EUR/USD: Fed balance sheet unwinding is largely priced in

Macroeconomic overview: We expect the Committee to announce the gradual normalization of its balance sheet today. Despite lower inflation readings and other headwinds – increased geopolitical risk, fiscal fights in Washington and the unknown economic consequences of the latest natural disasters – Fed officials have, until recently, reiterated that the announcement should be made “relatively soon”. In our view, this means the announcement will be made today. The most relevant comments in this respect were made at the beginning of this month by the Fed’s vice chair, William Dudley, and by usually dovish governor Lael Brainard. As laid out before, balance-sheet normalization is to be achieved by decreasing the amount of maturing debt that will be reinvested. In this process the Fed will reinvest maturing bonds only to an extent that they will surpass a defined cap level. The initial monthly cap is USD 10bn (USD 6bn of USTs and USD 4bn of MBS). This will increase on a quarterly basis by USD 10bn until it reaches USD 50bn per month (USD 30bn of USTs and USD 20bn of MBS). That means that, after the initial announcement, balance-sheet normalization will be on autopilot.

With the balance-sheet announcement being broadly expected, the bigger question may actually be whether the FOMC will adjust its outlook for short-term interest rates. We do not think it will and anticipate that FOMC members’ median interest-rate projections (the “dots”) will continue to show another rate hike occurring this year, followed by three more in 2018 and another three in 2019. To be sure, a few individual members may downgrade their rate expectations, but this is unlikely to be enough to move the median. If anything, the biggest risk is for a downward revision of the 2019 “dot”. The newly introduced 2020 forecast is likely to show no, or only very limited, further tightening beyond 2019. This is because the median dot for 2019 should be confirmed at 3% or slightly below, which is in line with the Fed’s estimate for the equilibrium rate, and the FOMC probably does not want to indicate tightening beyond that level at this point. The Fed’s economic and inflation forecasts should remain pretty much unchanged as well compared to June. That implies ongoing GDP growth of around 2%, a decline in the unemployment rate to 4%-4.25% and, most importantly, a return to 2% inflation by the end of 2018.

Similar to the Fed’s Summary of Economic Projections, the post-meeting statement is unlikely to contain important changes either. Most importantly, it will reiterate that the FOMC expects that “economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate”, while it “is monitoring inflation developments closely”. With all written releases almost unchanged, Fed Chair Janet Yellen’s press conference will remain an important wildcard. While Janet Yellen is also likely to reiterate the baseline outlook, she will certainly acknowledge the increased risks and may sound a tad more cautious about the timing of the next rate hike. For now, we continue to see the next move as occurring in December.

We do not think the Fed announcing the start of its balance sheet normalization will be a game changer for EUR/USD. The unwinding of the balance sheet is largely priced in as, other than the start date, we already know a fair amount of detail.

As far as the dot plot is concerned, any dovish changes may be taken as a confirmation of the market’s skepticism regarding the Fed’s rate hike intentions. That said, the drop in yields since the last FOMC meeting – and the generally low probability of a rate hike priced in by the market over the next two years – suggests that this is also at least partly in the price. We see the risks for EUR/USD as balanced.

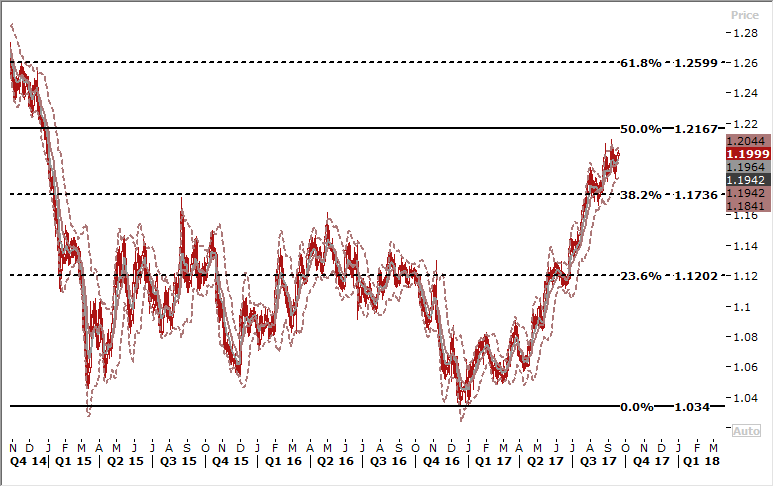

Technical analysis: EUR/USD extends to a new recovery high today at 1.2019 and the time spent above the 14-day exponential moving average gives hope to EUR/USD bulls. September 11 high at 1.2039 is the next resistance.

Short-term signal: Stay long for 1.2250.

Long-term outlook: Bullish

EUR/CHF at its highest since January 2015

Macroeconomic overview: The Swiss franc fell to its lowest level in over two years against the euro on Tuesday, as relative calm over North Korea eased demand for perceived safe-haven currencies.

The franc, which tends to gain in times of crisis, fell as much as half a percent to 1.1565 francs per euro in London trade. That was its lowest level since January 15, 2015, when the Swiss central bank dropped the franc's "cap" against the euro.

In a move only punctuated by short-lived spikes on geopolitical tensions, the Swiss currency has weakened more than 8% against the euro this year.

