EUR/USD continues to have an uneventful week. In the Wednesday session, the pair is trading at 1.2279, up 0.08% on the day. On the release front, it’s another busy day. In the eurozone, inflation indicators were within expectations. CPI Flash Estimate rose to 1.4%, matching the forecast. Core CPI Flash Estimate remained unchanged at 1.0%, just shy of the estimate of 1.1%. Eurozone unemployment ticked lower to 8.5%, matching the forecast. In the US, ADP Nonfarm Payrolls is expected to drop sharply to 208 thousand. We’ll also get a look at ISM Non-Manufacturing PMI, which is forecast to drop to 59.0 points.

Eurozone inflation remains slightly above 1 percent, well below the ECB target of around 2 percent. This means that the ECB is unlikely to change its monetary policy, although Germany wants to see a tighter policy, which would be better suited to its robust economy. In January, the ECB tapered its stimulus program, from EUR 60 billion to 30 billion per month. The stimulus is scheduled to wind up in September, and it remains an open question as to whether Mario Draghi will extend the scheme. If the eurozone economy remains on track and inflation moves higher, there is a strong likelihood that the ECB will adopt a policy of normalization, after years of stimulus. Such a move would likely boost the euro.

The Chinese government has fired the latest salvo in the escalating trade war with the United States. On Wednesday, China announced 25% tariffs on 106 American products, including soybeans, wheat and some motor vehicles. The value of these US exports amounts to some $50 billion – the same value as Chinese exports which have been slapped with tariffs by President Trump. This represents a significant raising of the stakes, and has the markets worried. China’s deputy finance minister has said that a trade war between the two sides would be a ‘lose-lose’, and few investors would disagree with his diagnosis. However, neither Trump nor Chinese President Xi Jinping has blinked so far, and the crisis shows no signs of being resolved anytime soon. As one US analyst wrote this week, “trade wars are easy to start but hard to stop.”

EUR/USD Fundamentals

Wednesday (April 4)

- 4:00 Italian Monthly Unemployment Rate. Estimate 11.0%. Actual 10.9%

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.4%. Actual 1.4%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.1%. Actual 1.0%

- 5:00 Eurozone Unemployment Rate. Estimate 8.5%. Actual 8.5%

- 8:15 US ADP Nonfarm Employment Change. Estimate 208K

- 9:45 US Final Services PMI. Estimate 54.3

- 10:00 US ISM Non-Manufacturing PMI. Estimate 59.0

- 10:00 US Factory Orders. Estimate 1.7%

- 10:30 US Crude Oil Inventories. Estimate 1.4M

- 11:00 US FOMC Member Loretta Mester Speaks

Thursday (April 5)

- 2:00 US German Factory Orders. Estimate 1.6%

- 3:55 German Final Services PMI. Estimate 54.2

- 4:00 US Final Services PMI. Estimate 55.0

- 5:00 Eurozone PPI. Estimate 0.0%

- 5:00 Eurozone Retail Sales. Estimate 0.6%

- 8:30 US Unemployment Claims. Estimate 225K

*All release times are DST

*Key events are in bold

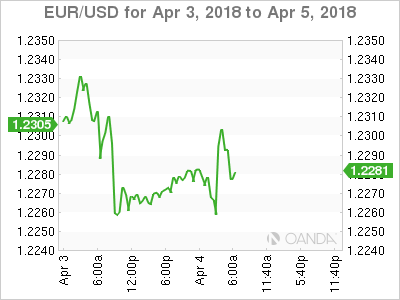

EUR/USD for Wednesday, April 4, 2018

EUR/USD for April 4 at 5:50 DST

Open: 1.2270 High: 1.2315 Low: 1.2257 Close: 1.2279

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2025 | 1.2092 | 1.2235 | 1.2319 | 1.2460 | 1.2581 |

EUR/USD has inched higher in the Asian European sessions

- 1.2235 is providing support

- 1.2319 is a weak resistance line

Further levels in both directions:

- Below: 1.2235, 1.2092 and 1.2025

- Above: 1.2319, 1.2460, 1.2581 and 1.2662

- Current range: 1.2235 to 1.2319

OANDA’s Open Positions Ratio

EUR/USD ratio remains almost unchanged this week. Currently, short positions still have a majority (54%), indicative of EUR/USD reversing directions and moving to higher ground.