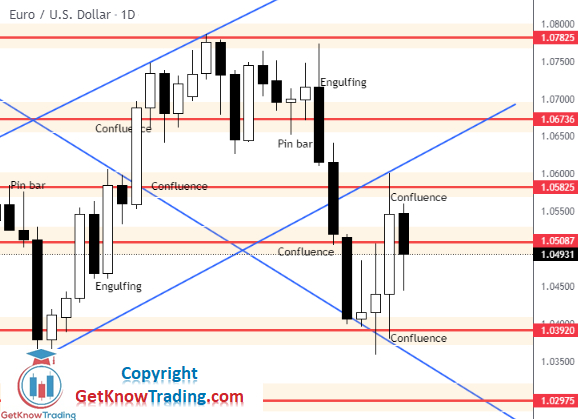

Last week's forecast discussed $1.03920 as a target, which EUR/USD reached on Monday.

The strong bearish candle made it to the demand zone around $1.03820. That move confirmed strong bearish sentiment that started with two robust bearish candles the previous week when we had price at the supply zone around $1.07825.

The demand around $1.03920 proved to be strong support from which the price could not break further down. On Tuesday, the price made a pullback upside, but selling pressure pushed the price down and created a large wick.

Wednesday had the price attempt a move to the upside, but selling pressure again held the price down with a large wick. This changed on Thursday, after bullish pressure moved the price upwards and through the $1.05087 resistance level.

EUR/USD stopped at the uptrend channel resistance line which is a confluence level of resistance with $1.05825 as horizontal resistance.

With each day closing as a bullish candle, we were signaled that bullish pressure was getting stronger each day.

On Friday we a small bearish candle formed with a wick below the $1.05087 support level, though the day closed at the demand zone around $1.05087.

The price is now sitting between two levels, $1.05087 and $1.05825, a previous range area where the price stopped for a while.

Given the wick being below $1.05087, and the weekly candle formation, EUR/USD is suggesting a move down.

Friday saw the pair close below the previous day's candle bodies; the first step to a move further down. On upside, we have $1.05825 resistance level as a decision level for buyers.

If the price manages to close the day above it, it will signal that sellers have lost momentum and the price should move higher.

But, as looking at the weekly and monthly time frame, $1.03920 is still next week's target. While it'll be the third time the pair touch that level, next support at $1.02975 becomes a more realistic target to be reached by the end of the month.

If we see the price next week close below $1.03920, then it will be highly likely that the price will try to break below.

$1.02975 is a monthly and weekly support level, so we can expect the price to bounce higher from that support level. It will make a nice entry level for a short term buying opportunity.