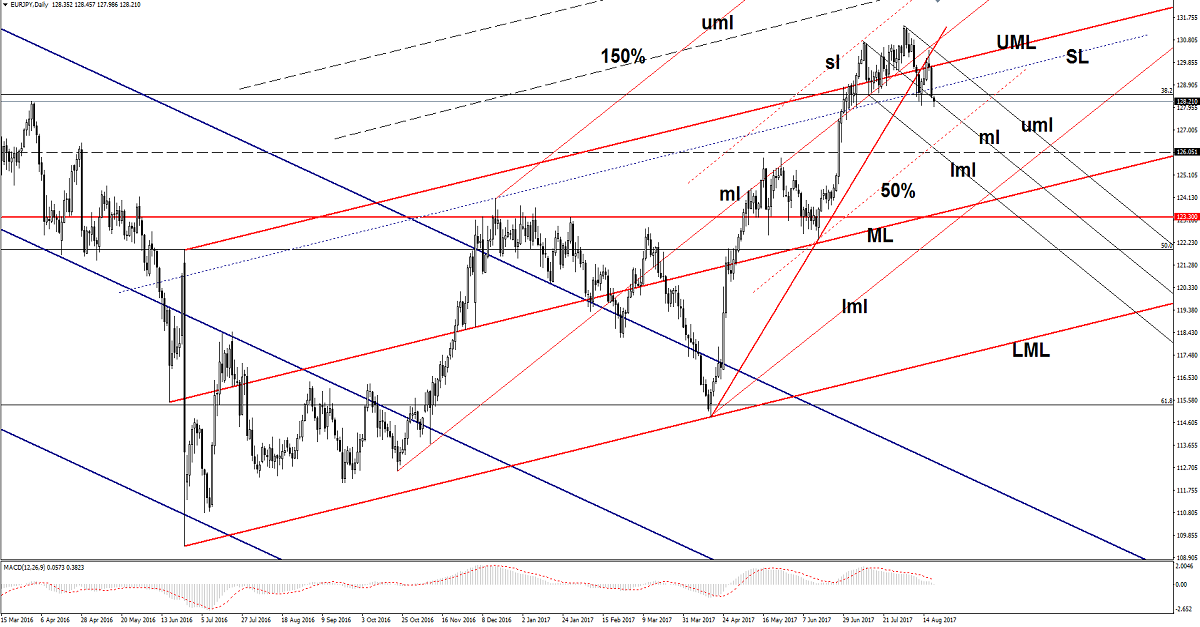

EUR/JPY On The Way Down

EUR/JPY is trading in the red and look too heavy to be stopped on the short term. Has managed to drop below the 128.04 previous low confirming a further drop in the upcoming period. The yen appreciates versus all its rivals as the Nikkei plunged aggressively in the yesterday’s trading session.

The Nikkie failed to stabilize above the 19700 major static resistance (support turned into resistance) and now is approaching the 19309 previous low. Technically, the index was expected to drop towards the 18936 static support, such a drop will force the Yen to dominate the currency market.

Euro posted humble gains right after the German PPI was released, the indicator increased by 0.2% in July, beating the 0.0% estimate and the 0.0% growth in the former reading. The Euro-zone Current Account could bring more action, is expected to decrease from 30.1B to 27.3B in June.

Has finally dropped below the 128.00 psychological level and seems poised for more drops. It is located below the median line (ml) of the minor descending pitchfork and much below the 38.2% retracement level, the next downside target will be at the 50% Fibonacci line (ascending dotted line). The further drop will be confirmed after a retest of the broken median line (ml).

The breakdown needs confirmation to be sure that will extend the sell-off, technically is expected to drop further after the retest of the red uptrend line and the upper median line (UML) of the ascending pitchfork.

