Here are the latest developments in global markets:

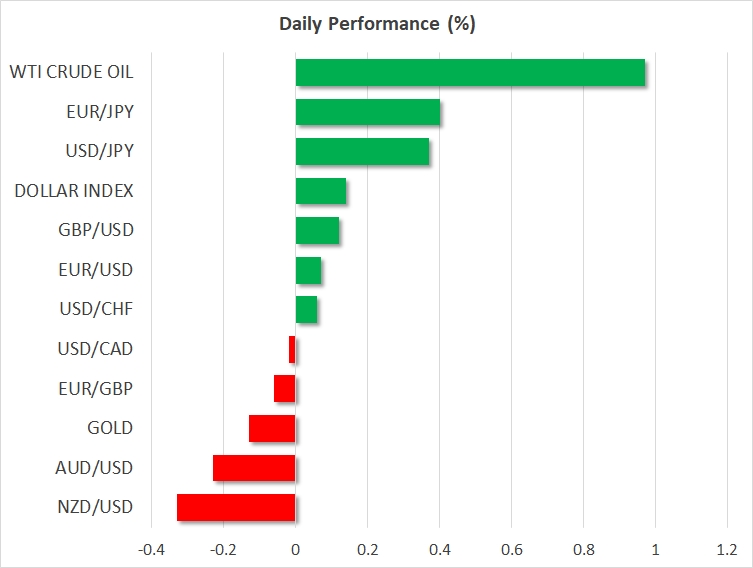

- FOREX: The dollar edged higher versus a basket of currencies on Tuesday after retreating against the euro and sterling on Monday. The yen was losing considerable ground relative to other major currencies, while the antipodeans were trading not far above recent lows against the greenback.

- STOCKS: US markets closed significantly lower yesterday, dragged down primarily by technology stocks, as a scandal involving Facebook (NASDAQ:FB) raised speculation that tech firms may see increased regulation soon. The Nasdaq Composite led the charge lower, declining by 1.8%, while the S&P 500 and the Dow Jones followed closely in its tracks, falling by 1.4% and 1.35% respectively. Futures tracking the Dow Jones and S&P 500 are more or less flat at the time of writing, but those tracking the Nasdaq 100 are in negative territory, pointing to a lower open for the tech-heavy index. In Asia, Japan’s Nikkei 225 and Topix tumbled by 0.5% and 0.2% respectively, while in Hong Kong, the Hang Seng was down by less than 0.1%. Europe was a different story, as futures tracking all the major benchmarks were a sea of green today, suggesting these indices are likely to open higher.

- COMMODITIES: Oil prices surged on Tuesday, with Crude Oil WTI and Brent Crude climbing by 1.0% and 0.8% correspondingly. The spike higher is being attributed to concerns that oil output from Venezuela could fall notably in the near future, as well as due to increased tensions in the Middle East. In this respect, a meeting between the US President and the Saudi Crown Prince today will be closely watched, for any hints on whether a new round of sanctions on Iran is on the cards. The private API crude inventory data will also be in focus at 2030 GMT. In precious metals, gold traded around 0.2% lower today, unable to hold onto the gains it posted yesterday. The yellow metal continues to be unresponsive to the broader risk-aversion in markets lately, even despite the rising risk of a “trade war” that has helped other safe havens like the Japanese yen.

Major movers: Euro and pound build on gains versus the dollar, advances moderate though; yen retreats

The dollar’s index against a basket of currencies was up by around 0.2% at 89.91 after being weighed the previous day by strength in the euro and the British pound. The focus for the dollar now turns to the Federal Reserve’s two-day meeting which concludes on Wednesday and during which the delivery of a quarter percentage point interest rate hike is widely expected. Meanwhile, US Treasury yields were rising on Tuesday, adding to the greenback’s allure.

The yen, which started yesterday’s trading on a positive footing as polls showed Prime Minister Abe’s administration losing public support, was retreating versus majors including the dollar, euro and sterling. Versus the former two, the Japanese currency was down by 0.4%, while pound/yen traded higher by 0.6%, not far below a near three-week high of 149.78 hit earlier in the day.

Euro/dollar was 0.1% up at 1.2343, building on Monday’s gains that saw it rise by 0.4% on the back of rising speculation – spurred by a Reuters report based on ECB sources – that the ECB will further scale back its asset purchases in 2018 and deliver a rate hike around the middle of next year.

The pound also traded 0.1% higher versus the greenback at 1.4036, after adding 0.6% the previous day and recording a one-month high of 1.4087. The British currency was boosted after the UK and the EU agreed to a 21-month post-Brexit transition period as well as a potential solution to avoid a “hard border” for Northern Ireland. Euro/pound, which recorded losses on Monday, was 0.1% down at 0.8789, at 0729 GMT. This compares to yesterday’s one-and-a-half month low of 0.8742.

