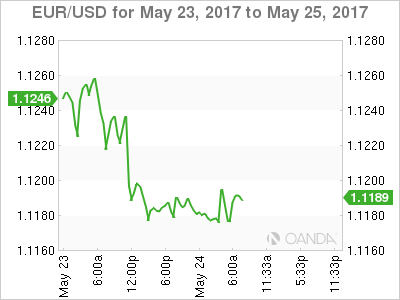

The euro continues to have a quiet week, as EUR/USD continues stays close to the 1.12 line. Currently, EUR/USD is trading at 1.1190. In economic news, German Consumer Climate improved to 10.4, beating the estimate of 10.2 points.

The ECB released its semi-annual Financial Stability Review, which was generally positive. Later in the day, ECB President Mario Draghi will speak at an event in Madrid. In the US, today’s highlight is Existing Home Sales, which is expected to dip to 5.65 million. On Thursday, the US releases unemployment claims.

German indicators continue to point upwards, indicative of a healthy German economy. On Tuesday, Consumer Climate improved to 10.4, its highest level in over a decade. Stronger consumer confidence should translate into increased consumer spending, a key driver of economic growth. Final GDP for the first quarter remained at 0.6%, unchanged from the Preliminary GDP reading.

Business confidence and manufacturing PMI reports also improved in May. An improvement in the global demand has boosted the German export and manufacturing sectors, and Germany is on track for a solid second quarter, which is good news for the euro-area.

Will the Federal Reserve raise rates in June? The markets think so, as the odds of a rate hike have increased to 83%, according to the CME Group (NASDAQ:CME). Just last week, the likelihood of rate increase stood at 73%. Still, Fed policymakers are playing it safe, at least in their public statement.

On Tuesday, Philadelphia Fed President Patrick Harker said that a June move was a “distinct possibility”, but cautioned that a weak inflation report could delay a rate hike. Earlier in the week, Robert Kaplan, President of the Dallas Fed, stated that three interest increases in 2017 was “appropriate”. The Fed minutes are expected to underscore support for a June move, but may not shed much light on what happens after that. Still any clues about the Fed’s rate plans could shake up the listless EUR/USD.

On Tuesday, the White House presented Trump’s 2018 budget proposal to lawmakers in Congress. Trump is eager to pick up the axe and slash government spending, and the budget proposes major cuts to the Medicaid health program, disability benefits and food stamps. Trump has outlined an ambitious program to cut government spending by $3.6 trillion in the next 10 years and achieving a balanced budget by 2020. The budget includes $25 billion for paid leave after childbirth and some $200 billion for infrastructure programs. Trump’s budget will face tough opposition on Capitol Hill, with both Democrats and Republicans likely to demand changes. Still, with the Trump administration beset by Congressional investigations, the White House can point to the budget as a step forward in his agenda to slash government spending.

Trump Releases Budget Plan For Tax Payers

EUR/USD Fundamentals

Wednesday (May 24)

- 2:00 GfK German Consumer Climate. Estimate 10.2. Actual 10.4

- 4:00 ECB Financial Stability Review

- Tentative – German 10-y Bond Auction

- 8:45 ECB President Mario Draghi Speaks

- 9:00 Belgian NBB Business Climate. Estimate -0.5

- 9:00 US HPI. Estimate 0.5%

- 10:00 US Existing Home Sales. Estimate 5.65M

- 10:30 US Crude Oil Inventories. Estimate -2.4M

- 14:00 US FOMC Minutes

- 18:00 US FOMC Member Robert Kaplan Speaks

Thursday (May 25)

- 8:30 US Unemployment Claims. Estimate 238K

*All release times are EDT

*Key events are in bold

EUR/USD for Wednesday, May 24, 2017

EUR/USD Wednesday, May 24 at 6:20 EDT

Open: 1.1182 High: 1.1197 Low: 1.1170 Close: 1.1185

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0873 | 1.0985 | 1.1122 | 1.1242 | 1.1366 | 1.1465 |

EUR/USD has been flat in the Asian and European sessions

- 1.1122 is providing support

- 1.1242 is the next line of resistance

Further levels in both directions:

- Below: 1.1122, 1.0985 and 1.0873

- Above: 1.1242, 1.1366, 1.1465 and 1.1534

- Current range: 1.1122 to 1.1242

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Wednesday session. Currently, short positions have a majority (67%), indicative of EUR/USD breaking out and moving lower.