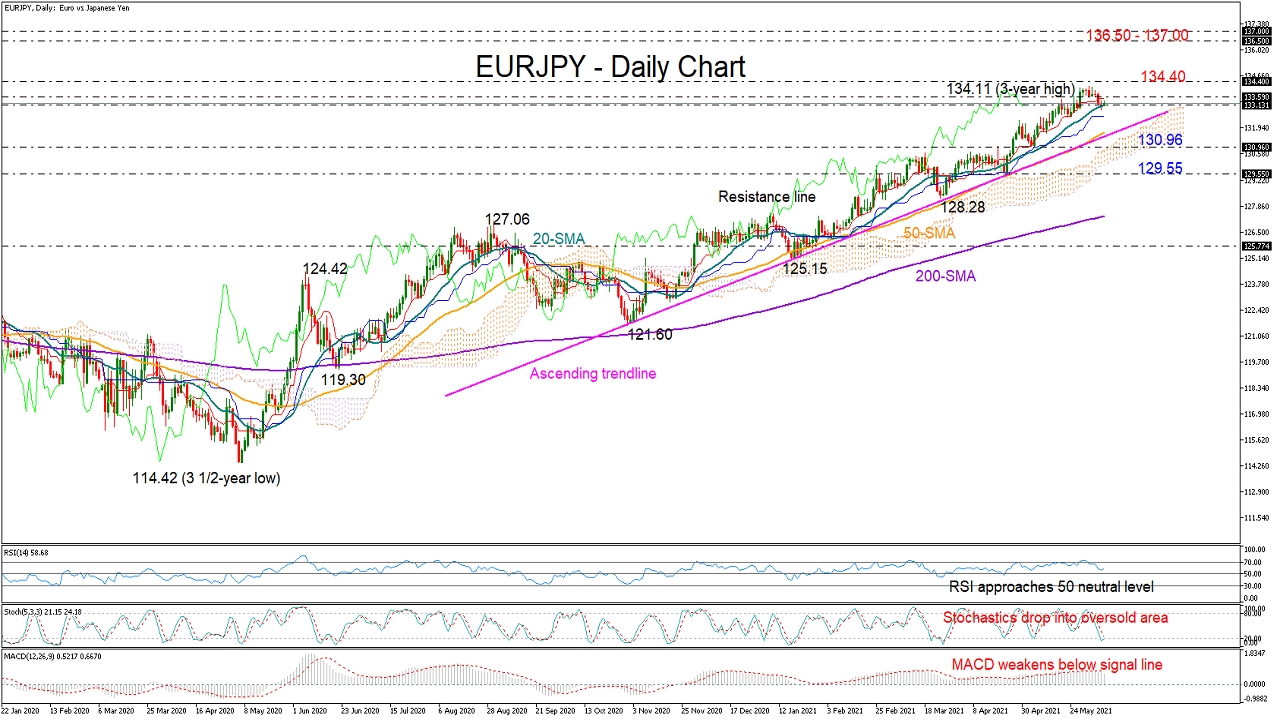

EURJPY ran out of bullish steam around a new 3-year high of 134.11 last week, with the price shifting southwards to seek support near the 20-day simple moving average (SMA) at 133.13.

The pair is currently trading comfortably above the key ascending trendline, and the positive gap between the 20- and 50-day SMAs has further widened, increasing speculation that the upward pattern could see more extensions before fading out.

As regards the price momentum, some weakness cannot be ruled out since the pair is hovering near the 2017 ceiling of 134.40. The recent downfall in the RSI, the pullback in the MACD, as well as the price’s drop below the supportive red Tenkan-sen line are further endorsing this narrative, while the dip in the Stochastics has yet to reach a bottom in the oversold area, keeping the bearish scenario in favor too.

The 20-day SMA should give way for the bears to speed up to meet the tough ascending trendline and the 50-day SMA at 131.80. The restrictive surface of the Ichimoku cloud is in the same location, adding extra importance to the region, while not far below, the swing low of 130.96 could be the last opportunity for a rebound before a more aggressive sell-off develops towards 129.55.

On the upside, a new bullish wave could start above 134.40 with scope to test the 136.50 – 137.00 resistance zone taken from the 2015 limitations.

In brief, trend signals remain encouraging for EURJPY, though some caution is warranted as a downside correction could precede any progress in the market trend.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/JPY Favors Uptrend, But Close To 2017 Resistance

ByXM Group

AuthorTrading Point

Published 06/08/2021, 05:12 AM

Updated 02/07/2024, 09:30 AM

EUR/JPY Favors Uptrend, But Close To 2017 Resistance

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.