Lastly, the antipodean currencies extended their recent losses versus their US counterpart. Aussie/dollar was 0.2% down at 0.7699, not far above Monday’s three-month low of 0.7684, while kiwi/dollar was 0.3% lower at 0.7219 after yesterday recording a near three-week low of 0.7194. Cautiousness ahead of the FOMC meeting as well as fears of a global trade war were seen as hurting the currencies of the two commodity-exporting countries; US President Donald Trump is anticipated to unveil up to $60 billion in new tariffs on Chinese products by Friday. In addition, the Aussie was hurt by softer Iron ore prices, Australia’s top export earner, while the RBA minutes of its March meeting released earlier on Tuesday possibly weighed on the currency as well. The central bank reiterated its cautious stance on consumer spending, sending the message that interest rates may need to stay at record lows for longer.

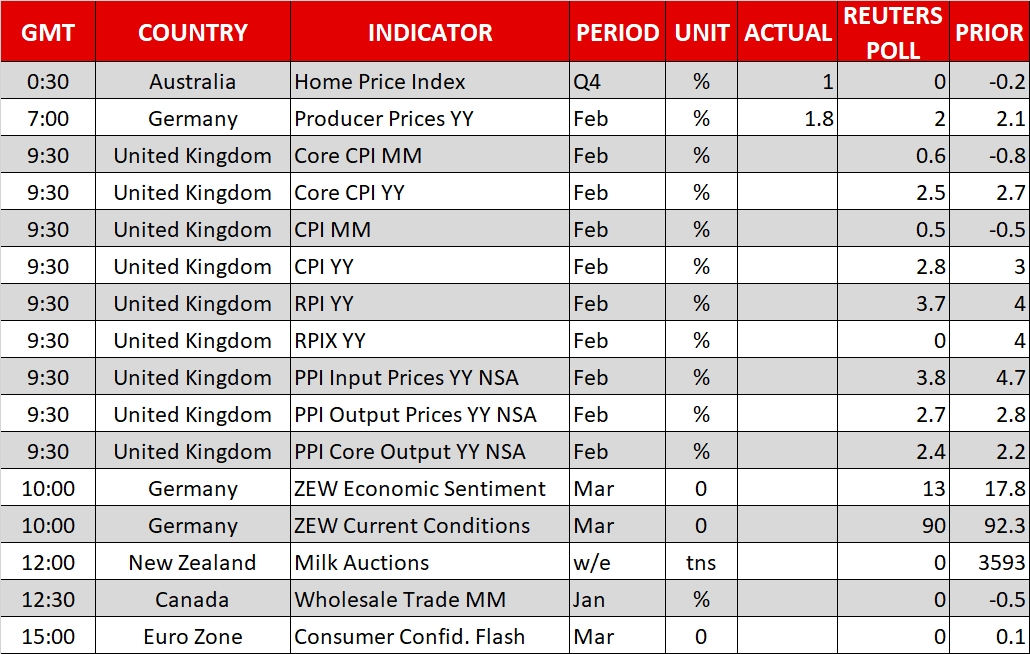

Day ahead: UK inflation data and US-Saudi meeting in the spotlight; G20 trade message also of importance

The most important release today will be the UK CPI data for February, due out at 0930 GMT. Both the headline and the core CPI rates are expected to have declined in yearly terms, but both are still anticipated to remain well-above the Bank of England’s (BoE) 2% target. In such case, slowing inflation would likely ease some of the pressure on the Bank to hike rates in the near-term. Markets currently see a 70% probability for the BoE to raise rates in May. A notable decline in the CPIs – particularly the core rate – could push that probability lower, and sterling alongside it. The Markit services PMI for February supports the forecasts, as it showed prices charged by service companies increasing at the weakest rate for six months. Data on producer prices (PPI) for February will also be made public at the same time.

In Germany, the ZEW survey for March will be in focus at 1000 GMT. Both the current conditions and the expectations indices are anticipated to decline. Even though falling sentiment among German financial experts would be a negative development for the ECB, policymakers are likely to focus more on the Markit PMIs that are due out on Thursday in order to gauge the momentum of eurozone’s economy. The bloc’s preliminary consumer confidence index for March is also coming out, at 1500 GMT.

In New Zealand, the bi-weekly milk auction will be held today. Given New Zealand’s status as a major dairy exporter, these data tend to impact the kiwi dollar. The time of this release is always tentative, though most calendars have it marked for 1200 GMT. Overall, the attention of NZD-traders remains on the RBNZ policy decision tomorrow, as it could determine the currency’s short-term direction.

In the US, the FOMC will begin its policy meeting today, which will conclude tomorrow at 1800 GMT.

