EUR/USD: 1.1605 would be next bear objective

Macroeconomic overview: President Donald Trump proposed on Wednesday the biggest U.S. tax overhaul in three decades, calling for tax cuts for most Americans, but prompting criticism that the plan favors business and the rich and could add trillions of dollars to the deficit.

The plan would lower corporate and small-business income tax rates, reduce the top income tax rate for high-earning American individuals and scrap some popular tax breaks, including one that benefits people in high-tax states dominated by Democrats.

Forged during months of talks among Trump's aides and top congressional Republicans, the plan contained few details on how to pay for the tax cuts without expanding the budget deficit and adding to the nation's USD 20 trillion national debt.

The plan still must be turned into legislation, which was not expected until after Congress makes progress on the fiscal 2018 budget, perhaps in October. It must then be debated by the Republican-led congressional tax-writing committees.

Financial markets rallied on the plan's unveiling, an event long anticipated by traders betting that stocks would benefit from both faster economic growth and inflation.

Boston Fed President Eric Rosengren said Inflation readings, which have fallen short of a 2% target this year, provide "flexibility" to raise rates more slowly, adding he would be concerned if it misses the target for a period of time. On the other hand, he said, holding policy steady for too long risks an inflation jump that forces the Fed to more aggressively tighten policy.

St. Louis Fed President Bullard (non-voter, dove) said with inflation low and economic growth slow, it is appropriate for the Fed to maintain current levels on administered rates. He said recent data indicate that U.S. real GDP growth remains consistent with the 2% trend growth "regime" of recent years, adding that growth in the second half of 2017 will probably not move meaningfully above 2%. Effects from the hurricanes are to add uncertainty to data interpretation in the coming months, he said, but the "substantial damage" from those weather events dampened hopes for second-half growth to reach as high as 3%.

Bullard judged that inflation's downside surprise in the first half is unlikely to reverse itself in the second half. And despite continued strong performance of labor markets, wage inflation is modest and unlikely to drive inflation meaningfully higher over the balance of the year. He called into question the idea that inflation is reliably returning toward the Fed's 2% objective. Bullard thus concluded that the current level of the federal funds rate target "is appropriate given current macroeconomic data." We should know, however, that without a vote on this year's or next year's FOMC and the lowest dot on the dot plot, Bullard seldom moves markets with his comments these days.

New orders for U.S.-made capital goods increased more than expected in August and shipments maintained their upward trend, pointing to underlying strength in the economy despite an anticipated drag on growth from Hurricanes Harvey and Irma.

The signs of an acceleration in business spending on equipment bolstered prospects of a December interest rate hike by the Federal Reserve, boosting the dollar and pushing up the yield on the U.S. 2-Year. Treasury note to its highest level since 2008.

The Commerce Department said on Wednesday non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, rose 0.9% last month after an upwardly revised 1.1% gain in July. Shipments of core capital goods rose 0.7% after advancing 1.1% in July. Core capital goods shipments are used to calculate equipment spending in the government's GDP measurement.

The Commerce Department said it was unable to isolate the effects of Hurricanes Harvey and Irma on the data. Harvey, which devastated parts of Texas, has hurt August retail sales, industrial production, homebuilding and home sales. Irma, which struck Florida early this month, is expected to further hold down housing activity. That was flagged by a report on Wednesday from the National Association of Realtors showing that contracts to buy previously owned homes dropped 2.6% in August to a 19-month low.

