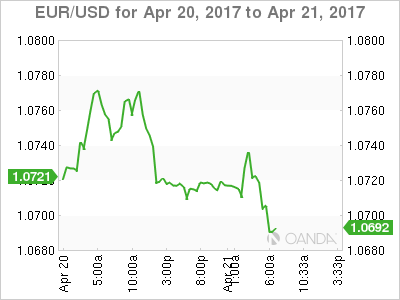

EUR/USD is showing little movement in the Friday session. Currently, the pair is trading just above the 1.07 line. On the release front, Eurozone and German Manufacturing PMIs both beat their estimates, and the Eurozone current account surplus was much higher than expected. In the US, today’s key event is Existing Home Sales, which is expected to climb to 5.61 million. On Saturday, US Treasury Secretary Robert Mnuchin will speak at the International Monetary Fund meeting in Washington. On Sunday, France goes to the polls for the first round of the presidential election.

Sunday is Election Day across France, which holds the first round of the presidential election. The election campaign has been divisive and charged, so perhaps it’s fitting that the four front-runners (in a crowded field of 11) are all within a few percentage points of one another. Given the tightness of the race, final opinion polls have become market-movers. An opinion poll on Thursday showed centrist Emmanuel Macron with 25% of the vote, just ahead of far-right candidate Marie Le Pen with 22%. Le Pen’s platform includes sharp curbs on immigration and a referendum on France’s membership in the European Union. If Le Pen does better than predicted, investor sentiment could sour and send the euro sharply lower. A shooting in Paris on Thursday which killed a policeman and a tourist have stretched taught nerves even further, as security and the terrorism threat remain one of the key issues in the campaign. The markets are expecting more volatility ahead of and following the election, and French banks will be staffed throughout Sunday night in order to respond quickly to developments in the currency markets after the election results.

PMI reports for March from the eurozone, France and Germany all pointed to expansion in the services and manufacturing sectors, underscoring an improving eurozone economy. Manufacturing data was particularly encouraging, as Eurozone and German Manufacturing PMIs came in at 56.8 and 56.2 respectively, as both readings beat their estimates. The strong PMI numbers have helped support the euro on Friday, as cautious investors keep a close eye on Sunday’s vote in France. There was more positive news as the eurozone’s current account surplus jumped to EUR 37.9 billion, well above the estimate of EUR 26.3 billion.

The Federal Reserve has broadly hinted that it will gradually raise rates in 2017, but it’s unclear how many times Janet Yellen will press the rate trigger. Most analysts are expecting two more moves this year, but there have been calls from some Fed policymakers for three more hikes. However, soft retail sales and CPI numbers in March are likely to make the Fed more dovish, and on Tuesday, the Atlanta and New York Federal Reserve lowered their outlook for US economic growth for the first quarter. The Fed can point to a labor market that is close to capacity as well as strong consumer confidence, but surprisingly, this has not translated into stronger consumer spending, a key driver of economic growth. Will the Fed raise rates in June? The odds of a June move are showing a surprising amount of volatility, and the latest CME Group (NASDAQ:CME) reading shows the likelihood a 1/4 point hike have jumped to 58%, up from 45% earlier this week.

EUR/USD Fundamentals

Friday (April 21)

- 3:00 French Flash Manufacturing PMI. Estimate 53.2. Actual 55.1

- 3:00 French Flash Services PMI. Estimate 57.2. Actual 57.7

- 3:30 German Flash Manufacturing PMI. Estimate 58.1. Actual 58.2

- 3:30 German Flash Services PMI. Estimate 55.5. Actual 54.7

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 56.1. Actual 56.8

- 4:00 Eurozone Flash Services PMI. Estimate 56.0. Actual 56.2

- 4:00 Eurozone Current Account. Estimate 26.3B. Actual 37.9B

- 9:30 US FOMC Member Neel Kashkari Speech

- 9:45 US Flash Manufacturing PMI. Estimate 53.9

- 9:45 US Flash Services PMI. Estimate 53.7

- 10:00 US Existing Home Sales. Estimate 5.61M

Saturday (April 22)

- 16:15 US Treasury Secretary Robert Mnuchin Speech

Sunday (April 23)

- All Day – French Presidential Election

*All release times are EST

*Key events are in bold

EUR/USD for Friday, April 21, 2017

EUR/USD April 21 at 5:55 EST

Open: 1.0714 High: 1.0738 Low: 1.0710 Close: 1.0718

EUR/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0506 | 1.0616 | 1.0708 | 1.0873 | 1.0985 | 1.1122 |

EUR/USD was flat in the Asian session and has ticked lower in European trade

- 1.0708 is providing support

- 1.0873 is a strong resistance line

Further levels in both directions:

- Below: 1.0708, 1.0616 and 1.0506

- Above: 1.0873, 1.0985 and 1.1122

- Current range: 1.0708 to 1.0873

OANDA’s Open Positions Ratio

In the Friday session, EUR/USD ratio is unchanged. Currently, long positions and short positions are close to an even split, indicating a lack of trader bias as to what direction EUR/USD takes next.