The USD hit three-week lows on Friday after data showed the US economy created more jobs than expected in June, but a closely watched inflation gauge - wage growth - rose less than forecast and the unemployment rate increased.

As a result, expectations dimmed somewhat that the Federal Reserve would raise interest rates a fourth time this year. Our EUR/USD long looks good now.

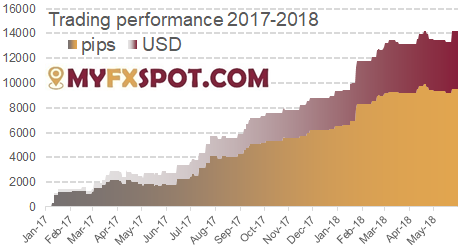

This is how MyFXspot.com trades now:

EUR/USD

Trading strategy: Long

Open: 1.1700

Target: 1.1830

Stop-loss: 1.1635

Recommended size: 2.50 mini lots per $10,000 in your account

Short analysis: The long remains in solid shape. A new short-term high has been set, RSIs are biased up, the 61.8% Fib of 1.1853-1.1508 and daily cloud base have been pierced and the 10-day SMA is about to cross above the 21-Day SMA. The 1.1830 target looks set to be hit soon.

GBP/USD

Trading strategy: Long

Open: 1.3255

Target: 1.3415

Stop-loss: 1.3175

Recommended size: 1.88 mini lots per $10,000 in your account

Short analysis: The GBP/USD broke above 30-DMA resistance (1.3273). Further resistance is at 1.3315 the June 22 high. Bears need a close below 10-day MA (1.3196) to regain momentum, but in our opinion long trade is much better idea for now.

USD/JPY

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: Important levels to the stagnating uptrend since March are the Kijun and 55-DMA at 109.93/88. A close below those props would increase downside risk. We stand aside for now.

USD/CAD

Trading strategy: Sell

Open: 1.3095

Target: -

Stop-loss: 1.3180

Recommended size: 2.31 mini lots per $10,000 in your account

Short analysis: The USD/CAD resumes downtrend as USD sold off broadly post-non-farm payrolls. Chances of a Bank of Canada interest rate increase at the July 11 announcement climbed to more than 90% from 88% before the data, the overnight index swaps market indicated. We have placed a sell order at 1.3095

AUD/USD

Trading strategy: Buy

Open: 0.7415

Target: -

Stop-loss: 0.7345

Recommended size: 2.14 mini lots per $10,000 in your account

Short analysis: The 10-day MA limits the downside and RSIs are biased up. Monthly RSI is diverging. We closed our short position at the entry level (0.7410) and we will be looking to switch to the long. Bid placed at 0.7415.

EUR/GBP

Trading strategy: Long

Open: 0.8820

Target: 0.8910

Stop-loss: 0.8775

Recommended size: 2.51 mini lots per $10,000 in your account

Short analysis: Our long is in black now, but long upper wick on Friday's candlestick is worrying.  Trading ideas by MyFXspot.com

Trading ideas by MyFXspot.com