In energy markets, besides the weekly API crude inventory data that will be released at 2030 GMT, investors will also keep their eyes on a meeting between US President Trump and Saudi Crown Prince Mohammad bin Salman in Washington. Media reports suggest the two will be discussing Iran and as such, attention will be on whether a new round of sanctions is to be imposed on the nation soon. Any hints suggesting as much could boost oil prices, on speculation that a large chunk of Iranian oil supply could be removed from the market in the foreseeable future.

Elsewhere, the G20 meeting between finance ministers and central bank governors will conclude today. The common statement on trade will be worth watching, as it could provide some signals on whether the “trade war” theme is set to intensify further.

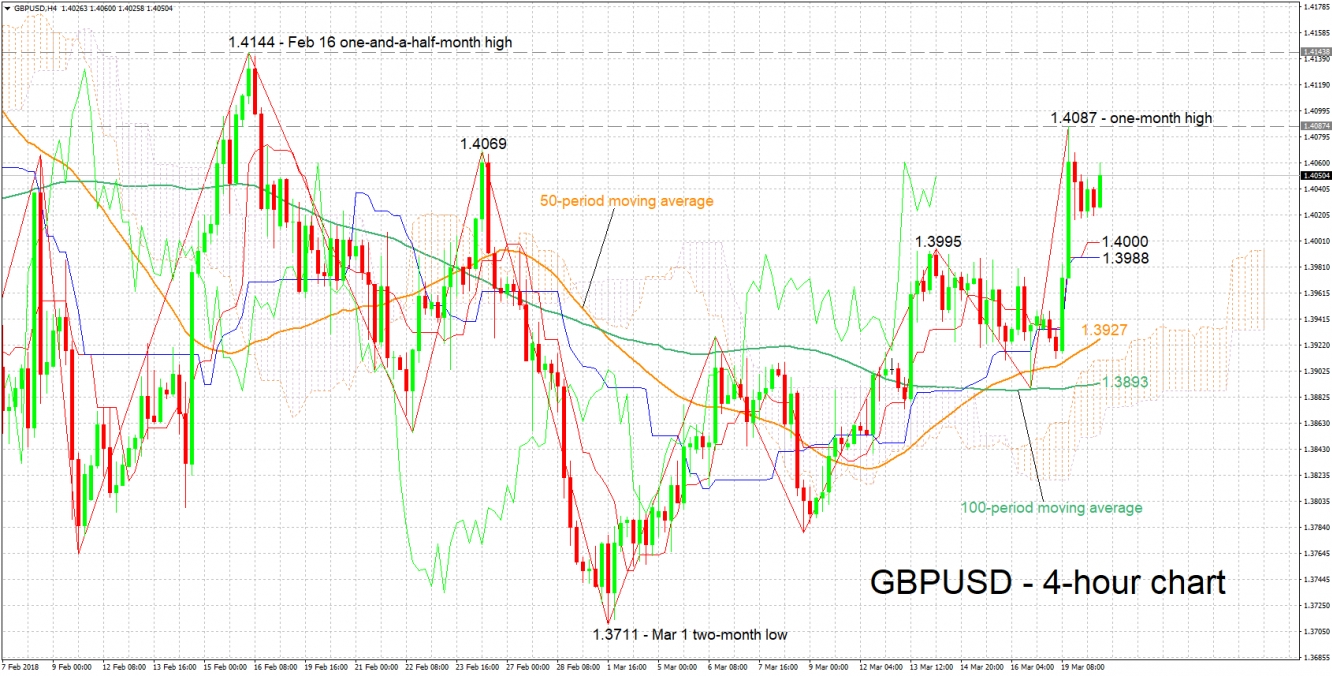

Technical Analysis: GBP/USD bullish bias but positive momentum may be losing steam

GBP/USD is trading roughly 40 pips below Monday’s one-month high of 1.4087. The positively aligned Tenkan- and Kijun-sen lines are projecting a bullish bias, though the fact that the two lines have flatlined is an indication that positive momentum has lost part of its steam. UK inflation figures due later on Tuesday have the capacity to either refuel the positive momentum or alter it altogether, turning the pair to the downside.

Should CPI data be interpreted by markets as increasing the odds for a more aggressive tightening cycle by the Bank of England, then GBP/USD is likely to gain. Resistance in this case might come around yesterday’s high of 1.4087. Notice that the area around this point also encapsulates another top from the recent past at 1.4069, as well as the 1.41 handle that may be of psychological significance.

A downside deviation from inflation projections though is likely to push back expectations for more aggressive monetary policy normalization by the BoE, leading to weakness in GBP/USD. Support in this scenario could be met around the current level of the Tenkan-sen at 1.40. The range around this level also includes the Kijun-sen at 1.3988, as well as a previous peak at 1.3995.