Helen of Troy Limited (NYSE:EL) is slated to release first-quarter fiscal 2020 results on Jul 9. The company’s earnings surpassed the Zacks Consensus Estimate in the trailing four quarters, the average being 15.9%. Let’s see how things are placed ahead of the release for this renowned beauty products as well as other personal and home care products player.

Aspects Likely to Impact Q1

Helen of Troy’s Leadership Brands are yielding and likely to remain an upside in the first quarter. In this context, brands like OXO, Honeywell (NYSE:HON), Braun, PUR, Hydro Flask, Vicks and Hot Tools are well positioned to enhance market share. Notably, management is on track with investments toward product launches and marketing efforts for Leadership Brands that are likely to boost prospects. Moreover, the company is steadily gaining from growth in online sales and digital marketing efforts. Also, the company’s efforts to streamline supply chain network and boost capabilities of the Beauty and Nutritional Supplements units are encouraging.

In spite of these positive factors, Helen of Troy’s performance is exposed to certain headwinds. The company is under pressure from escalated costs stemming from higher tariffs, advertising, freight and transportation. Persistent rise in costs is a threat to the company’s bottom line in the quarter to be reported.

Further, management expects adjusted earnings per share to decline in the range of 4-8% in the first half of fiscal 2020. In fact, most of the decline is anticipated to be witnessed in the first quarter, thanks to tough year-over-year comparisons stemming from the cough/cold/flu-related volatility. Additionally, adverse currency fluctuations are likely to weigh on performance in the Beauty and Health & Home categories.

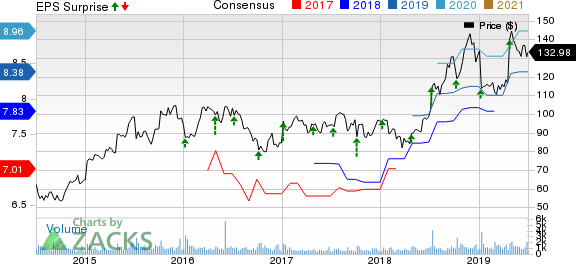

Helen of Troy Limited Price, Consensus and EPS Surprise

Estimates are Unimpressive

The Zacks Consensus Estimate for fiscal first quarter earnings has been stable at $1.68 in the past 30 days. The estimate indicates a decline of 10.2% from earnings delivered in the year-ago quarter.

Moreover, the consensus mark for revenues is pegged at $353.2 million, indicating a drop of almost 0.4% from the year-ago quarter’s tally.

What Does the Zacks Model Say?

Our proven model doesn’t show that Helen of Troy is likely to beat bottom-line estimates this quarter. For this to happen, a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Though Helen of Troy carries a Zacks Rank #3, its Earnings ESP of 0.00% makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks Poised to Beat Earnings Estimates

Estee Lauder (NYSE:EL) has an Earnings ESP of +6.58% and a Zacks Rank #3.

Lamb Weston Holdings (NYSE:LW) has an Earnings ESP of +2.31% and a Zacks Rank #3.

Philip Morris International (NYSE:PM) has an Earnings ESP of +0.54% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

The Estee Lauder Companies Inc. (EL): Free Stock Analysis Report

Helen of Troy Limited (HELE): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Philip Morris International Inc. (PM): Free Stock Analysis Report

Original post

Zacks Investment Research