For the 24 hours to 23:00 GMT, the EUR rose 0.7% against the USD and closed at 1.0482, after the Euro-zone’s flash consumer price index (CPI) jumped to a more than three-year high of 1.1% on an annual basis in December, thus providing some relief to the European Central Bank (ECB) which has used a range of stimulus programs to get inflation back toward the central bank’s target of just below 2.0%. In the prior month, the consumer price index had climbed 0.6%, while markets expected for a gain of 1.0%. Additionally, the region’s final Markit services PMI surprisingly advanced to a level of 53.7 in December, defying market expectations for the PMI to remain steady at a level of 53.1, recorded in the preliminary print. The PMI had registered a level of 53.8 in the previous month.

Separately, Germany’s final Markit services PMI unexpectedly rose to a level of 54.3 in December, compared to market anticipation for the PMI to remain unchanged at a level of 53.8, registered in the flash estimate. In the preceding month, the PMI had recorded a level of 55.1.

According to minutes of the US Federal Reserve’s (Fed) most recent meeting, policymakers thought the central bank’s gradual interest rate policy path was under threat, as quicker economic growth under President-elect Donald Trump could require faster interest rate hikes to avoid a potential build-up of inflationary pressure. Further, the committee pointed out “substantial uncertainty” about the US fiscal policy ahead.

In other economic news, mortgage applications in the US rose 0.1% in the week ended 30 December 2016, following a drop of 12.1% in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.0518, with the EUR trading 0.34% higher against the USD from yesterday’s close.

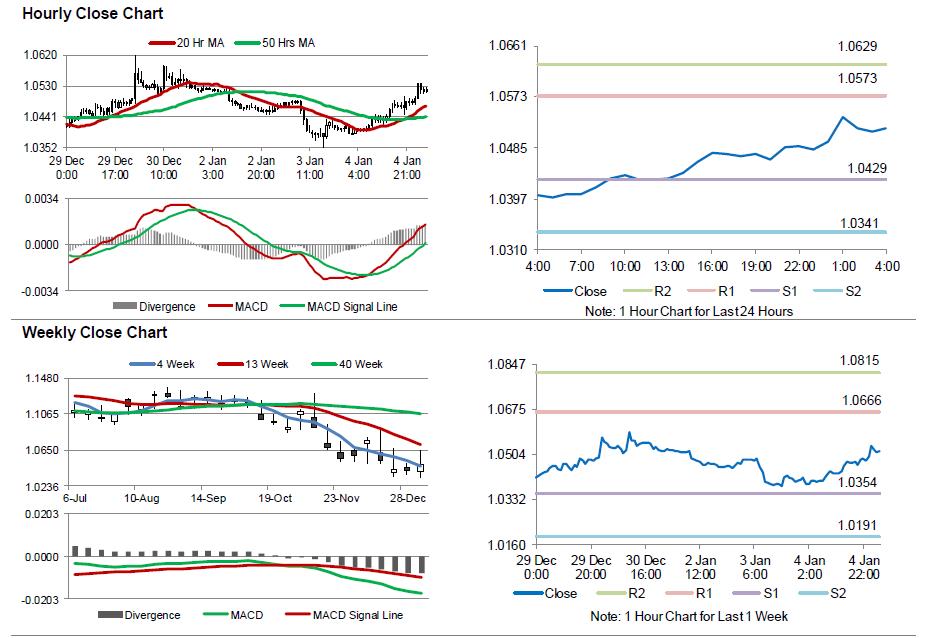

The pair is expected to find support at 1.0429, and a fall through could take it to the next support level of 1.0341. The pair is expected to find its first resistance at 1.0573, and a rise through could take it to the next resistance level of 1.0629.

Ahead in the day, investors will closely monitor ECB’s recent meeting minutes along with Germany’s construction PMI for December, slated to release in a few hours. Additionally, in the US, ADP employment change, ISM non-manufacturing and final Markit services PMIs, all for December, accompanied with weekly jobless claims data, scheduled to release later today, will garner significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.