Yesterday, the minutes form the latest FOMC gathering confirmed that the Fed is unlikely to start any policy normalization any time soon. Today, we get more meeting minutes, this time from the ECB, and it would be interesting to see whether officials of this Bank stand ready to ease further if deemed necessary.

Overall, we stick to our guns that market sentiment is likely to continue improving, but not immediately, as investors may stay reluctant to drastically increase their risk exposure ahead of the earnings season.

Fed Officials Are In No Rush To Start Normalizing Policy

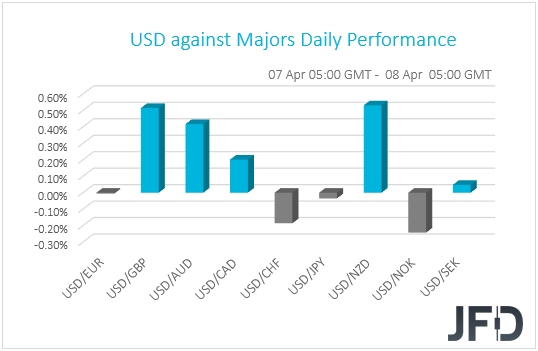

The US dollar traded higher or unchanged against all but two of the other G10 currencies on Wednesday and during the Asian session Thursday. It gained versus NZD, GBP, AUD, and CAD in that order, while it was found virtually unchanged against EUR, JPY, and SEK. The greenback underperformed only against NOK and CHF.

The relative strength of the US dollar and the weakness in the commodity-linked Aussie, Kiwi, and Loonie suggest that markets traded in a risk-off fashion yesterday and today in Asia.

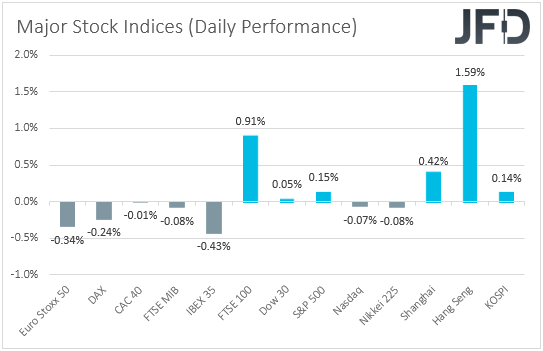

Turning our gaze to the equity world, we see that, indeed, most major EU indices ended their trading in the red, but UK’s FTSE edged 0.91% higher. In the US, the Dow Jones and the S&P 500 gained 0.05% and 0.15%, but NASDAQ slid 0.07%.

Market sentiment was improved even more during the Asian session today. Although Japan’s Nikkei 225 slid 0.08%, China’s Shanghai Composite, Hong Kong’s Hang Seng, and Sough Korea’s KOSPI gained 0.42%, 1.59%, and 0.14% respectively.

Yesterday, the main event on the economic agenda was the minutes from the latest FOMC gathering. The minutes confirmed that bond purchases will continue until substantial further progress towards the Committee’s maximum-employment and price-stability goals has been made, and that it would take some time until that happens.

They also confirmed that members see any boost in inflation this year as temporary. This is in line with what we’ve been expecting and adds more credence to our view that the Fed is unlikely to start policy normalization any time soon. After all, in the minutes it was also revealed that a number of participants highlighted the importance to clearly communicate their assessment of progress towards their goals well in advance of the time when it would warrant a policy change.

Will The ECB Stand Ready To Do More If Needed?

We get more meeting minutes today, this time from the ECB. At its latest meeting, this Bank decided to accelerate its Pandemic Emergency Purchase Program in order to stop any unwarranted rise in bond yields.

Although other major central banks share the view that the latest rise in bond yields around the globe just represents a healthy economic recovery, that’s not the case for the ECB. Rising bond yields in Europe have partly spilled over from US markets reacting to President Biden’s massive fiscal stimulus.

