EUR/USD is steady at the start of the week. In the North American session, EUR/USD is trading at 1.0534, down 0.06%. The US dollar has been struggling and fell 1.5% against the euro last week. The euro rally fizzled on Friday as the US employment report was stronger than expected.

The economy created 263,000 jobs in November, slightly lower than the October reading of 284,000 but well above the consensus of 200,000. Wage growth impressed, as the reading of 5.1% y/y was up from 4.9% and beat the forecast of 4.6%. The labor market continues to show a surprising resiliency, and the increase in wage growth will drive inflationary pressure.

The Fed is expected to ease rates to 50 bp in December, but the strong labor market indicates that the economy can absorb further rate hikes in the New Year. Investors were hoping for a weak jobs report which would force the Fed to scale back its hikes and fuel a stock market rally, but the strong data has dashed those hopes.

The eurozone continues to struggle, and the data didn’t help things. German and Eurozone services PMIs remained in decline, with readings below 50.0. Eurozone retail sales fell by 1.8%, a 10-month low, while Investor Confidence remains deep in negative territory, at -21.0.

Despite recent gains, the outlook for the euro is weak, as the European Commission expects the eurozone economy to decline in Q4 2022 and Q1 2023. The driver of the expected decline is the huge jump in energy prices caused by the war in Ukraine.

The eurozone is grappling with double-digit inflation, and the ECB will have to continue raising rates, despite weak economic conditions until there are unmistakable signs that inflation is finally on the way down.

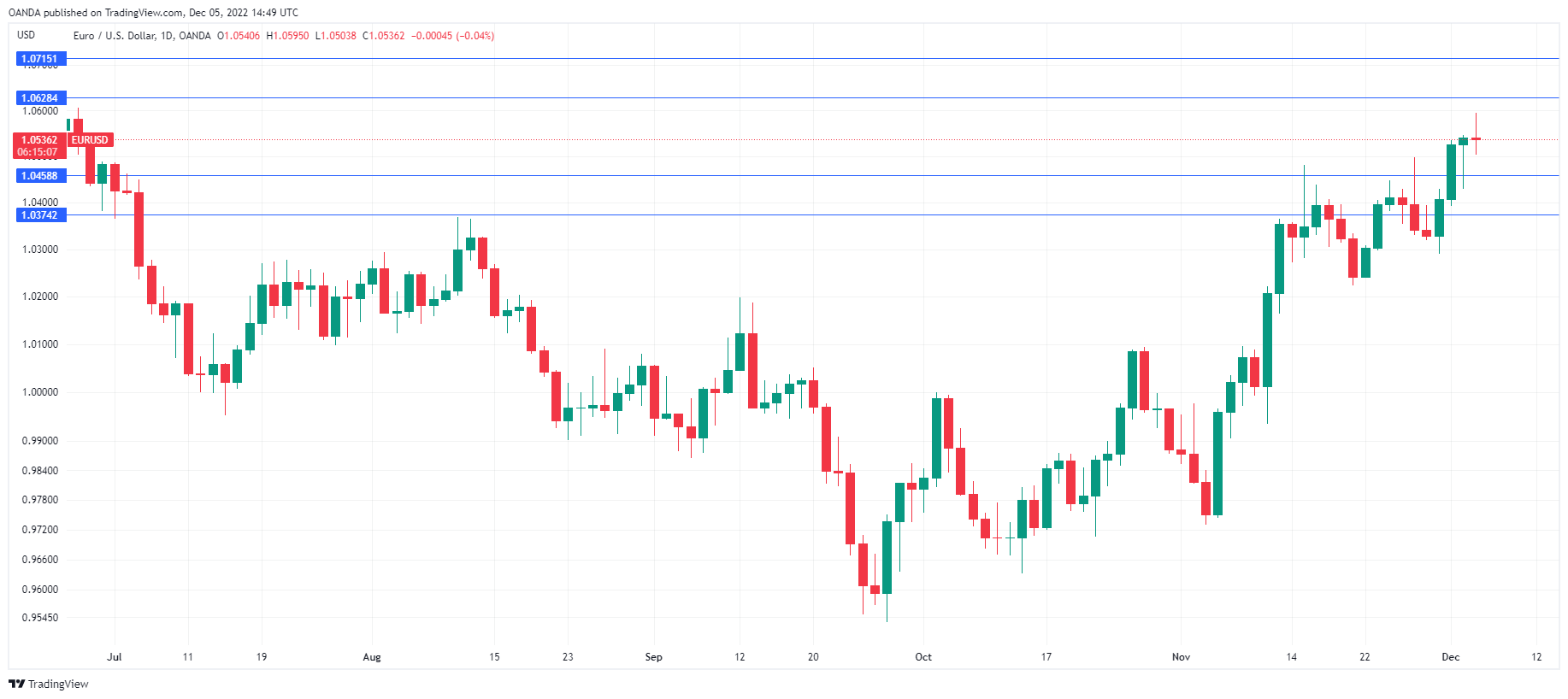

EUR/USD Technical

- There is resistance at 1.0629 and 1.0714

- EUR/USD has support at 1.0459 and 1.0374