For the 24 hours to 23:00 GMT, the EUR rose 0.72% against the USD and closed at 1.1821, after a reading on the Euro-zone consumer sentiment came in better-than-expected in November.

Data showed that the Euro-zone’s preliminary consumer confidence index advanced to a level of 0.1 in November, jumping back into the positive territory and surging to a nearly 17-year high level, suggesting that upbeat growth prospects across the Euro-area are further lightening the region’s consumer morale. The index had recorded a reading of -1.0 in the previous month, while investors had envisaged for a rise to a level of -0.8.

The US Dollar fell against most of the major currencies, after minutes of the Federal Reserve’s (Fed) November meeting revealed lingering concerns over tepid US inflation.

According to minutes, officials proffered an upbeat assessment on the US economy and indicated that an increase in interest rates would be warranted “in the near term”. However, policymakers had some disagreements on the pace of inflation as many felt that tightness in the labour market would likely fuel higher inflation in the medium term while others expressed concerns over the inflation outlook. Also, board members fretted that asset prices are out of balance and could pose a threat to the economy.

Macroeconomic data released in the US showed that preliminary durable goods orders unexpectedly dropped 1.2% in October, after three straight months of strong gains, pulled down by declining orders for commercial aircraft. Market participants had anticipated durable goods orders to rise 0.3%, after advancing 2.0% in the previous month. Moreover, the nation’s final Reuters/Michigan consumer sentiment index declined to a level of 98.5 in November, while the preliminary figures had indicated a drop to a level of 97.8. The index had registered a level of 100.7 in the previous month.

Other data revealed that initial jobless claims in the US eased to a level of 239.0K in the week ended 18 November, more than market expectations for a fall to a level of 240.0K. In the prior week, initial jobless claims had registered a revised level of 252.0K. Additionally, the nation’s MBA mortgage applications registered a rise of 0.1% in the week ended 17 November, following a gain of 3.1% in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.1834, with the EUR trading 0.11% higher against the USD from yesterday’s close.

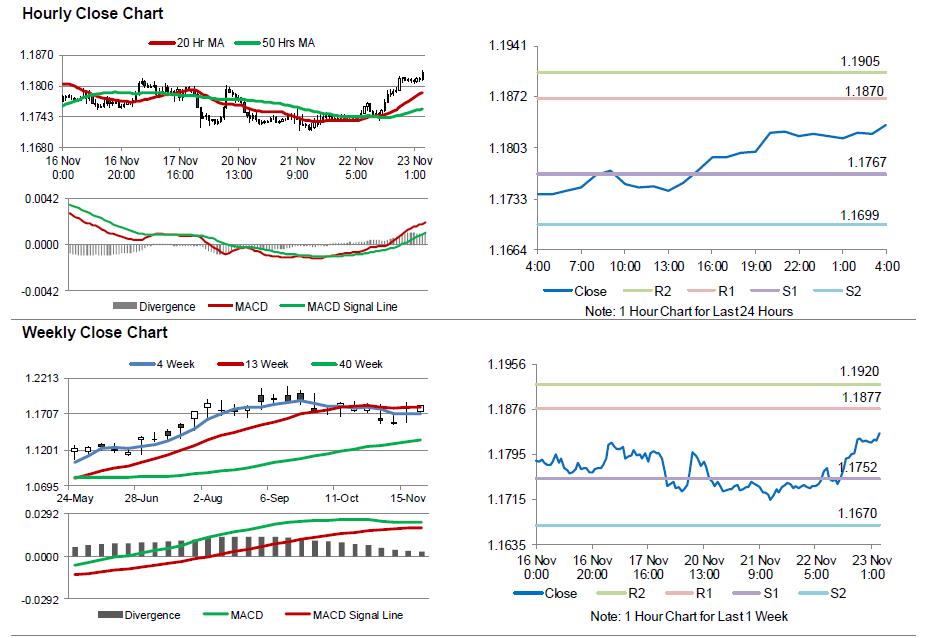

The pair is expected to find support at 1.1767, and a fall through could take it to the next support level of 1.1699. The pair is expected to find its first resistance at 1.1870, and a rise through could take it to the next resistance level of 1.1905.

Trading trend in the Euro today is expected to be determined by the release of minutes of the European Central Bank’s recent meeting, due later in the day. Moreover, investors would keenly monitor the flash Markit manufacturing and services PMIs for November across the Euro-zone.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.