For the 24 hours to 23:00 GMT, the EUR rose 0.62% against the USD and closed at 1.1242, as investors brushed off downbeat inflation data from the Euro-zone.

Data showed that the flash consumer price index in the common currency region advanced less-than-expected by 1.4% in May, rising at its weakest pace in five months, a development that would likely ease pressure on the ECB to curtail its monetary stimulus programme. The CPI had climbed 1.9% in the previous month, while markets anticipated for a rise of 1.5%. Nevertheless, the region’s unemployment rate unexpectedly fell to an eight-year low level of 9.3% in April, pointing towards further tightening in the region’s labour market. Meanwhile, market participants had envisaged the unemployment rate to remain steady at 9.4%.

Elsewhere, in Germany, the seasonally adjusted unemployment rate dropped a record low level of 5.7% in May, meeting market consensus and compared to a level of 5.8% registered in the prior month. On the other hand, the nation’s retail sales registered an unexpected fall of 0.2% on a monthly basis in April, defying market consensus for a gain of 0.2%, dampening hopes that consumer spending will play a leading role in driving growth in Euro-zone’s biggest economy this year. In the previous month, retail sales had risen by a revised 0.2%.

The greenback dropped against its major currencies, after the US pending home sales unexpectedly dropped 1.3% on a monthly basis in April, declining for a second straight month, compared to a revised fall of 0.9% in the previous month. Market anticipation was for pending home sales to rise 0.5%. Also, the nation’s Chicago Fed purchasing managers index fell more-than-anticipated to a level of 55.2 in May, compared to a reading of 58.3 in the prior month.

Separately, the Federal Reserve’s (Fed) latest Beige Book report showed that economic activity grew at a modest to moderate pace across the twelve districts of US from early April through late May. Further, it noted that consumer spending had softened in many districts and a number of firms have become somewhat less optimistic about the future.

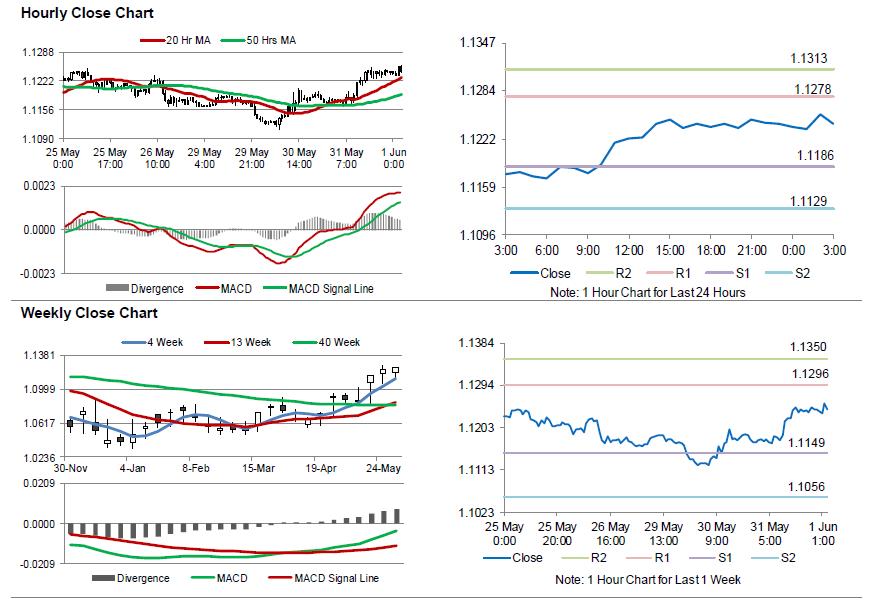

In the Asian session, at GMT0300, the pair is trading at 1.1242, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.1186, and a fall through could take it to the next support level of 1.1129. The pair is expected to find its first resistance at 1.1278, and a rise through could take it to the next resistance level of 1.1313.

Moving ahead, market participants will focus on final Markit manufacturing PMI data for May across the Euro-zone. Additionally, in the US, ADP employment change, the ISM manufacturing as well as the final Markit manufacturing PMIs, all for May along with construction spending data for April, slated to release later in the day, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.