It has been a relatively quiet week in the currency markets, and the limited activity has continued today, with the EUR/USD unchanged.

German consumer confidence drops

Germany, the bellwether for the eurozone, continues to churn out weak numbers, raising concerns that the bloc could be headed toward a recession. German ifo Business Climate dipped to 92.3 in June, down from 93.0 in May (92.8 est.) Germany and the rest of the eurozone remain vulnerable to negative economic factors which, unfortunately, do not show signs of improving anytime soon. These are the war in Ukraine, supply chain disruptions due to lockdowns in China, and spiraling inflation. The ECB has been slow to respond to higher inflation and the danger of stagflation is a serious risk.

Germany has been slowly trying to wean itself off of Russian energy exports, but Moscow has decided to retaliate by decreasing its natural gas exports to Germany. This prompted Berlin to implement phase two of its emergency energy plan earlier this week. The energy crisis is getting worse and could result in the euro losing ground. The currency slipped below the 1.0500 line last week, and the risk is tilted to the downside for the euro due to the deteriorating situation with regard to Russian energy exports.

Fed Chair Powell’s appearance on Capitol Hill this week was keenly watched by nervous markets. Powell didn’t hold back any punches, acknowledging that a recession was possible and a soft landing for the economy would be a challenge. At the same time, Powell sounded relatively optimistic about the strength of the US economy, and this message appeared to calm the financial markets, for the time being at least.

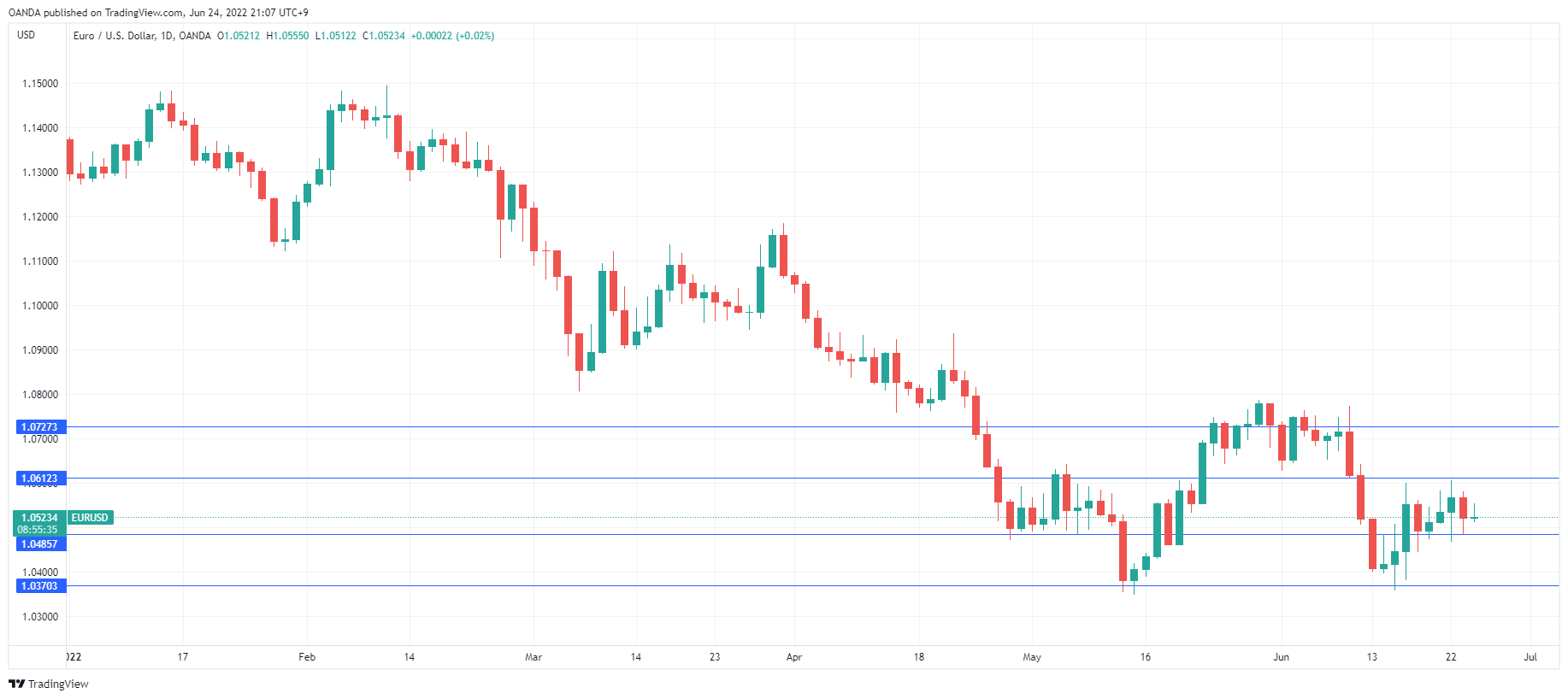

EUR/USD Technical

- EUR/USD has initial resistance at 1.0612, followed by resistance at 1.0727

- EUR/USD has support at 1.0485 and 1.0370