EUR/USD: Markets are waiting for news on who will replace Janet Yellen

Macroeconomic overview:

- The Federal Reserve said industrial production increased 0.3% last month after a 0.7% drop in August that was smaller than initially reported. The U.S. central bank said the "continued effects of Hurricane Harvey and, to a lesser degree, the effects of Hurricane Irma combined to hold down the growth in total production in September by a quarter percentage point."

- Despite the hurricane-related setback, manufacturing remains on solid ground amid a weakening dollar, firming global economy and inventory accumulation by businesses. Factory sentiment is also at multi-year highs. In September, mining production rose 0.4%, reflecting gains in oil and gas extraction. Utilities production rose 1.5% last month. With output tepid last month, industrial capacity use rose 0.2 percentage point to 76.0%, and is 3.9 percentage points below its long-run average.

- Officials at the Fed tend to look at capacity use as a signal of how much "slack" remains in the economy and how much room there is for growth to accelerate before it becomes inflationary.

- The dollar rose against a basket of currencies yesterday as investors focused on the Labor Department report showing a 0.7% jump in import prices in September. Last month's increase in import prices was the biggest since June 2016 and followed a 0.6% rise in August. In the 12 months through September, import prices climbed 2.7% after advancing 2.1% in August.

- The USD is strengthening on progress on U.S. tax reforms. U.S. Senate Republicans on Monday gained crucial support for a vote on a budget resolution that is vital to President Donald Trump's hopes of signing tax reform legislation into law before January.

- With the Federal Reserve expected to raise interest rates for the third time this year in December, markets are looking to who will replace Janet Yellen as chair when her term expires in February. U.S. President Donald Trump has a pool of five candidates to choose from for the next chair of the Federal Reserve and is likely to announce his choice in early November. Trump has an interview scheduled on Thursday with current Fed Chair Janet Yellen. She is one of the five candidates. The others consist of his chief economic adviser, Gary Cohn, along with former Fed Governor Kevin Warsh, Fed Governor Jerome Powell and Stanford University economist John Taylor.

- Investors will focus on U.S. Beige Book data later in the day, with some likely to be wary of buying dollars aggressively after disappointing U.S. inflation data.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Technical analysis and trading signals:

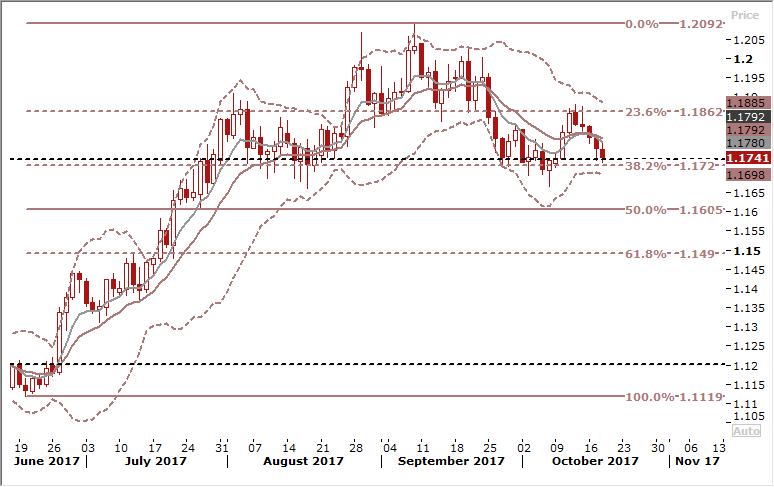

- The EUR/USD is continuing its downward move and is likely to test the base of the cloud at 1.1703. The close under 7-day exponential moving average has increased bearish sentiment.

- Daily charts show a large head and shoulders top, beginning in August. Neckline line is at 1.1670. Another important support level is 50% fibo of June-September rise at 1.1605.

- We think that current fall in EUR/USD could be a good opportunity to open a long position. We estimate that EUR/USD fair value is 1.2400 now and this is our medium-term target.

Source: GrowthAces.com - your daily forex trading strategies