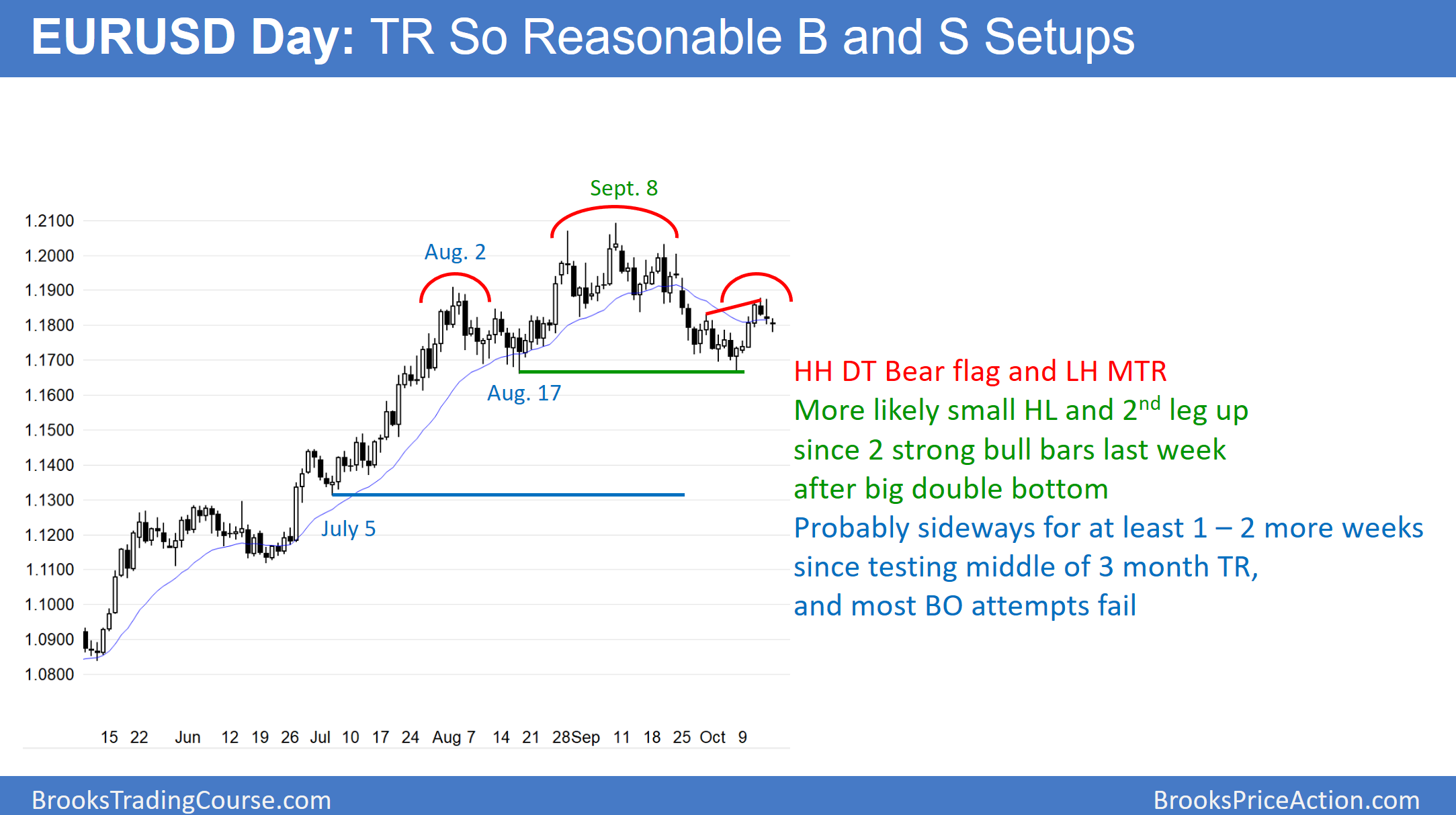

The daily EUR/USD pulled back after last week’s string reversal up. The odds favor a 2nd leg up and a continued trading range.

EUR/USD has been in a trading range for 3 months. Trading ranges always have both a reasonable buy setup and a reasonable sell setup. Most breakouts fail, and therefore these setups usually fail and are replaced by other buy and sell setups.

The bulls reversed up from the August 17 low 2 weeks ago, forming a big double bottom bull flag. The chart had consecutive big bull bars closing on their highs. That reversal up was strong enough to make at least a small 2nd leg sideways to up likely this week. This is especially true because the 2-day pullback is made of doji bars instead of strong bear bars. Hence, the odds favor at least 1 – 2 day small leg up starting in the next 3 days.

The bears have a 3 month head-and-shoulders top. Last week’s rally is the right shoulder. This is also a lower high major trend reversal. Finally, Thursday's high formed a small higher-high double-top bear flag with the September 29 lower high. Major trend reversals have a 40% chance of leading to a major reversal after they break out. Since this one has not yet broken out, the odds favor a continuation of the range.

Overnight EUR/USD Forex Trading

The 5-minute chart reversed up slightly overnight from its 3-day pullback. Friday was a doji bar on the daily chart, and today so far is another one.

In addition, the past 3 days have been small. This is trading range behavior, and it therefore increases the odds of another small trading range day again today. However, the daily chart is likely to have a 2nd leg up starting this week. Furthermore, the rally will probably be about the same size as lat week’s rally. Therefore, the bulls will be looking to hold part of their longs for a 100 – 200 pip swing trade up.

While the bears might swing part of their short positions, they know that shorting at the bottom of a 3-month trading range is a low probability bet. Most will therefore only scalp until there is a strong reversal down. Many will wait to sell after a strong breakout below the bottom of the range, or from a reversal down from near the top of the range.