Therefore, with Eurozone’s economic recovery still being fragile, we will scan the minutes for hints and clues as to whether ECB officials stand ready to ease their monetary policy further if Eurozone bond yields remain elevated.

Last week, President Lagarde noted that investors could test the Bank’s willingness to rein in rising borrowing costs “as much as they want”, and thus, we believe that the minutes will show that policymakers will not hesitate to do more if needed.

With the Fed pledged to keep its policy extra-loose for longer, and with the ECB perhaps ready to ease further if deemed necessary, we believe that equities are likely to continue trending north. On top of that, inflation fears have been easing lately, resulting in a pullback in US Treasury yields, and thus, we see the case for the US dollar to trade lower, despite its relative strength yesterday.

However, market sentiment may not improve immediately as investors may stay reluctant to drastically increase their risk exposure ahead of the earnings season.

EURO STOXX 50 Technical Outlook

The Euro STOXX 50 index is still moving higher, as it continues to balance well above a short-term upside support line taken from the low of Feb. 26. Yesterday, the price found support near the 3951 hurdle, from which it rebounded. If the index continues to trade above that hurdle, or above the 21 EMA, we will stay positive with the near-term outlook.

Euro Stoxx 50 could make its way towards the current highest point of April, at 3988, which might provide an initial hold-up, maybe even sending the price back down a bit. However, if the 3951 hurdle continues to hold, another push higher could be possible. If this time the index is able to overcome the 3988 barrier, this will confirm a forthcoming higher high, this way increasing its chances of potentially testing the 4025 level, marked by the lowest point of August 2007.

On the other hand, if the index suddenly falls below the 21 EMA and then slides below the 3929 hurdle, marked by the high of Mar. 30, that could lead to a larger correction lower. Euro Stoxx 50 may then drift to the low of Mar. 31, at 3910, a break of which might clear the path towards the 3874 level, marked by the high of Mar. 18. Around there, the index may also test the aforementioned upside line, which could provide additional support.

