EUR/USD is slightly lower in Thursday trade. Currently, the pair is trading at 1.1133, down 0.16% on the day. After a dearth of fundamental releases this week, the markets will be knee-deep in data on Thursday. German Final GDP posted a gain of 0.4%, matching the estimate. This was unrevised from the initial GDP reading earlier in May. German Manufacturing PMI dropped to 44.3 in April, down from 44.5 a month earlier. Services PMI continued to point to expansion, with a score of 55.0. It was a similar story for Eurozone PMIs – contraction in manufacturing, expansion in the services sector. The ECB releases the minutes of its April policy meeting, and voters go to the polls over the next several days to elect a new European parliament. In the U.S., today’s highlight is unemployment claims, which is expected to drop to 212 thousand. On Friday, the U.S. releases durable goods orders.

Will the European parliament elections shake up the euro? Starting on Thursday, voters in the 28 EU countries (including the U.K.) will elect lawmakers to the European parliament. Key issues included the economic slowdown, the migrant crisis and the rise in Euroskpeticism. Euro-skeptics increased their representation in parliament from 12% to 25% in the last election, and with the dramatic increase in strength of populist parties, this trend could well continue. A strong showing by parties with an anti-EU agenda could have an important impact on upcoming elections in Italy, where the populist government wants to raise its deficit above EU rules. If euroskeptic parties do well in the election, investors could give a thumbs-down to the euro. As well, the outcome of the vote could have an impact on the choice of the new head of the ECB, as Mario Draghi steps down in October, after an eight-year term.

There were no surprises from the Federal Reserve minutes, which provided details of the policy meeting earlier in May. Fed members continued to preach patience, stating that rates will likely remain unchanged for some time. The minutes indicated that although members are more optimistic about economic growth, they remain committed to maintaining current rate levels, given that inflation remains low. It should be noted that the policy meeting took place on May 1-2, one week before President Trump announced new tariffs on China, which has significantly escalated trade tensions between the U.S. and China.

The Fed minutes may have reinforced the central bank’s stance that no rate moves are planned until next year, but the markets don’t share this view, with many analysts expecting at least one rate cut in 2019. Lower U.S. rates could dampen enthusiasm for the U.S. dollar. The CME Group (NASDAQ:CME) has priced in a 36% likelihood of a 25-point basis cut at the September meeting.

EUR/USD Fundamentals

Thursday (May 23)

- 2:00 German Final GDP. Estimate 0.4%. Actual 0.4%

- 3:15 French Flash Manufacturing PMI. Estimate 50.7. Actual 51.7

- 3:15 French Flash Services PMI. Estimate 50.1. Actual 50.6

- 3:30 German Flash Manufacturing PMI. Estimate 44.9. Actual 44.3

- 3:30 German Flash Services PMI. Estimate 55.2. Actual 55.0

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 48.2. Actual 47.7

- 4:00 Eurozone Flash Services PMI. Estimate 53.0. Actual 52.5

- 4:00 German Ifo Business Climate. Estimate 99.2. Actual 97.9

- Day 1 – European Parliamentary Elections

- 7:30 ECB Monetary Policy Meeting Accounts

- 8:30 US Unemployment Claims. Estimate 215K

- 9:45 US Flash Manufacturing PMI. Estimate 53.0

- 9:45 US Flash Services PMI. Estimate 53.6

- 10:00 US New Home Sales. Estimate 678K

- 10:30 US Natural Gas Storage. Estimate 104B

Friday (May 24)

- Day 2 – European Parliamentary Elections

- 8:30 US Core Durable Goods Orders. Estimate 0.1%

- 8:30 US Durable Goods Orders. Estimate -2.0%

*All release times are DST

*Key events are in bold

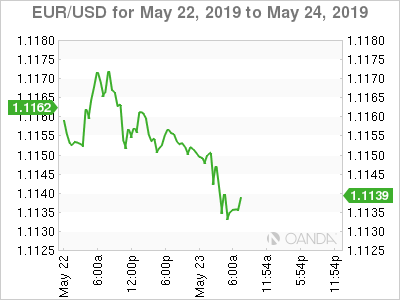

EUR/USD for Thursday, May 23, 2019

EUR/USD for May 23 at 5:45 DST

Open: 1.1151 High: 1.1157 Low: 1.1130 Close: 1.1133

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0950 | 1.1046 | 1.1120 | 1.1212 | 1.1300 | 1.1434 |

EUR/USD was mostly flat in the Asian session and has posted slight losses in European trade

- 1.1120 has weakened in support. This line could be tested on Thursday

- 1.1212 is the next resistance line

- Current range: 1.1120 to 1.1212

Further levels in both directions:

- Below: 1.1120, 1.1046 and 1.0950

- Above: 1.1212, 1.1300, 1.1434 and 1.1553