Eurodollar Futures Non-Commercial Speculator Positions:

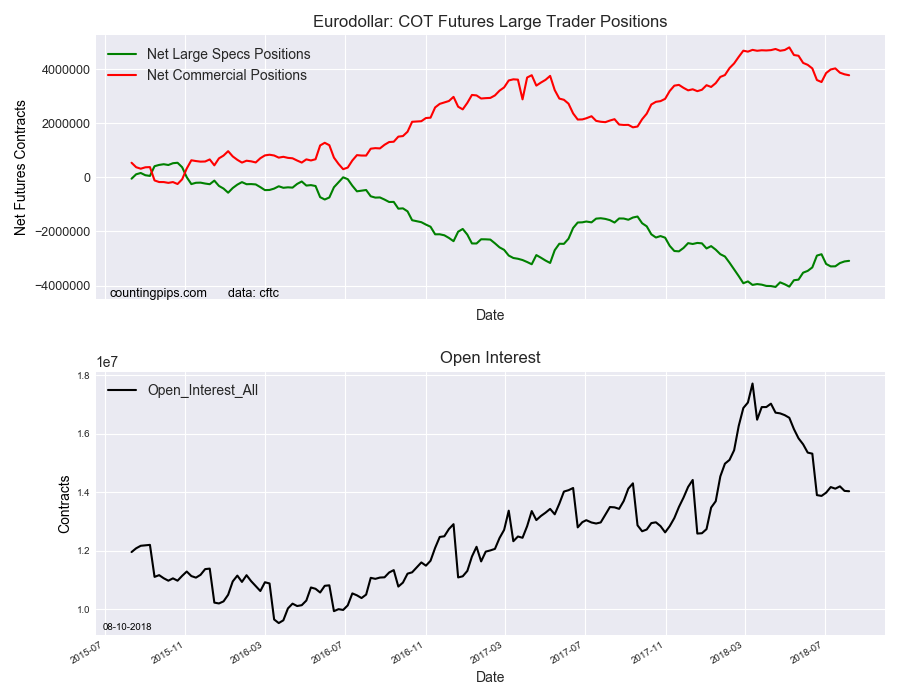

Large speculators cut back on their bearish net positions in the Eurodollar futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Eurodollar futures, traded by large speculators and hedge funds, totaled a net position of -3,085,784 contracts in the data reported through Tuesday August 7th. This was a weekly advance of 21,722 contracts from the previous week which had a total of -3,107,506 net contracts.

The speculative bearish position in Eurodollar futures fell for a fifth consecutive week and for the eighth time out of the past ten weeks. The overall net bearish standing is now at the lowest level since June 26th but does remain above the -3,000,000 net contract level for a sixth straight week.

Eurodollar Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 3,780,039 contracts on the week. This was a weekly decrease of -34,804 contracts from the total net of 3,814,843 contracts reported the previous week.

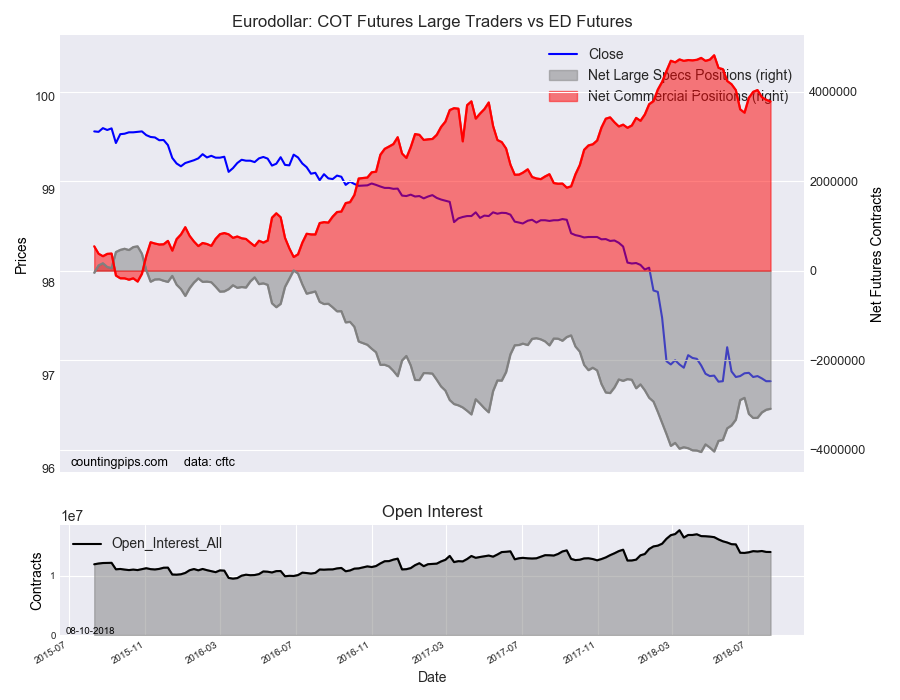

ED Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Eurodollar Futures closed at approximately $96.94 which was unchanged from the previous close of $96.94, according to unofficial market data.