“One data point is a dot, two’s a line, but three’s a trend”

After back-to-back disappointing jobs reports (while US inflation figures have simultaneously come in at multi-decade highs), Federal Reserve policymakers are no doubt on the edges of their seats hoping we don’t see a full-out “trend” of slowing labor market growth confirmed this month.

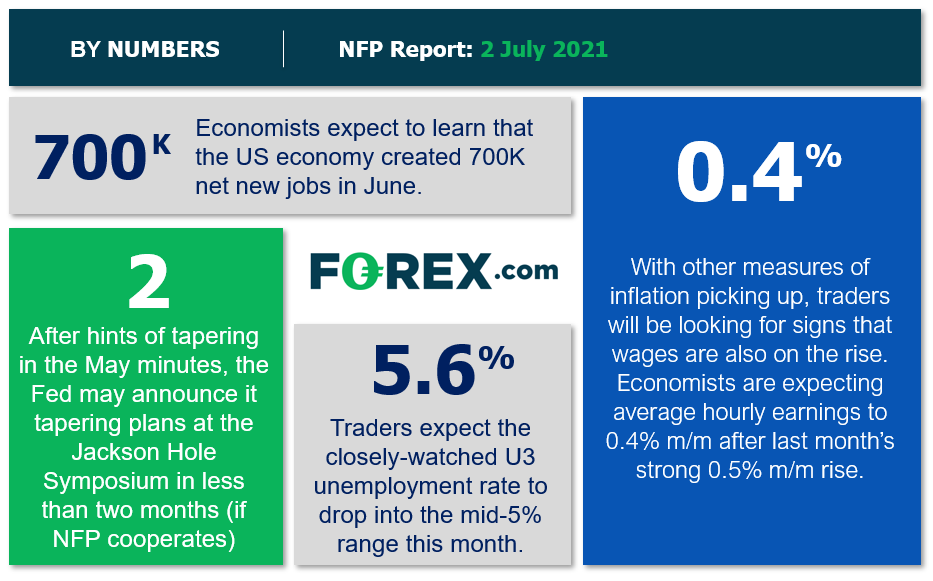

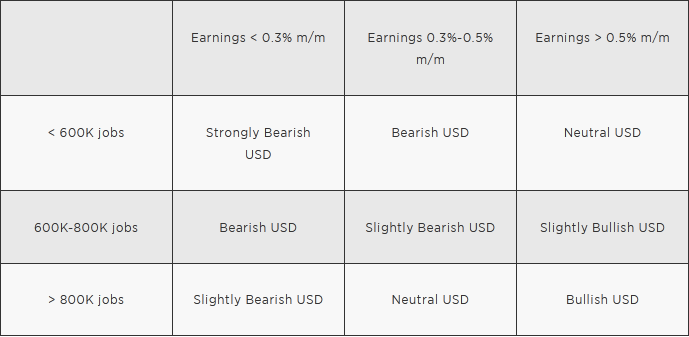

Traders and economists are expecting an improvement to 700K net new jobs following last month’s soft 559k reading, with the average hourly earnings figure expected to rise 0.4% m/m, down a tick from last month’s 0.5% rise:

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

As regular readers know, we usually focus on four historically reliable leading indicators to help handicap each month’s NFP report, but due to the vagaries of the economic calendar this month, we won’t get to see the ISM Services PMI until next week, leaving just three relevant data points:

- The ISM Manufacturing PMI Employment component printed at 49.9, down a tick from last month’s 50.9 print and barely slipping into into contractionary territory (

- The ADP Employment report came in at 692K net new jobs, moderating from last month’s downwardly-revised 886K reading.

- Finally, the 4-week moving average of initial unemployment claims fell to 393K, down from last month’s 428K print.

As a reminder, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic. That said, weighing the data and our internal models, the leading indicators point to a below expectations reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 500-600k range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.5% m/m in May, will likely be just as important as the headline figure itself.

Potential NFP market reaction

The greenback surged against most of its major rivals through the month of June, bucking the previous two-month downtrend and leaving the dollar index near the middle of its range over the last year.

We don’t have to dig too deep to see a potential trade if the NFP report comes out softer than expected. EUR/USD, the world’s most widely-traded currency pair, is trying to form a short-term double bottom pattern near 1.1850 with a bullish divergence in the 14-day RSI indicator. If we see a third consecutive miss on the NFP report, EUR/USD could be poised for a bounce back toward the mid-1.1900s moving into next week.

Meanwhile, a stronger-than-anticipated jobs report could present a buy opportunity in USD/JPY. The pair tends to have the cleanest and most logical reaction to major US economic data and is already holding its breakout to 1+ year highs above 1.1100 as of writing.