EUR/USD is down slightly in the Friday session, after posting considerable gains on Thursday. Currently, the pair is trading at 1.1583, down 0.07% on the day. Earlier in the day, EUR/USD climbed above the 1.16 level for

On the release front, German Final CPI gained 0.4%, matching the forecast. Eurozone Industrial Production jumped 1.0%, well above the estimate of 0.4%. In the U.S, today’s key indicator is UoM Consumer Sentiment, which is expected to remain above the 100-level, with an estimate of 100.4 points.

German inflation climbed 2.3% in September on a year-to-year basis, its strongest gain since November 2011. Not surprisingly, much of the increase is a result of higher energy prices, as brent crude remains above $80 a barrel. Eurozone inflation has also been moving higher and is finally closing in on the ECB’s target of just below 2 percent. Stronger inflation has reinforced speculation that the ECB could raise interest rates for the first time in years in the second half of 2019.

U.S. consumer inflation reports missed their estimates, and the euro took advantage, posting gains on Thursday. CPI and Core CPI both posted small gains of 0.1%, shy of the estimate of 0.2%. On a year-to-year basis, CPI increased 2.3% in September, down from 2.7% in August. Still, with inflation above the Fed’s 2% inflation target, these readings are unlikely to affect the Fed’s plans to raise interest rates in December, which would mark the fourth rate increase this year. The likelihood of a rate hike remains high, with the CME pegging the odds at 76%.

On Thursday, the ECB released its minutes from the September meeting. Policymakers debated whether to lower their risk assessment, clearly concerned that global trade tensions could dampen eurozone growth. However, the policymakers decided that the eurozone economy was strong enough to allow the ECB to maintain its ‘slow but steady’ stance of tightening policy. The ECB remains on track to end its massive bond purchase program at the end of the year. Meanwhile, with bond yields pointing higher, investors have reacted negatively and stock markets continue to spin lower. On Thursday, German 10-year bonds fetched 0.55%, marking a 6-month high. The U.S dollar often is the winner in times of crisis, providing a safe haven for nervous investors. However, the euro has weathered this latest crisis, holding its own against the greenback this week.

EUR/USD Fundamentals

Friday (October 12)

- 2:00 German Final CPI. Estimate 0.4%. Actual 0.4%

- 5:00 Eurozone Industrial Production. Estimate 0.4%. Actual 1.0%

- 8:30 US Import Prices. Estimate 0.3%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 100.4

- 10:00 US Preliminary UoM Inflation Expectations

- Day 1 – IMF Meetings

- 12:30 US FOMC Member Raphael Bostic Speaks

- 12th-18th US Federal Budget Balance. Estimate 71.0B

- 22:30 US FOMC Member Randal Quarles Speaks

*All release times are DST

*Key events are in bold

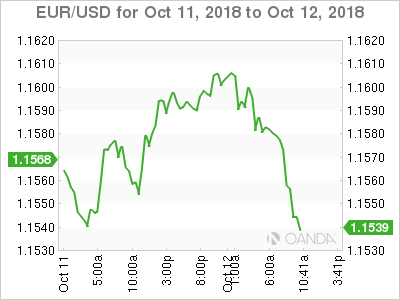

EUR/USD for Friday, October 12, 2018

EUR/USD for October 12 at 6:35 DST

Open: 1.1593 High: 1.1610 Low: 1.1576 Close: 1.1583

EUR/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1300 | 1.1434 | 1.1553 | 1.1637 | 1.1718 | 1.1840 |

EUR/USD posted small gains in the Asian session. The pair has reversed directions and edged lower in European trade

- 1.1553 is providing support

- 1.1637 is the next line of resistance

Further levels in both directions:

- Below: 1.1553, 1.1434, 1.1300 and 1.1190

- Above: 1.1637, 1.1718 and 1.1840

- Current range: 1.1553 to 1.1637