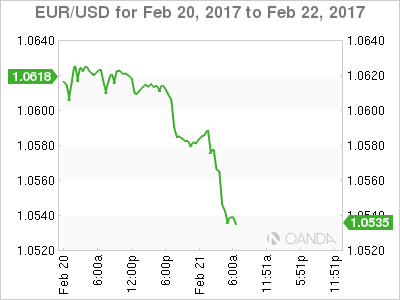

EUR/USD has posted losses in the Tuesday session, as the pair trades at 1.0540. After a quiet start to the week, there are a host of events on Tuesday. In the eurozone, Manufacturing PMIs in Germany and the Eurozone continued to indicate expansion. German Flash Manufacturing PMI climbed to 57.0, beating the estimate of 56.2. The Eurozone report followed suit and improved to 55.5, above the forecast of 55.0. In the US, we’ll get a look at Flash Manufacturing and Flash Services PMI reports. On Wednesday, the Federal Reserve releases the minutes of the January policy meeting.

After Fed Chair Janet Yellen’s upbeat take on the US economy, the markets are keen to review the Fed policy minutes, which will be released on Wednesday. Testifying before Congress last week, Yellen noted that inflation is moving towards the Fed’s 2 percent target, the labor market remains red-hot and consumer spending is strong. Yellen strongly hinted that a rate hike was imminent, leaving the markets to speculate if the Fed prefers to make a move in March or June. If the US economy stays on track in 2017, analysts expect two or three rate hikes of a quarter-point. At the same time, the Fed wants to take into account the economic stance of the new administration, but this remains an elusive goal. Donald Trump continues to have difficulty filling in key cabinet positions and the media continues to probe connections between Trump officials and Russia. Trump has fired back by bitterly attacking the media, and lost in the mayhem is a clear and coherent economic policy. Although Trump has been in office for just over a month, the perception of a muddled and disoriented White House is creating uncertainty in the markets, and is, as Trump would say, “bad for business”.

Recent eurozone numbers have been steady, with the economy expanding and inflation levels moving upwards. Nonetheless, the ECB appears reluctant to make any changes to current monetary policy. The ECB released the minutes of its January policy meeting on Thursday. The minutes indicated that the central bank continues to have little appetite for reducing stimulus. Policymakers stated that the recent climb in inflation could prove to be temporary and there is political uncertainty ahead. France and Germany, the two largest economies in the eurozone, go to the polls later this year, as does the Netherlands. Inflation has moved close to the central bank’s target of around 2 percent, prompting calls from Germany and elsewhere to tighten monetary policy. At this point in time, a majority of ECB policy makers are in favor of maintaining course the asset-purchase program, which ends in December. However, if growth and inflation numbers continue to climb, there will be increased pressure and louder voices calling for a tightening in monetary policy.

EUR/USD Fundamentals

Tuesday (February 21)

- 2:45 French Final CPI. Estimate -0.2%. Actual -0.2%

- 3:00 French Flash Manufacturing PMI. Estimate 53.5. Actual 52.3

- 3:00 French Flash Services PMI. Estimate 53.8. Actual 56.7

- 3:30 German Flash Manufacturing PMI. Estimate 56.2. Actual 57.0

- 3:30 German Flash Services PMI. Estimate 53.6. Actual 54.4

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 55.0. Actual 55.5

- 4:00 Eurozone Flash Services PMI. Estimate 53.7. Actual 55.6

- All Day – ECOFIN Meetings

- 8:50 US FOMC Member Neel Kashkari Speech

- 9:45 US Flash Manufacturing PMI. Estimate 54.7

- 9:45 US Flash Services PMI. Estimate 55.8

- 12:00 US FOMC Member Patrick Harker Speech

Wednesday (February 22)

- 4:00 German Ifo Business Climate. Estimate 109.6

- 10:00 US Existing Home Sales. Estimate 5.55M

- 14:00 US FOMC Minutes

*All release times are EST

*Key events are in bold

EUR/USD for Tuesday, February 21, 2017

EUR/USD February 21 at 5:45 EST

Open: 1.0609 High: 1.0613 Low: 1.0533 Close: 1.0537

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0333 | 1.0414 | 1.0506 | 1.0616 | 1.0708 | 1.0873 |

EUR/USD was flat in the Asian session and has posted losses in European sessions

- 1.0506 is providing support

- 1.0616 is the next resistance line

Further levels in both directions:

- Below: 1.0506, 1.0414 and 1.0333

- Above: 1.0616, 1.0708, 1.0873 and 1.0985

- Current range: 1.0506 to 1.0616

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged in the Tuesday session. Currently, short positions have a majority (56%), indicative of trader bias towards the euro reversing directions and moving higher.