The euro is muted in the Thursday session. Currently, EUR/USD is trading at 1.1781, down 0.12% on the day. On the release front, German Industrial Production declined 1.4%, well off the forecast of a 0.9% gain. Eurozone Revised GDP for the third quarter posted a respectable gain of 0.6%. The US will release unemployment claims, which are expected to inch up to 239 thousand. ECB President Mario Draghi will host a press conference presented by the Bank for International Settlements in Frankfurt. The markets will be looking for clues regarding future monetary policy moves. On Friday, Germany releases Trade Balance, and the US publishes three key employment indicators – Average Hourly Earnings, Nonfarm Employment Change and the unemployment rate. The week wraps up with the release of UoM Consumer Sentiment. Traders should be prepared for some volatility from EUR/USD during Friday’s North American session.

It’s been an excellent 2017 for the eurozone, as the bloc’s economy has posted its best growth in years. The manufacturing sector continues to expand, exports have surged and unemployment continues to head lower. The latest ECB economic forecast is predicting GDP of 2.2% in 2017 and inflation of 1.2%. Things are so good that the ECB finally acted and tapered its asset purchase program, although it did extend the program until September 2018. Still, the cautious ECB said on Wednesday that it was concerned about “increased risk-taking behavior in global financial markets” as this could lead to sharp asset price corrections. The ECB is also keeping its eye on political uncertainty in Europe, notably the deadlocked Brexit negotiations and the political vacuum in Germany. In the meantime, European stock markets remain at high levels and the euro is enjoying the view from the 1.18 level.

The ADP nonfarm employment report came in as expected, with a gain of 190 thousand. Still, this was a soft reading compared to the previous release, which showed a gain of 235 thousand. Attention now turns to the official nonfarm employment change release on Friday. Again, the markets are expecting a soft landing, with a forecast of 200 thousand, down from 261 thousand in the October release. If nonfarm payrolls, one of the most important indicators, is weaker than expected, the US dollar could lose ground.

EUR/USD Fundamentals

Thursday (December 7)

- 2:00 German Industrial Production. Estimate +0.9%. Actual -1.4%

- 2:45 French Trade Balance. Estimate -4.7B. Actual -5.0B

- 4:00 Italian Quarterly Unemployment Rate. Estimate 11.2%. Actual 11.2%

- 5:00 Eurozone Revised GDP. Estimate 0.6%. Actual 0.6%

- Tentative – Spanish 10-year Bond Auction

- Tentative – French 10-year Bond Auction

- 7:30 US Challenger Job Cuts

- 8:30 US Unemployment Claims. Estimate 239K

- 10:30 US Natural Gas Storage. Estimate -5B

- 11:00 ECB President Mario Draghi Speaks

- 15:00 US Consumer Credit

Friday (December 8)

- 2:00 German Trade Balance. Estimate 22.0B

- 8:30 US Average Hourly Earnings. Estimate 0.3%

- 8:30 US Nonfarm Employment Change. Estimate 198K

- 8:30 US Unemployment Rate. Estimate 4.1%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 99.0

*All release times are GMT

*Key events are in bold

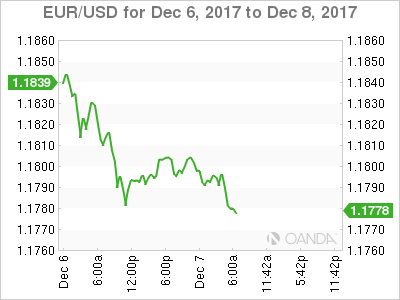

EUR/USD for Thursday, December 7, 2017

EUR/USD for December 7 at 5:30 EDT

Open: 1.1796 High: 1.1809 Low: 1.1780 Close: 1.1781

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1574 | 1.1657 | 1.1777 | 1.1876 | 1.1961 | 1.2092 |

EUR/USD ticked lower in the Asian session and is showing little movement in European trade

- 1.1777 is a weak support line. It could be tested on Thursday

- 1.1876 is the next resistance line

Further levels in both directions:

- Below: 1.1777, 1.1657 and 1.1574

- Above: 1.1876, 1.1961, 1.2092 and 1.2193

- Current range: 1.1777 to 1.1876

OANDA’s Open Positions Ratio

EUR/USD remains unchanged this week. Currently, short positions have a majority (60%), indicative of EUR/USD breaking out and moving downwards.