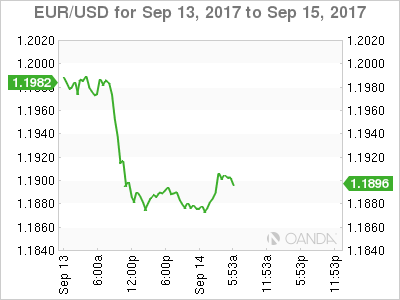

The euro has steadied on Thursday, after sustaining losses in the Wednesday session. Currently, the pair is trading at 1.1901, up 0.13% on the day. On the release front, the sole eurozone indicator was French Final CPI, which posted a gain of 0.5%, matching the forecast. Later in the day, Deutsche Bundesbank President Jens Weidmann will speak about monetary policy.

The US will release CPI and Core CPI, which are expected to edge up to 0.3% and 0.2%, respectively. As well, unemployment claims are expected to rise to 303 thousand. On Friday, the US publishes retail sales and consumer confidence reports.

The German economy, the largest in Europe, has been the locomotive for improved growth in the eurozone in 2017. Still, Germany has not been immune to stubbornly low inflation, which has also been a chronic problem in major economies such as the US and Japan.

On Wednesday, German inflation indicators were mixed. Final CPI, the primary gauge of consumer inflation, slowed to 0.1% in September, down from 0.4% in the August release. There was better news from WPI, which rebounded to 0.3%. This beat the forecast and marked the first gain in four months.

On the employment front, there was positive news as Eurozone Employment Change posted a second straight gain of 0.4%. This reflects stronger employment numbers in the eurozone, as stronger economic conditions have improved the labor market and pushed unemployment rates lower.

The German economy continues to impress. Unemployment levels remain low, growth is steady, and the country even has a budget surplus. However, analysts are divided on the extent of the momentum. The German Economy Ministry is predicting that the economy could slow in the second half of 2017, and is holding to its forecast of 1.5% growth this year. The BDI Group is projecting an expansion of just above 2.0%, while the International Monetary Fund has pegged growth at 1.8% for 2017. Strong German growth in the second half would be good news for the streaking euro.

EUR/USD Fundamentals

Thursday (September 14)

- 2:45 French Final CPI. Estimate 0.5%. Actual 0.5%

- 8:30 US CPI. Estimate 0.3%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Unemployment Claims. Estimate 303K

- 10:30 US Natural Gas Storage. Estimate 80B

- 11:30 Deutsche Bundesbank President Jens Weidmann Speaks

Friday (September 15)

- 8:30 US Core Retail Sales. Estimate 0.5%

- 8:30 US Retail Sales. Estimate 0.1%

- 8:30 US Empire State Manufacturing Index. Estimate 18.2

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 95.1

*All release times are GMT

*Key events are in bold

EUR/USD for Thursday, September 14, 2017

EUR/USD Thursday, September 14 at 5:10 EDT

Open: 1.1885 High: 1.1910 Low: 1.1866 Close: 1.1906

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1611 | 1.1712 | 1.1876 | 1.1996 | 1.2018 | 1.2108 |

EUR/USD ticked lower in the Asian session, but has reversed directions and edged upwards in European trade

- 1.1876 was tested earlier in support and is a weak line

- 1.1996 is the next resistance line

Further levels in both directions:

- Below: 1.1876, 1.1712 and 1.1611

- Above: 1.1996, 1.2018, 1.2108 and 1.2221

- Current range: 1.1876 to 1.1996

OANDA’s Open Positions Ratio

EUR/USD ratio has shown little movement this week. Currently, short positions have a majority (59%), indicative of EUR/USD reversing directions and moving lower.