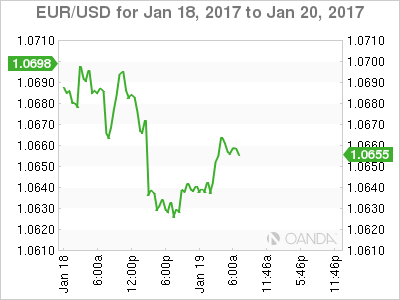

EUR/USD has recorded slight gains in the Thursday session. Currently, the pair is trading at 1.0660. In economic news, the Eurozone Current Account surplus improved to EUR 36.1 billion, well above the forecast of EUR 29.3 billion. Later in the day, the ECB will set its minimum bid rate, which is expected to remain pegged at a flat 0.0%. It’s a busy day in the US, with three key events – Building Permits, Philly Fed Manufacturing Index and Unemployment Claims. Friday is Inauguration Day in the US, and the markets will be closely monitoring President-elect Trump’s inaugural address to the nation.

The ECB holds its first policy meeting of 2017 on Thursday. The bank is expected to maintain interest rates at 0.00%, where they have been pegged since March 2016. As well, no change is expected to the bank’s asset-purchase program (QE). ECB President Mario Draghi’s press conference often steals the thunder on Rate Day, and this could again prove to be the case. The markets will be looking for clues from Draghi regarding the timing of further tapering of the asset-purchase program.

In December, the bank extended its asset-purchase program until December 2017, but also cut the size of the program from EUR 80 billion to 60 billion. Draghi insisted that the cut was not a taper, possibly to provide him with wiggle room in case the ECB decided to reverse directions and raise the purchase amounts. The Eurozone economy has shown signs of improved growth and higher inflation, but policymakers will want to see this trend strengthen before tapering QE. Earlier this week, Eurozone Final CPI jumped 1.1%, its strongest showing in over three years.

British Prime Minister Theresa May’s landmark speech on Brexit sent the pound surging earlier this week. However, the euro has not showed nearly as much volatility as the British currency, even though Brexit will have significant political and economic repercussions on Europe. In her remarks, May announced that Britain would be quitting Europe’s common market, but would assume full control over its borders and immigration policy. She said that Britain was not looking for a “half-in, half out” relationship with the EU, and Britain would seek free-trade deals with Europe and countries around the world.

May intends to trigger Article 50 (the formal mechanism for leaving the EU) in March and has set a two-year time frame for an agreement to be reached. Many European leaders were decidedly cool towards the speech, but Germany’s foreign minister acknowledged that May had finally clarified Britain’s stance on Brexit. The next step is to set up a negotiation process, which promises to be tough and arduous as Britain and the EU must come to some divorce arrangement that both sides can agree upon.

European Central Bank Expected to Hold in 1st Meeting of 2017

EUR/USD Fundamentals

Thursday (January 19)

- 4:00 Eurozone Current Account. Estimate 29.3B. Actual 36.1B

- 7:45 Eurozone Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

- 8:30 US Building Permits. Estimate 1.22M

- 8:30 US Philly Fed Manufacturing Index. Estimate 16.3

- 8:30 US Unemployment Claims. Estimate 252K

- 8:30 US Housing Starts. Estimate 1.19M

- 10:30 US Natural Gas Storage. Estimate -235B

- 11:00 US Crude Oil Inventories. Estimate 0.1M

- 20:00 US Fed Chair Yellen Speech

Upcoming Key Events

Friday (January 20)

- Tentative – President Trump Speech

*All release times are EST

*Key events are in bold

EUR/USD for Thursday, January 19, 2017

EUR/USD January 19 at 6:05 GMT

Open: 1.0628 High: 1.0670 Low: 1.0622 Close: 1.0657

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0414 | 1.0506 | 1.0616 | 1.0708 | 1.0873 | 1.0985 |

- EUR/USD has edged higher in the Asian and European sessions

- 1.0616 is providing support

- 1.0708 was tested in resistance earlier and is a weak line

Further levels in both directions:

- Below: 1.0616, 1.0506 and 1.0414

- Above: 1.0708, 1.0873 and 1.0985

- Current range: 1.0616 to 1.0708

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Thursday session. Currently, short positions have a slim majority (52%), indicative of slight trader bias towards EUR/USD reversing directions and moving higher.