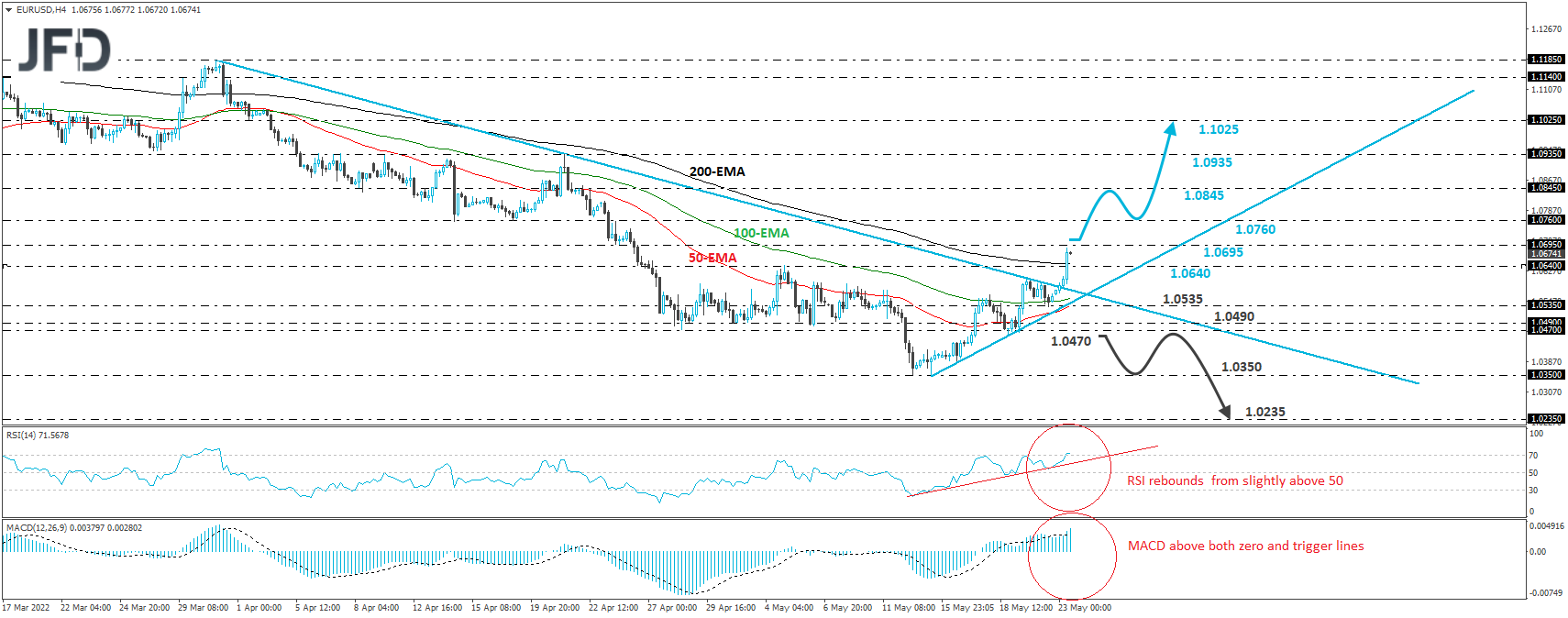

EUR/USD spiked higher on Monday, breaking above the downside resistance line drawn from the peak of Mar. 31. This, combined with the fact that the rate has been also respecting an upside support line drawn from the low of May 13, suggests that the short-term outlook may have turned to somewhat positive for now.

At time of writing, the rate is trading slightly below the 1.0695 barrier, marked by the inside swing low of Apr. 25, the break of which could aim for the key area of 1.0760, which is marked by the inside swing lows of Apr. 14 and 19.

If the bulls are not willing to stop there, we may see them aiming for the 1.0845 zone, where another break could target the key obstacle of 1.0935, which acted as a temporary ceiling between Apr. 6 and 21.

If they don’t abandon the action there either, then we may see them pushing towards the 1.1025 area, marked by the inside swing low of Apr. 1.

Shifting attention to our short-term oscillators, we see that the RSI moved higher and just crossed above 70, while the MACD lies above both its zero and trigger lines, pointing up as well.

Both indicators detect strong upside speed and support the notion for further declines in this exchange rate.

On the downside, we would like to see a clear dip below 1.0470 before we reconsider the bearish case. Such a move would confirm the rate’s return back below both the aforementioned diagonal lines, and may initially target the 1.0350 zone, marked by the lows of May 12 and 15, the break of which could carry larger bearish implications, perhaps setting the stage for a teste near the 1.0235 territory, marked by the inside swing high of July 2002.