EUR/USD has posted gains in the Tuesday session. Currently, the pair is trading at 1.1733, up 0.18% on the day. In economic news, there are no events in the eurozone. The US releases manufacturing and housing indicators. Federal Reserve Chair Jerome Powell testifies before the Senate Banking Committee. On Wednesday, the eurozone releases Final CPI and the US publishes building permits and housing starts. Fed Chair Jerome Powell testifies before the House Financial Services Committee.

After a sluggish first quarter, US retail sales reports have rebounded in the second quarter. Core retail sales were revised upwards to 0.8% in May, and the June gain of 0.5% edged above the forecast of 0.4%. Retail sales gained 0.4%, and were up an impressive 6.6% on an annualized basis. Consumer spending is a key driver of economic growth, and a tight labor markets and firming inflation are further indications that the economy is in excellent shape. The Fed is widely expected to raise rates again at the September meeting, with odds of a quarter-point hike at 87%, according to the CME Group.

The escalating trade war between the US and China is raising concerns not just on the equity markets but at the Federal Reserve as well. On Friday, Dallas Fed President Robert Kaplan said he would have to downgrade his economic outlook for the economy if the tariff battle continues. Kaplan said that US tariffs on steel and aluminum imports had dampened capital expenditures plans and further trade tensions could lead to currency fluctuations and geopolitical instability. With Fed policymakers split on whether to raise rates once or twice in the second half of 2018, the outcome of the tariff battle could have a significant impact on the monetary policy and on the direction of the US dollar.

EUR/USD Fundamentals

Tuesday (July 17)

- 9:15 US Capacity Utilization Rate. Estimate 78.4%

- 9:15 US Industrial Production. Estimate 0.5%

- 10:00 US Federal Reserve Jerome Powell Testifies

- 10:00 US NAHB Housing Market Index. Estimate 69

- 16:00 US TIC Long-Term Purchases. Estimate 34.3B

Wednesday (July 18)

- 5:00 Eurozone Final CPI. Estimate 2.0%

- 5:00 Eurozone Final Core CPI. Estimate 1.0%

- Tentative – German 30-year Bond Auction

- 8:30 US Building Permits. Estimate 1.33M

- 8:30 US Housing Starts. Estimate 1.32M

- 10:00 US Federal Reserve Jerome Powell Testifies

- 10:30 US Crude Oil Inventories

- 14:00 US Beige Book

*All release times are DST

*Key events are in bold

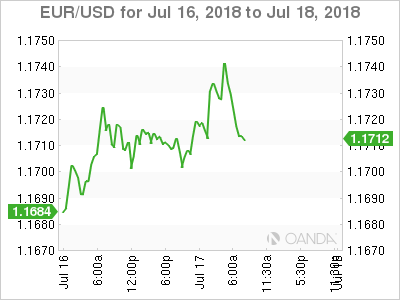

EUR/USD for Tuesday, July 17, 2018

EUR/USD for July 17 at 5:35 DST

Open: 1.1712 High: 1.1737 Low: 1.1702 Close: 1.1733

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1553 | 1.1637 | 1.1728 | 1.1829 | 1.1910 | 1.1996 |

EUR/USD ticked higher in the Asian session and is has posted small gains in European trade

- 1.1728 has switched to a support role following gains by EUR/USD on Tuesday

- 1.1829 is the next resistance line

Further levels in both directions:

- Below: 1.1728, 1.1637, 1.1553 and 1.1434

- Above: 1.1829, 1.1910 and 1.1996

- Current range: 1.1728 to 1.1829