- Treasury yields keep climbing after big miss in US payrolls, pressuring stocks

- Dollar mixed but steady, may get more direction from Fed and CPI data

- Pound edges up as BoE flags rate hike again but EU row casts shadow

Is it still all systems go for Fed taper?

The much anticipated jobs report on Friday raised a lot of question marks about how strong the momentum really is in the US labour market as nonfarm payrolls increased by just 194k in September, far fewer than the 500k anticipated. Fed Chair Jerome Powell had indicated he was looking for a “reasonably good” employment print to give the go ahead for tapering to start. However, once again the Delta variant appears to be causing much more disruption than what either investors or policymakers have been factoring into their economic predictions.

Nevertheless, there were enough strong points in the report to possibly give the Fed the green light. The unemployment rate dropped more than expected to 4.8% while wage growth accelerated to 4.6% y/y.

Given all the worries that this global surge in inflation might quickly become entrenched, the Fed will likely press on with scaling back its asset purchases in November and hope that jobs growth will bounce back in the coming months.

Higher yields support dollar ahead of Fed and US data activity

Those expectations have maintained the upward pressure on US yields in the aftermath of Friday’s NFP release. Ten-year Treasury yields have hit fresh four-month highs today, breaking above 1.60%, even as the jobs data has sparked talk that whilst nothing much has changed in terms of tapering, the Fed may now be more inclined to delay its first post-pandemic rate hike.

Upcoming appearances by a host of Fed speakers this week should provide more clues as to whether markets should expect a dovish or hawkish taper decision in November. CPI numbers out of the US on Wednesday will also be crucial in the run up to the November 2-3 meeting, although the minutes of the September gathering due the same day are unlikely to shed anything new.

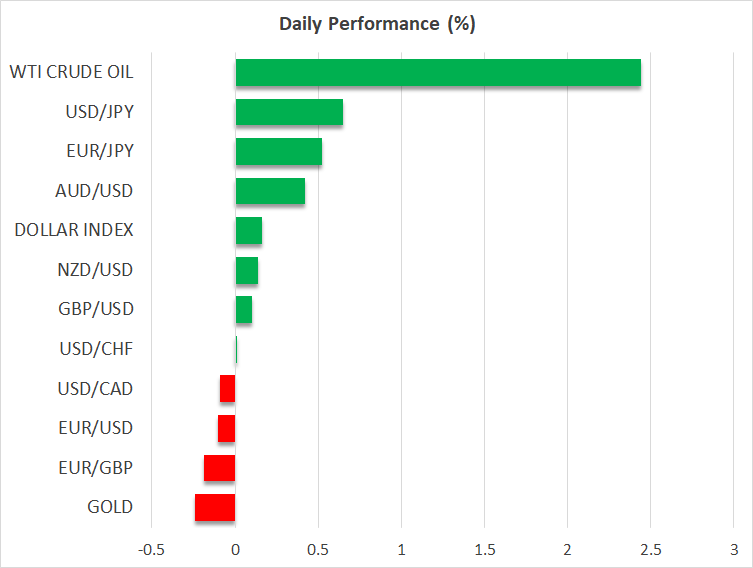

The busy US agenda this week is bound to keep the spotlight on the dollar, which has been soaring against the yen but retreating against riskier currencies. The greenback has jumped to near three-year highs versus the safe haven Japanese currency, closing in on the 113 handle today. The euro is also struggling against the mighty US dollar, hovering around the $1.1570 level since Friday.

Pound, aussie and loonie on the offensive

But other majors such as the pound and Australian and Canadian dollars are advancing. Sterling climbed a two-week high of $1.3673 earlier in the session following hawkish remarks over the weekend by Bank of England policymakers. MPC member Michael Saunders warned the British public to expect “significantly earlier” rate hikes, while Governor Andrew Bailey didn’t hide his growing concern about rising inflation.

However, the latest rate hike bets have only modestly been boosting the pound as, apart from the supply and fuel shortages that are clouding Britain’s outlook, London and Brussels are facing another standoff over Northern Ireland. The EU will reportedly unveil proposals on Wednesday to reduce checks on the Northern Irish border, but the UK government has already signalled they don’t go far enough.

Hopes that booming exports and easing lockdown restrictions will spur a quick rebound in the Australian economy are bolstering the aussie to four-week highs. The loonie is also on a roll following Friday’s super-strong employment report out of Canada and it’s being additionally buoyed by the resumption of the oil rally today.

Oil flying again, but stocks subdued

WTI oil futures have surged past $80 a barrel to the highest since October 2014 amid a worsening energy crunch around the world that’s left many countries scrambling for more supply. But the risk-on theme wasn’t evident in equity markets, with US stock futures and European shares extending Friday’s losses.

Trading is expected to be somewhat lighter on Monday as US markets are partially shut due to Columbus Day, but activity should soon pick up when the big banks kick off the Q3 earnings season on Wednesday. Wall Street ended last week higher despite the NFP-led losses. But whether stocks can recover further could depend more on what the new earnings season holds than what the Fed says this week.