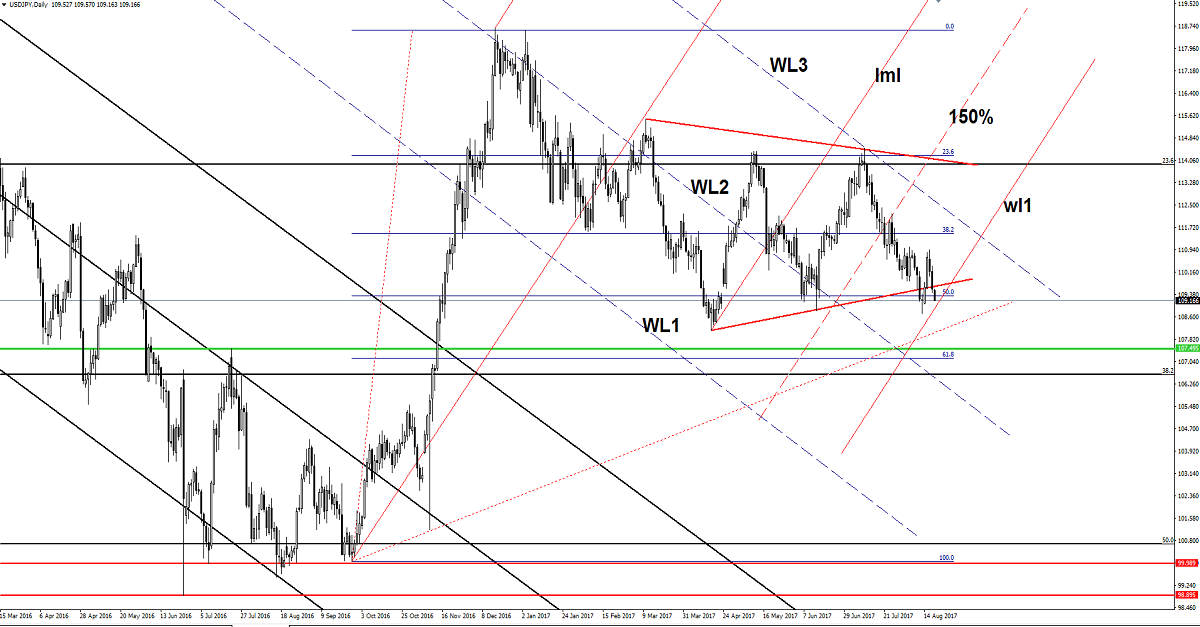

USD/JPY Breakdown In Play

Price drops like a rock and seems unstoppable on the short term. It has ignored the red uptrend line and now the 50% retracement level, a valid breakdown below these levels will bring a breakdown through the warning line (wl1) as well.

Should drop much deeper as the Nikkei’s drop is boosting the Yen, the index is very heavy on the daily chart after the false breakout above the 19700 horizontal resistance.

The major downside targets will be at the 61.8% and below at the long term 38.2% retracement level, could also be attracted by the second warning line (WL2) of the former descending pitchfork.

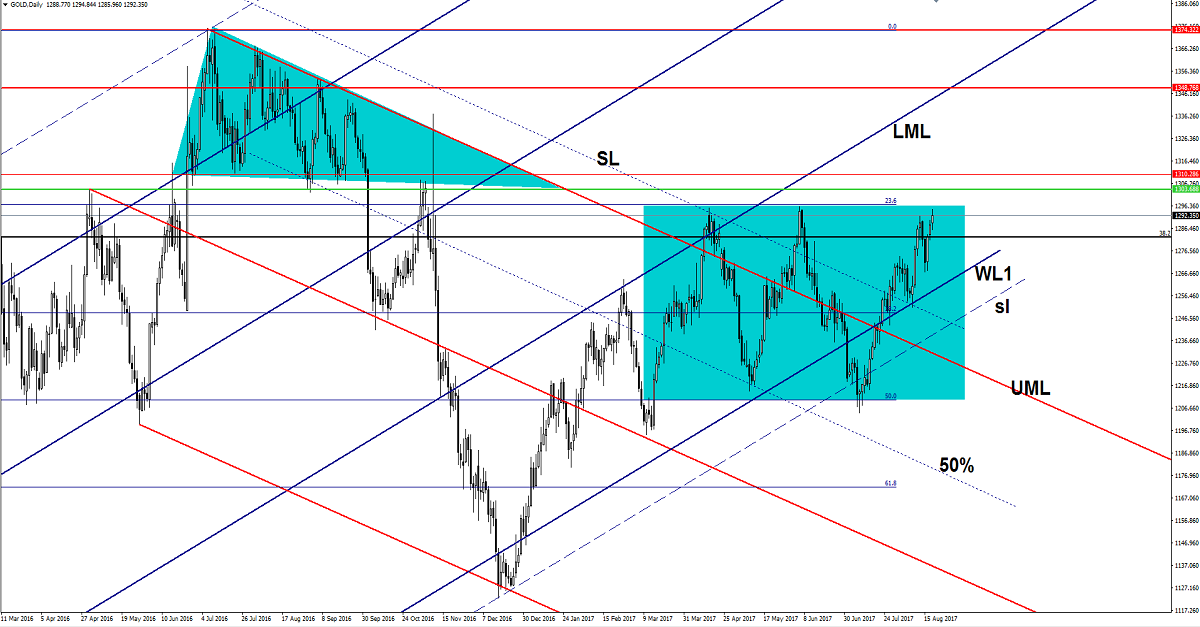

Gold Targeting New Peaks

Price rallies as the USD is going down again, you can see that is almost to hit the 23.6% retracement level and the $1295 per ounce. A breakout from the extended sideways movement is favored after the aggressive jump above the 38.2% retracement levels. Technically is expected to climb much higher after the failure to retest the warning line (WL1).

Risk Disclaimer: Trading, in genera,l is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.