, and the manager has used the correction to add to holdings with strong long-term prospects at historically low valuations.

Investment strategy: Selecting for quality and growth

FCSS holds a diversified Chinese equity portfolio, unrestricted by index weightings. The manager looks for companies with robust cash flows and strong management in structurally faster-growing areas of the economy. He has a bias to small/mid-cap stocks, which tend to be under-researched and often provide better opportunities. Detailed research is conducted on all holdings by Fidelity’s extensive analyst team. Site visits and company meetings are an essential part of the investment process, with risk management a priority. Contracts for difference (CFDs) are used to add gearing, as well as to take short positions and to hedge market exposure, alongside futures and options. Unlisted securities are permitted up to 10% of the portfolio.

To read the entire report Please click on the pdf File Below..