The euro reversed gains made earlier today after the Italian President signaled that he would call a fresh election. President Sergio Mattarella appointed former IMF official Carlo Cottarelli as the interim prime minister with the mandate of organizing a new election. The president vetoed an agreement made by the two populist parties – League and Five Star Movement – to nominate Euro-skeptic Paolo Savona as the economy minister. The parties are now calling for the impeachment of the president, which could bring more tensions to the country. Italy has not had a government since March because no party had a majority in parliament. The EUR/USD pair is now trading at 1.1614, the lowest level in six and a half months.

The USD/JPY pair is little moved after Donald Trump reversed his decision to withdraw from the summit with North Korea’s Kim. Over the weekend, the administration said that the meeting was likely to take place on June 12. On Saturday, the presidents of the two Koreas met at the demilitarized zone at the border to try to salvage the meeting. On Sunday, it was announced that a team of American diplomats was already in North Korea to discuss the meeting. Last week, after Trump announced his decision, the Japanese yen strengthened against the dollar as investors moved to the Yen which is often regarded as a safe haven currency. Earlier today, Japan released the Corporate Services Price Index (CSPI) which measures the change in the price of goods sold by corporations. The index jumped by 0.9%, easily beating the analysts’ forecast of 0.5%.

Gold fell today as the dollar strengthened and the North Korea situation eased. The decline ended a gaining streak that saw the metal rise by almost three percent. Gold tends to do well when global uncertainties are on the rise and when the dollar is falling. This is because investors use gold as a safe haven in times of uncertainties.

EUR/USD

Initially, the EUR/USD pair went up and tested the resistance level of 1.1725 as shown below. The pair then reversed and fell to the lowest level in more than 6 months. The pair is now trading at the 1.1635 level, which is below the 20-day moving average. The price is on the lower band of the Bollinger bands® while the RSI is currently pointed lower. The pair could continue moving lower, potentially to the 1.1535 support level.

USD/JPY

The USD/JPY was little moved as the talks between the US and North Korea appeared to be on track. The pair is now trading at 109.26, which is lower than the 111.4 level where the pair was on Monday last week. It is also slightly below the 25 and 50-day moving average. Yesterday, the pair was trading at low volumes because the US markets were closed. The technical indicators are showing a neutral outlook for the pair, which is likely to change today after the consumer confidence data is released.

XAU/USD

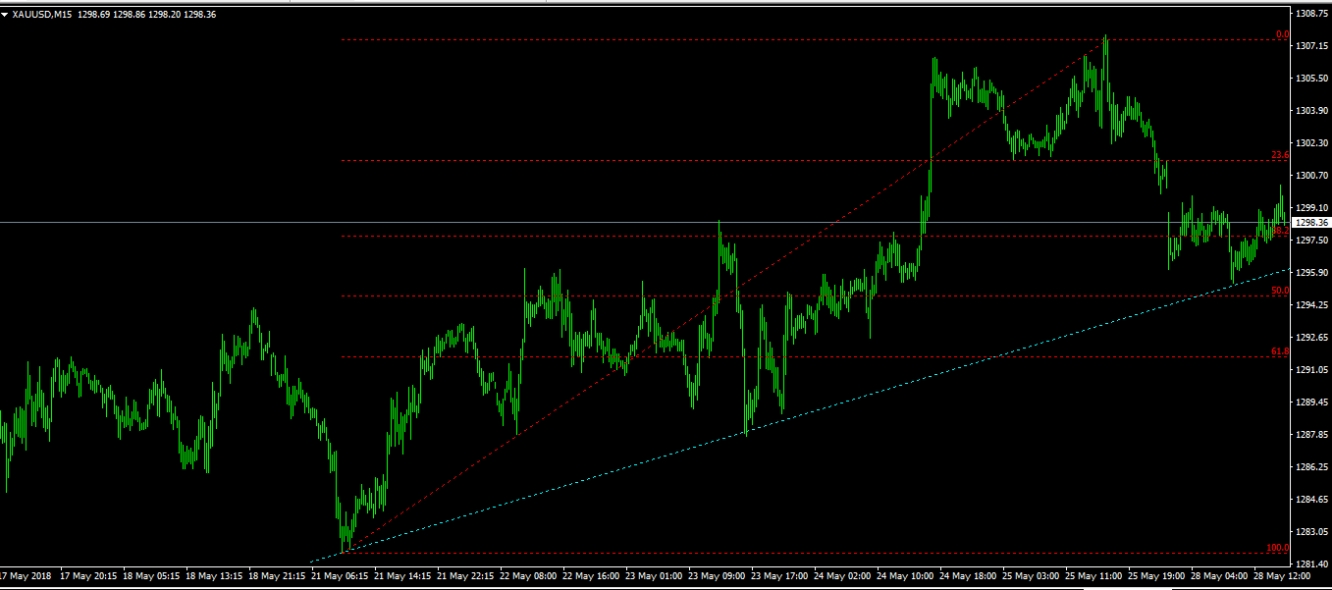

Yesterday, gold fell against the dollar as the latter strengthened. Gold fell by almost 50 basis points as the dollar index rose by about 20 basis points. As shown below, the XAU/USD pair fell to an intraday low of 1,295, which is an important support level. In the past one week, the pair rose from a low of 1,281 and reached an intra-week high of 1,307 as global tensions rose. The pair is likely to test the 1,300 level which is also the 23.6% Fibonacci Retracement level as shown below.