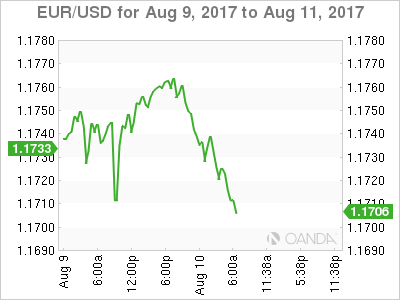

EUR/USD has posted slight losses on Thursday. Currently, the pair is trading at 1.1712, down 0.40% on the day. On the release front, there are no German or Eurozone events on the schedule. In the US, there are two key events – Producer Price Index and unemployment claims. Both indicators are expected to remain unchanged – PPI at 0.1% and unemployment claims at 240 thousand. On Friday, the US releases CPI, and we’ll hear from two FOMC members – Robert Kaplan and Neel Kashkari.

The eurozone economy has improved in 2017, but stubbornly low inflation levels remain a major headache for ECB policymakers. Inflation stood at 1.3% year-on-year in July, well below the bank’s inflation target of 2%. The ECB’s ultra-accommodative policy, which includes interest rates of 0.00% and asset purchases (QE) of 60 billion euros/month, has failed to push inflation upwards. The QE program, which is scheduled to terminate in December, is coming under closer scrutiny. However, December should not be treated as a drop-dead date – the ECB has been careful to state that QE could be extended “if necessary”. The ECB holds its next policy meeting in September 7, and there is a strong possibility that the bank will make an announcement regarding tapering QE, which could start in early 2018. The dilemma facing policymakers is that despite a stronger labor market and improved growth, which would suggest that a tighter monetary might be appropriate, inflation levels remain stubbornly low, as the ECB’s inflation target of 2% has proven overly optimistic. The ECB is well aware that any talk of tighter policy could send the euro higher, as was the case in June, when investors snapped up euros after Mario Draghi made some hawkish comments at a meeting of central bankers. As far as interest rate moves, the ECB is unlikely to raise rates until its tapering process is well under way, meaning we’re unlikely to see any rate moves before the second half of 2018.

The markets are looking for some clarity from the Federal Reserve, which is showing signs of backtracking on another rate hike in 2017. Earlier this year, the Fed strongly hinted that it planned to raise rates three times in this year, but so far only pressed the rate trigger twice, in March and June. After the June hike, Fed Chair Janet Yellen shrugged off concerns over low inflation, saying that it was due to “transient” factors. However, inflation has not improved and the Fed has changed its tune. Last week, St. Louis Federal Reserve President James Bullard said he opposed further Fed hikes, warning that another hike would actually delay inflation from hitting the Fed’s target of 2%. The Fed appears uncertain about when to raise rates, and predictably, this hesitancy is making investors skeptical that the Fed will act. There is little chance that the Fed will make any moves at the September and November meetings, and the odds of a rate hike in December are currently at 42%. Analysts are hoping for some insight into the Fed’s thinking when the Fed Reserve Dallas President Robert Kaplan and Minneapolis President Neel Kashkari deliver speeches on Friday.

EUR/USD Fundamentals

Thursday (August 10)

- 2:45 French Industrial Production. Estimate -0.6%. Actual -1.1%

- 4:00 Italian Trade Balance. Estimate 3.87B. Actual 4.50B

- 8:30 US PPI. Estimate 0.1%

- 8:30 US Unemployment Claims. Estimate 240K

- 8:30 US Core PPI. Estimate 0.2%

- 10:00 US FOMC Member William Dudley Speaks

- 10:30 US Natural Gas Storage. Estimate 38B

- 13:01 US 30-y Bond Auction

- 14:00 US Federal Budget Balance. Estimate -60.9B

Friday (August 11)

- 2:00 German Final CPI. Estimate 0.4%

- 2:00 German WPI. Estimate 0.3%

- 8:30 US CPI. Estimate 0.2%

- 8:30 US Core CPI. Estimate 0.2%

- 9:40 US FOMC Member Robert Kaplan Speaks

- 11:30 US FOMC Member Neel Kashkari Speaks

*All release times are GMT

*Key events are in bold

EUR/USD for Thursday, August 10, 2017

EUR/USD Thursday, August 10 at 5:50 EDT

Open: 1.1759 High: 1.1770 Low: 1.1715 Close: 1.1712

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1534 | 1.1616 | 1.1712 | 1.1876 | 1.1996 | 1.2108 |

EUR/USD has inched lower in the Asian and European sessions

- 1.1712 is under pressure in support and could break in Thursday trade

- 1.1876 is the next resistance line

Further levels in both directions:

- Below: 1.1712, 1.1616 and 1.1534

- Above: 1.1876, 1.1996, 1.2108 and 1.2221

- Current range: 1.1712 to 1.1876

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged this week. Currently, short positions have a majority (69%), indicative of EUR/USD continuing to move lower.