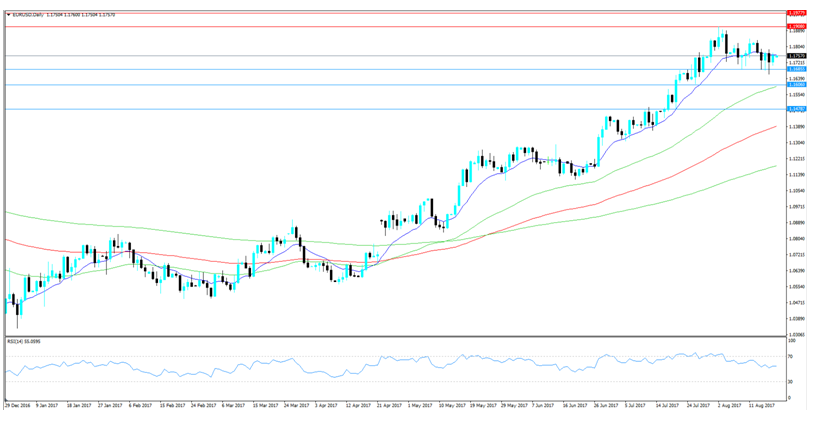

Key Points:

- Price action takes a sideways direction

- RSI Oscillator trending lower within neutral territory

- Pair likely to remain flat in the week ahead but watch for any upside breakouts

The euro continued its process of consolidation over the past week and trended sideways whilst giving up around 75 pips to close at 1.1759. Fundamentally, the pair was impacted by a relatively broad sentiment swing towards the USD which largely overshadowed the stronger than expected EU GDP figures. However, it remains to be seen if the pair will retain this sideways bias in the week ahead. Subsequently, it may be salient to review last week’s events with a view to ascertain what could be potentially looming on the near term horizon.

The euro dollar continued to moderate its recent gains over the past week which saw the pair give up around 75 pips in a gradual slow slide to close around the 1.1759 mark. Although, price action did initially move below near term support it soon rose again to retain its largely sideways direction. In addition, there was a very definite bid towards the USD which also impacted the pair.

This was fuelled by a fall in the U.S. Initial Jobless Claims figures to 232k as well as a rise to 18.9 in the Philly Fed Business Outlook Index and ongoing speculation that the U.S. Federal Reserve will commence a balance sheet taper in the coming months. Subsequently, this also overshadowed what proved to be a relatively robust EU GDP result of 2.2% and the euro saw little in the way of a bump from the result.

Looking ahead, the week ahead will be relatively busy for the euro dollar given the huge bevy of U.S. Economic data which is due for release. In particular, expect the U.S. Core Durable Goods Orders result, forecast at 0.4% m/m, to make its presence keenly felt. In addition, the German IFO Business Climate numbers are also due out and the market is broadly predicting a 115.5 print from the release.

Finally, the Jackson Hole Economic Symposium is happening in the latter part of the week and this always brings with it some interesting information and potential volatility. Janet Yellen is on the schedule to speak this year and is probable to provide plenty of commentary on U.S. economic policy given how close the Fed is to potentially commencing a balance sheet taper. Subsequently, it would pay dividends to monitor the proceedings closely in the coming days.

From a technical perspective, the pair is now clearly within a consolidation phase from the recent 1.1908 high. Subsequently, what we are currently seeing is plenty of sideways movement which is relieving the pressure on the oscillators. We expect this pattern to continue in the week ahead and our initial bias is, therefore, neutral. Any large downside moves should be capped by support around 1.1606 as the pair continues to consolidate its position. Support is currently in place for the pair at 1.1685, 1.1606, and 1.1478. Resistance exists on the upside at 1.1908, 1.1977, and 1.2179.

Ultimately, the euro dollar is likely to take a relatively leisurely sideways direction in the coming week unless a major economic event occurs. However, an upside breakout is highly probably sometime over the near term so watch for any moves back above the 1.1908 high.