EUR/USD Technical Outlook

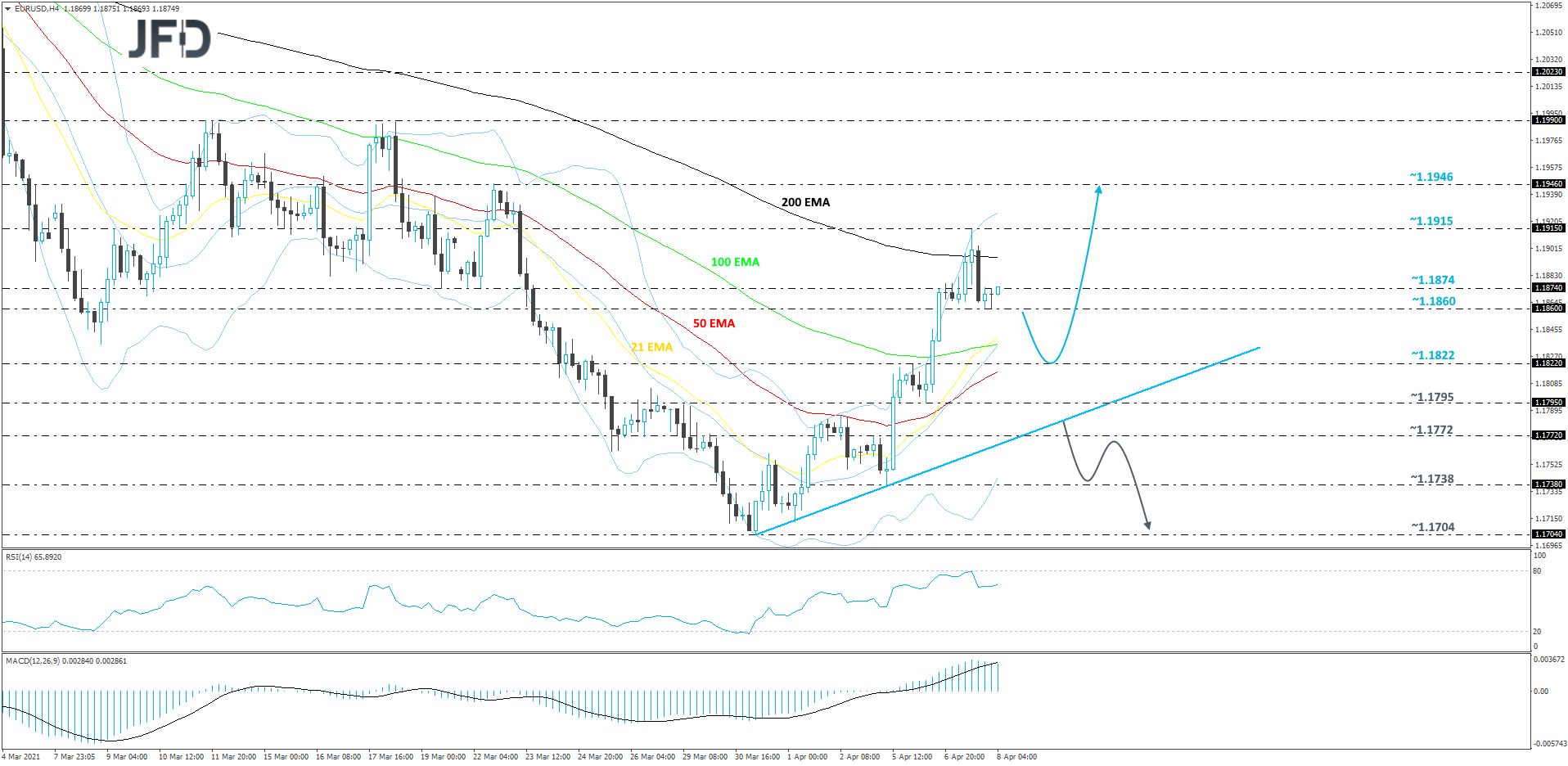

After a brief push above the 200 EMA on our 4-hour chart, EUR/USD drifted back down, but still remained well above a short-term upside support line taken from the low of Mar. 31. Even if the rate decides to move a bit more to the downside, it might still find some good support near one of the other EMAs, from which the pair could move back up again. For now, we will take a cautiously-bullish approach.

As mentioned above, there is a chance to see a move a bit lower, as on the shorter timeframe, the pair seems to be forming a bearish flag pattern. That said, if EUR/USD finds support somewhere near the 1.1822 hurdle, marked by an intraday swing high of Apr. 6, this may help quickly bring the bulls back into the game.

Such a move may lift the pair back to the 1.1860 zone, or to the 1.1915 area, marked by the current high of this week. If the buying continues and the rate overcomes that resistance area, this will confirm a forthcoming higher high, potentially setting the stage for a push to the 1.1946 level, marked by the high of Mar. 22.

Alternatively, if the pair is able to break the aforementioned upside line, this could result in a further decline, especially if EUR/USD drops below the 1.1772 zone, marked by an intraday swing high of Apr. 5. More bears could join in and drive the pair to the 1.1738 zone, marked by the low of Apr. 5, a break of which may open the door for move to the 1.1704 level, which is the lowest point of March.

As For The Rest Of Today's Events

Besides the ECB meeting minutes, we also get the US initial jobless claims for last week, which are forecast to have declined to 680k from 719k.

Tonight, during the Asian session Friday, China’s CPI and PPI for March are due to be released. The CPI rate is expected to have rebounded to +0.2% yoy from -0.2% in February, while the PPI rate is anticipated to have risen to +3.5% yoy from +1.7%.

As for the speakers, we will get to hear from Fed Chair Jerome Powell, but we don’t expect any fireworks. We expect him to reiterate his dovish stance, noting that it is too early to start discussing monetary policy normalization.