Package delivery giant FedEx Corporation (NYSE:FDX) late Tuesday posted worse than expected Q3 earnings results, but stood by its optimistic full-year outlook.

The Memphis-based company reported Reports Q2 EPS of $2.80, which was $0.11 worse than the $2.91 that analysts had expected. Revenues rose 19.2% from last year to $14.9 billion, which was in-line with Wall Street estimates.

FedEx noted at its Express revenue rose 2% on higher rates and volume, while U.S. domestic revenue per package increased 3%. U.S. freight revenue per pound jumped 6%, and International export revenue per package gained 1%.

FedEx Ground revenue average daily volume rose 5% in Q2, helped by e-commerce and commercial package growth. FedEx Freight revenues rose 3%.

Looking ahead, FDX reiterated its previously announced full-year 2017 EPS guidance of $11.85 $12.35, which straddles Wall Street’s $12.06 estimate.

The company commented via press release:

“FedEx increased revenues and operating income despite continued low growth rates in the global economy. We are in the home stretch of our peak shipping season, and our service levels are high, thanks to the outstanding efforts of our hundreds of thousands of team members around the world,” said Frederick W. Smith, FedEx Corp. chairman, president and chief executive officer. “The integration of TNT Express into our broad portfolio of global business solutions is proceeding smoothly and according to plan.”

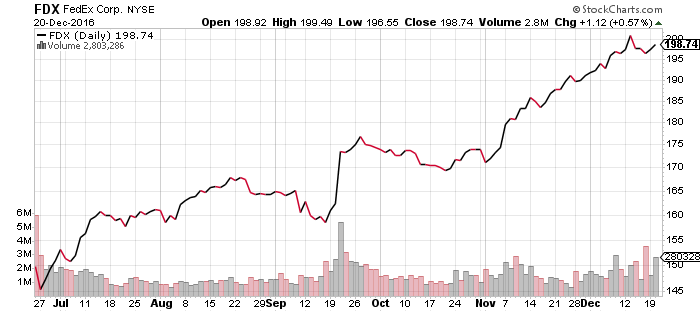

FedEx shares fell $5.54 (-2.79%) to $193.20 in after-hours trading Tuesday. Prior to today’s report, FDX had gained 33.39% year-to-date, more than tripling the performance of the S&P 500 during the same period.