The euro is unchanged in the Thursday session, after considerable losses this week. Currently, EUR/USD is trading at 1.2188, down 0.05% on the day. Om the release front, the focus is on manufacturing PMIs, which performed well in Germany and the eurozone. German Manufacturing PMI dipped to 60.6, above the estimate of 60.3 points. It was a similar trend for the eurozone indicator, which dropped to 58.6, just above the estimate of 58.5 points. In the US, there are a host of key events, led by unemployment claims and personal spending. As well, Fed chair Jerome Powell testifies before the Senate Banking Committee. On Friday, Germany releases Retail Sales and the US publishes UoM Consumer Sentiment.

Jerome Powell is barely settled in his new office, but it’s been an eventful few weeks for the new Federal Reserve chair. Powell was greeted by a sharp correction in US stock markets, as investors headed for the hills on fears that the Fed might accelerate its pace of rate hikes if inflation moves higher. On Tuesday, Powell testified before a congressional committee, and will speak before the Senate Banking Committee on Thursday. Powell’s message to Congress was decidedly hawish, as the Fed chair said that the current policy of gradual rate increases would continue. He added that the economy was strong and that he expected inflation to move up to the Fed target of 2 percent. Importantly, Powell did not address the question of an acceleration of rate hikes, but his hawkish stance has increased the likelihood that the Fed will increase it projection from three to four rate hikes this year.

Inflation in eurozone edged lower to 1.2% in February, down from 1.3% in January. This reading met expectations, but underscores that inflation levels remain well below the ECB target of around 2 percent. Economic growth has rebounded, led by a robust German economy. Still, there is plenty of slack in the eurozone economy and the ECB is not under pressure to tighten policy. The Bank will meet on March 8, and major changes are expected. Policymakers could deliberate the possibility of removing the Bank’s easing bias towards increasing bond purchases if needed. A removal of the easing bias would likely be interpreted as a plan to tighten policy and would be bullish for the euro.

Goldilocks and the three equity bears.

EUR/USD Fundamentals

Thursday (March 1)

- 3:15 Spanish Manufacturing PMI. Estimate 54.8. Actual 56.0

- 3:45 Italian Manufacturing PMI. Estimate 57.9. Actual 56.8

- 3:50 French Final Manufacturing PMI. Estimate 56.1. Actual 55.9

- 3:55 German Final Manufacturing PMI. Estimate 60.3. Actual 60.6

- 4:00 Eurozone Final Manufacturing PMI. Estimate 58.5. Actual 58.6

- 4:00 Italian Monthly Unemployment Rate. Estimate 10.8%. Actual 11.1%

- 5:00 Eurozone Unemployment Rate. Estimate 8.6%

- Tentative – Spanish 10-year Bond Auction

- Tentative – French 10-year Bond Auction

- 8:30 US Core PCE Price Index. Estimate 0.3%

- 8:30 US Personal Spending. Estimate 0.2%

- 8:30 US Unemployment Claims. Estimate 226K

- 8:30 US Personal Income. Estimate 0.3%

- 9:45 US Final Manufacturing PMI. Estimate 55.9

- 10:00 US Fed Chair Powell Testifies

- 10:00 US ISM Manufacturing PMI. Estimate 58.7

- 10:00 US Construction Spending. Estimate 0.3%

- 10:00 US ISM Manufacturing Prices. Estimate 70.5

- 10:30 US Natural Gas Storage. Estimate -71B

- All Day – US Total Vehicle Sales. Estimate 17.2M

Friday (March 2)

- 2:00 German Retail Sales. Estimate 0.8%

- 10:00 US Revised UoM Consumer Sentiment. Estimate 99.2

*All release times are GMT

*Key events are in bold

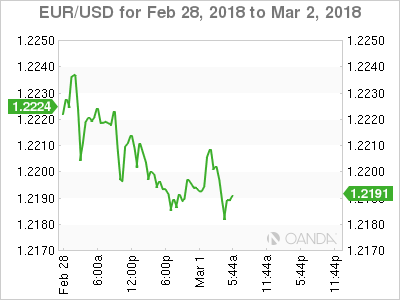

EUR/USD for Thursday, March 1, 2018

EUR/USD for March 1 at 5:10 EDT

Open: 1.2194 High: 1.2213 Low: 1.2183 Close: 1.2188

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1915 | 1.2025 | 1.2092 | 1.2200 | 1.2286 | 1.2357 |

EUR/USD has shown limited movement in the Asian and European sessions

- 1.2092 is providing support

- 1.2200 was tested earlier in resistance and is a weak line. It could see further action during the Thursday session

Further levels in both directions:

- Below: 1.2092, 1.2025 and 1.1915

- Above: 1.2200, 1.2286, 1.2357 and 1.2481

- Current range: 1.2092 to 1.2200

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged in the Thursday session. Currently, short positions are showing a majority (57%), indicative of EUR/USD breaking out and heading to lower ground.