EUR/USD has posted gains in the Monday session. Currently, the pair is trading at 1.1707, up 0.18% on the day. In economic news, the eurozone trade surplus slipped to EUR 16.9 billion, short of the estimate of EUR 17.6 billion. This marked the lowest surplus since January 2017. In the U.S, the focus is on consumer spending reports, with both retail sales and core retail sales expected to drop to 0.4%. On the manufacturing front, Empire State Manufacturing Index is forecast to drop to 20.3 points. On Tuesday, Federal Reserve Chair will testify before the Senate Banking Committee.

The U.S economy continues to perform well in 2018, and received a vote of confidence from the head of the Federal Reserve. On Thursday, Powell said that the economy is “in a really good place”, pointing to President Trump’s massive tax cut scheme and increased spending as key factors in boosting economic growth. Powell did not address monetary policy and said he was uncertain as to the effects of the current trade disputes which has embroiled the U.S and its trading partners. The Fed will likely press the rate trigger in the second half of the year, but it is an open question as to whether we’ll see one hike over the next six months. The Fed is projecting growth of 2.8% in 2018, compared to 2.3% in 2017. Powell will be in the spotlight next week when he appears for his semi-annual testimony before Congress.

Trade policy is not part of the Federal Reserve’s mandate, but Fed policymakers continue to voice concern about the escalating trade war between the U.S and its major trading partners, particularly China. On Friday, Dallas Fed President Robert Kaplan said he would have to downgrade his outlook if the tariff battle continues. Kaplan said that U.S tariffs on steel and aluminum imports had dampened capital expenditures plans and further trade tensions could lead to currency fluctuations and geopolitcal instability.

EUR/USD Fundamentals

Monday (July 16)

- 4:04 Italian Trade Balance. Estimate 3.25B Actual 3.38B

- 5:00 Eurozone Trade Balance. Estimate 17.6B. Actual 16.9B

- 8:30 US Core Retail Sales. Estimate 0.4%

- 8:30 US Retail Sales. Estimate 0.4%

- 8:30 US Empire State Manufacturing Index. Estimate 20.3

- 10:00 US Business Inventories. Estimate 0.4%

Tuesday (July 17)

- 9:15 US Capacity Utilization Rate. Estimate 78.4%

- 9:15 US Industrial Production. Estimate 0.5%

- 10:00 US Federal Reserve Jerome Powell Testifies

- 10:00 US NAHB Housing Market Index. Estimate 69

- 16:00 US TIC Long-Term Purchases. Estimate 34.3B

*All release times are DST

*Key events are in bold

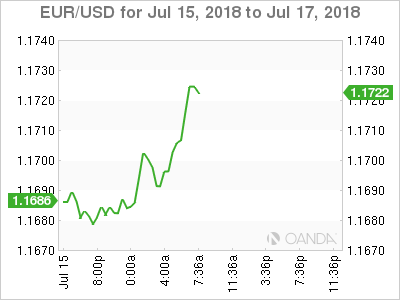

EUR/USD for Monday, July 16, 2018

EUR/USD for July 16 at 7:05 DST

Open: 1.1686 High: 1.1722 Low: 1.1676 Close: 1.1721

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1434 | 1.1553 | 1.1637 | 1.1728 | 1.1829 | 1.1916 |

EUR/USD was flat in the Asian session and has edged higher in European trade

- 1.1637 is providing support

- 1.1728 is a weak resistance line

Further levels in both directions:

- Below: 1.1637, 1.1553, 1.1434 and 1.1312

- Above: 1.1728, 1.1829 and 1.1910

- Current range: 1.1637 to 1.1728