That prompted the Swiss National Bank last week to temper its view of the franc's over-valuation. The central bank ditched its nearly three-year mantra that the franc was "significantly over-valued", saying instead that the currency remained "highly valued".

But we think the shift in language should not be taken as heralding a departure from the SNB's ultra-loose monetary policy. While the SNB is in no rush to tighten policy, other central banks (ECB, BOE) are moving closer to tightening policy, that is starting to feed through some downward pressure on the CHF.

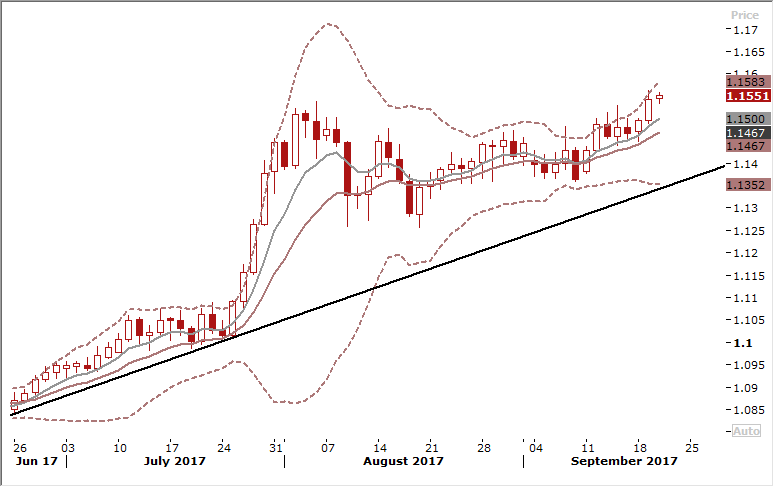

Technical analysis: The EUR/CHF remains above 14-day exponential moving average and broke above August 4 high of 1.1537. This opens the way to further gains, as fundamentals supports stronger EUR/CHF.

Short-term signal: We stay long. Target raised to 1.1690.

Long-term outlook: Bullish

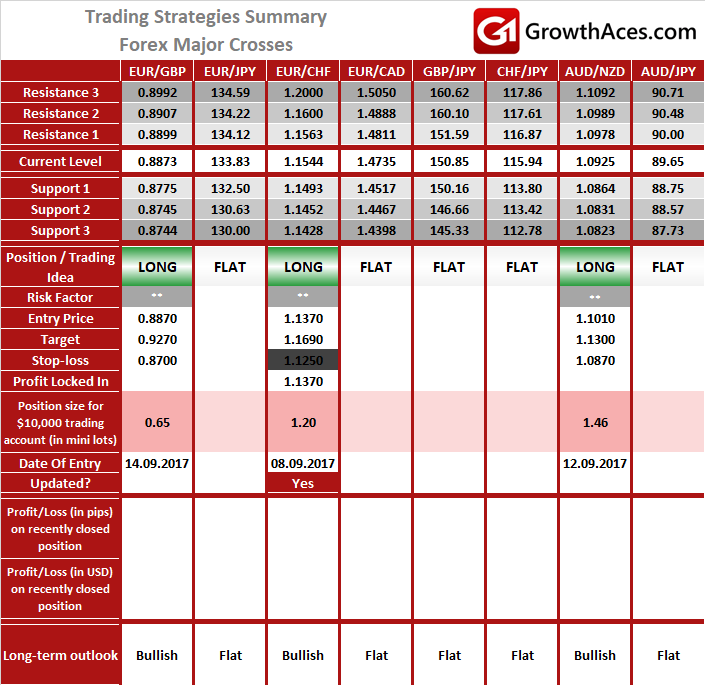

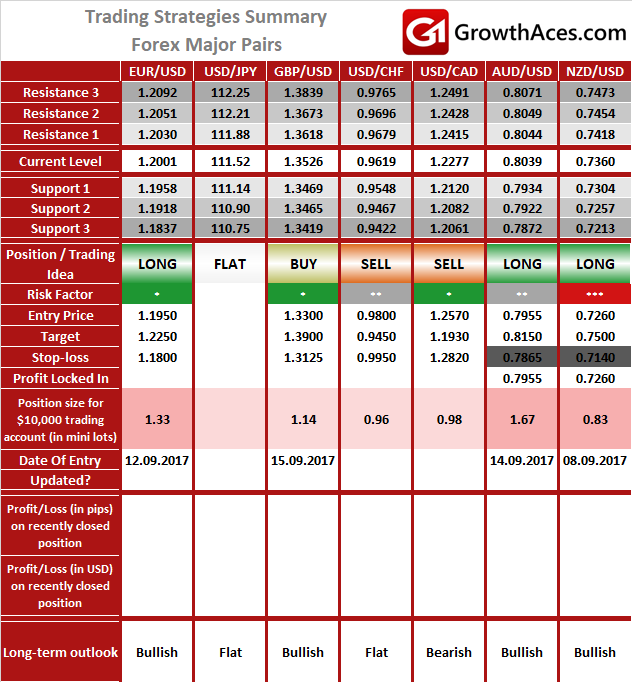

TRADING STRATEGIES SUMMARY:

FOREX - MAJOR PAIRS:

FOREX - MAJOR CROSSES: