EUR/USD is showing little movement in the Wednesday session. Currently, the pair is trading at 1.1884, up 0.27% on the day. In economic news, German and French banks are closed for a holiday. ECB releases an economic bulletin, and the US will publish consumer inflation reports. CPI is expected to rebound with a gain of 0.3%, while Core CPI is expected to remain unchanged at 0.2%. On Friday, ECB President Mario Draghi will speak at an event in Florence and the US releases UoM Consumer Sentiment.

The currency markets have not shown much interest in President Trump’s dramatic speech on Tuesday. Trump announced that the US would withdraw from the Iran nuclear deal. Trump blasted the agreement and said that the US would impose stiff sanctions on Iran. However, Britain, France and Germany have said they plan to remain in the deal, and will be holding a high-level meeting with Iranian leaders on how the agreement can be salvaged. With the US acknowledging that the White House does not have a ‘Plan B’, it’s unclear what happens next. Meanwhile, tensions between Israel and Iran are at a fever pitch after Israel struck dozens of military targets in Syria on Tuesday.

The ECB continues to send a message of cautious optimism to the markets, and this was underscored by the ECB Economic Bulletin. The report stated that the eurozone economy continues to show “solid and broad-based expansion” but did acknowledge that growth in the first quarter slowed. As for inflation, policymakers remain confident that inflation will continue to move towards the inflation target of 2 percent. However, inflation remains subdued and has not shown signs of an upward trend. The report reaffirmed that the ECB plans to maintain interest rates at current levels for an “extended period of time, and well past the horizon of the net asset purchases.”

EUR/USD Fundamentals

Thursday (May 10)

- 4:00 ECB Economic Bulletin

- 4:00 Italian Industrial Production. Estimate 0.4%. Actual 1.2%

- 8:30 US CPI. Estimate 0.3%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Unemployment Claims. Estimate 219K

- 10:30 US Natural Gas Storage. Estimate 81B

- 13:01 US 30-year Bond Auction

- 14:00 US Federal Budget Balance. Estimate 201.2B

Friday (May 11)

- 9:15 ECB President Mario Draghi Speaks

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 98.4

*All release times are DST

*Key events are in bold

EUR/USD for Thursday, May 10, 2018

EUR/USD for May 10 at 6:30 DST

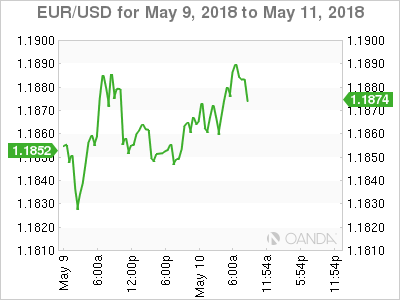

Open: 1.1851 High: 1.1885 Low: 1.1843 Close: 1.1883

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1613 | 1.1718 | 1.1809 | 1.1915 | 1.2025 | 1.2092 |

EUR/USD edged higher in the Asian session and has ticked upwards in European trade

- 1.1809 is providing support

- 1.1915 is the next resistance line

Further levels in both directions:

- Below: 1.1809, 1.1718 and 1.1613

- Above: 1.1915, 1.2025, 1.2092 and 1.2235

- Current range: 1.1809 to 1.1905

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged in the Thursday session. Currently, long positions have a slight majority (52%), indicative of slight trader bias towards EUR/USD continuing to move upwards.