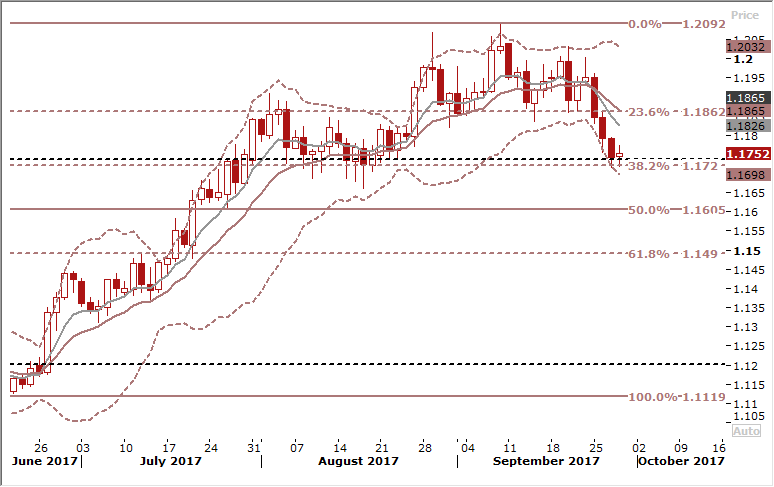

Technical analysis: The cloud top at 1.1725 and 38.2% fibo of June-September 1.1119-1.2092 rise at 1.1720 were breached on Wednesday and EUR/USD bears are looking for follow through below there today. The 50% fibo is the next bear objective at 1.1605.

Short-term signal: Buy at 1.1610, slightly above the above-mentioned 50% fibo level

Long-term outlook: Bullish

USD/CAD: Poloz dampens rate hike bets

Macroeconomic overview: There is no predetermined path for Canadian interest rates and the central bank's next move will depend on incoming data, Bank of Canada Governor Stephen Poloz said on Wednesday in a speech that suggested a third rate hike is not imminent.

Striking a cautious note and listing uncertainties facing Canada's economy, Poloz said the central bank will closely watch movements in longer-term interest rates and the exchange rate as it considers how to follow its two recent rate hikes.

He added: “Monetary policy will be particularly data-dependent in these circumstances and, as always, we could still be surprised in either direction”.

Poloz said it was not yet clear how the economy will react to the recent hikes, especially given high household debt, and he declined to directly comment on the recent appreciation of the Canadian dollar.

The dovish tone made the market revise expectations for the next rate hike and the Canadian dollar weakened to a near four-week low as investors bet on a slower pace of tightening. Chances of another Canadian rate hike this year fell to 81% from almost 100% before the release of Poloz's remarks, overnight index swaps data showed.

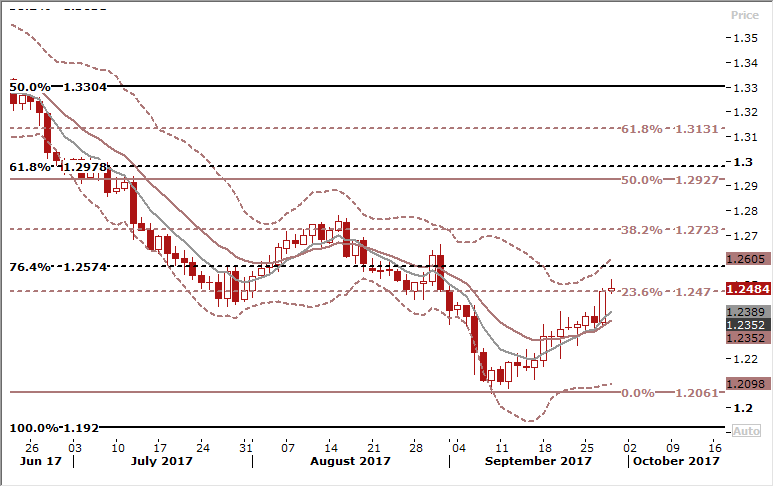

Technical analysis: The upward move is being continued. The pair broke above the 23.6% fibo of May-September 1.3793-1.2061 fall. The next important resistance levels are 1.2662 high on August 31 and 38.2% fibo of the above-mentioned move at 1.2723.

Short-term signal: Our short position was stopped, but it did not change our medium-term bearish view on the USD/CAD. We are looking to sell USD/CAD again at 1.2700.

Long-term outlook: Bearish