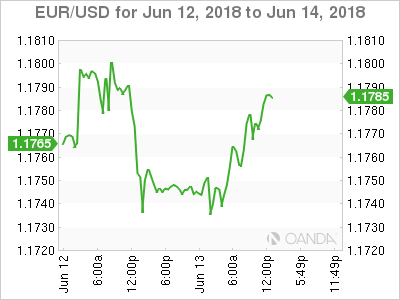

EUR/USD is steady in the Wednesday session. Currently, the pair is trading at 1.1760, up 0.13% on the day. In the eurozone, Employment Change edged up to 0.4%, above the estimate of 0.3%. Industrial Production declined 0.9%, weaker than the forecast of -0.6%. In the U.S, PPI is expected to rise to 0.3% and Core PPI is forecast to remain pegged at 0.2%. The Federal Reserve is expected to raise the benchmark rate by a quarter-point. On Thursday, German releases CPI and the ECB is expected to maintain rates at a flat 0.0%. The U.S will release retail sales reports and unemployment claims.

The Singapore Summit was a milestone, as it marked the first time that leaders of the United States and North Korea met face-to-face. However, the joint statement put out by Presidents Trump and Kim was short on details, which could explain a lack of movement in the currency markets following the summit. The joint statement reaffirmed North Korea’s full commitment to complete denuclearization, but there was no mention of a timetable or any verification mechanisms. Even if the summit was largely symbolic, there’s no denying that tensions have significantly eased and that the summit could mark a first step in bringing peace to the Korean peninsula.

Central banks will be in the spotlight this week, with rate statements from the Federal Reserve on Wednesday and the ECB on Thursday. The Fed is widely expected to raise rates, with odds of a quarter-rate hike at 94%. Although the rate increase has been priced in, the U.S dollar could still make some gains against its major rivals. In Europe, the ECB will be looking for any clues with regard to the ECB’s asset-purchase program. Currently, the bank is purchasing EUR 30 billion/mth, and the scheme is scheduled to wind up in September. However, some ECB policymakers want to phase out the program slowly, rather than turn off the tap completely in September. ECB chief economist Peter Praet recently said that the ECB board members would conduct a detailed discussion about the fate of the stimulus package at the June meeting. Mario Draghi will likely make mention of the program at his press conference, so traders should be prepared for some volatility from EUR/USD on Thursday.

EUR/USD Fundamentals

Wednesday (June 13)

- 5:00 Eurozone Employment Change. Estimate 0.3%. Actual 0.4%

- 5:00 Eurozone Industrial Production. Estimate -0.6%. Actual -0.9%

- Tentative – German 10-year Bond Auction

- 8:30 US PPI. Estimate 0.3%

- 8:30 US Core PPI. Estimate 0.2%

- 10:30 US Crude Oil Inventories. Estimate -1.4M

- 14:00 US FOMC Economic Projections

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate <2.00%

- 14:30 US FOMC Press Conference

Thursday (June 14)

- 2:00 German Final CPI. Estimate 0.5%

- 7:45 Eurozone Main Refinancing Rate. Estimate 0.00%

- 8:30 ECB Press Conference

- 8:30 US Core Retail Sales. Estimate 0.5%

- 8:30 US Retail Sales. Estimate 0.4%

- 8:30 US Unemployment Claims. Estimate 223K

*All release times are DST

*Key events are in bold

EUR/USD for Wednesday, June 13, 2018

EUR/USD for June 13 at 13:05 DST

Open: 1.1745 High: 1.1763 Low: 1.1730 Close: 1.1760

EUR/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1448 | 1.1613 | 1.1718 | 1.1809 | 1.1915 | 1.1996 |

EUR/USD was flat in the Asian session and has edged higher in European trade

- 1.1718 is providing support

- 1.1809 is the next resistance line

Further levels in both directions:

- Below: 1.1718, 1.1613 and 1.1448

- Above: 1.1809, 1.1915, 1.1996 and 1.2154

- Current range: 1.1718 to 1.1809

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Tuesday session. Currently, long positions have a majority (54%), indicative of trader bias towards EUR/USD continuing to climb to higher ground.