EUR/USD: Profit taken at 1.1960, buy again at 1.1830

Macroeconomic overview:

- The USD strengthened slightly in the yesterday’s afternoon, with the near-term focus on a possible Senate vote on a U.S. tax plan later in the week. Worries about potential delays in the implementation of U.S. tax cuts and the possibility of reform measures being weakened have weighed on the greenback in recent weeks.

- A U.S. Senate Republican tax bill strongly backed by President Donald Trump faced potential opposition on Monday from two Republican lawmakers who could prevent the sweeping legislation from reaching the Senate floor. Senators Ron Johnson and Bob Corker, both members of the Senate Budget Committee, said they could vote against the tax package at a Tuesday hearing that Republican leaders hoped would send the legislation to a full Senate vote as early as Thursday. Each senator is seeking different changes to the legislation. Their opposition could create the first major hurdle for the Republican tax overhaul in the Senate, where political infighting killed the party's effort to overturn the Obamacare healthcare law earlier this year

- Jerome Powell, the nominee to chair the Federal Reserve, defended the Fed's use of broad crisis-fighting powers in remarks prepared for his Tuesday Senate confirmation hearing, positioning himself as an extension of the central bank policies of current Chair Janet Yellen and her predecessor Ben Bernanke. Powell, who is currently a member of the Fed's Board of Governors, endorsed the core ideas that have defined U.S. central banking since the financial crisis of 2007 to 2009 - a willingness to move aggressively against a downturn, and an insistence on flexibility and independence from political influence in setting policy. On current monetary policy, he said, "We expect interest rates to rise somewhat further and the size of our balance sheet to gradually shrink."

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

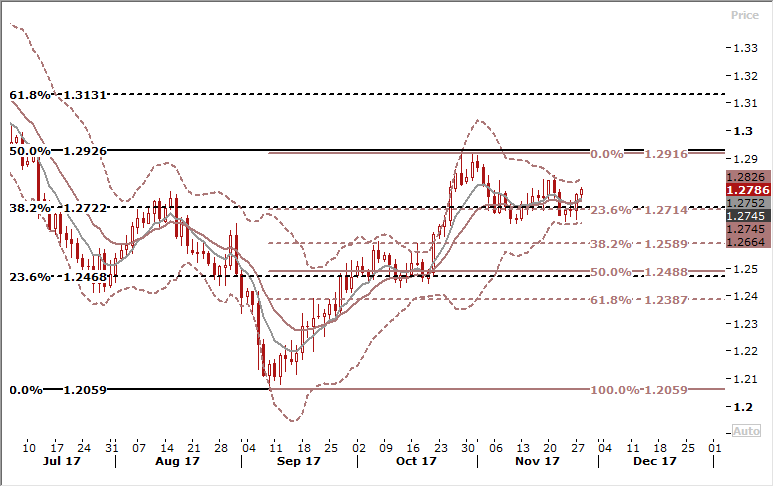

Technical analysis and trading signals:

- The EUR/USD is looking a little overstretched on the charts. We took profit at 1.1960 on Monday and our strategy now is to use corrective action as opportunities to rejoin bull trend.

- We placed bid at 1.1830.

USD/CAD: Focus on OPEC meeting

Macroeconomic overview:

- The CAD turned weaker against the USD on Monday, as U.S. oil prices pulled back from a two-year high amid uncertainty about Russia's resolve to extend output cuts at a meeting of producing countries this week.

- Members of the Organization of the Petroleum Exporting Countries and other key producers, including Russia, will meet on November 30 to discuss whether to continue with the cuts after they agreed last January to withhold 1.8 million bpd of output.

- United Arab Emirates energy minister Suhail bin Mohammed al-Mazroui said on Tuesday that while the meeting would not be easy, he was personally optimistic producers would reach an agreement that served the market.

- Saudi energy minister Khalid al-Falih said the oil market should wait for the outcome of this week's OPEC meeting when asked on Tuesday in Dubai about how long producers might extend their cuts.

- Russia's economy was negatively affected in October by the ongoing curbs, which saw Moscow agree to cut output by 300k bpd, Economy Minister Maxim Oreshkin said on November 23.

- We expect the following: 1. the current deal to be extended to the end of 2018, 2. the production cut to be increased to about 2 million bpd from 1.8 million bpd, 3. Nigeria to be added to the deal (but not Libya, where the political situation is still too unstable for a credible commitment) and 4. the export cap for Saudi Arabia (at around 6.6-6.8 million bpd) might be formalized after having been introduced last summer.

- The loonie's next major catalyst could come at the end of this week, with both a domestic jobs report for November and GDP data for the quarter that ended in September due on Friday.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

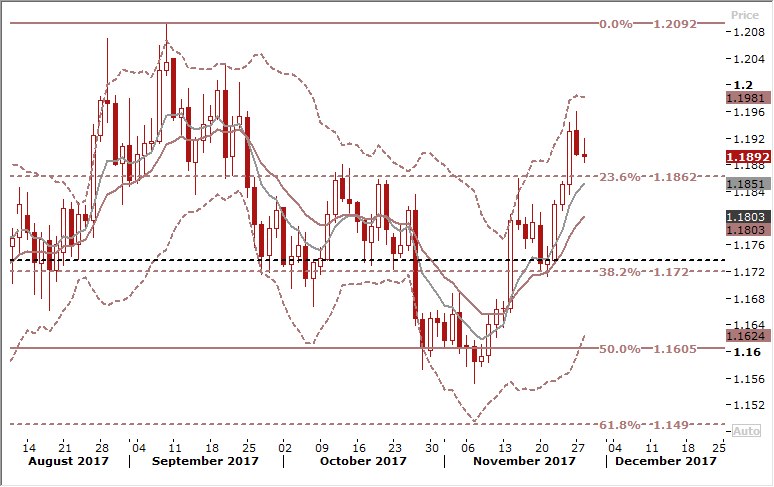

Technical analysis and trading signals:

- The USD/CAD remains in consolidation mode. The pair did not manage to break below the November 23 low at 1.2672 yesterday and today’s is back above short-term moving averages. The nearest resistance level is November 21 high at 1.2836.

- We think that using upticks as selling opportunities could be a good trading idea. We stay short at 1.2815 for 1.2500.