EUR/USD Gaps Upward and U.S Index Downward, Eyes on German Ifo

EUR/USD inaugurated Monday trading session with a +23-pips upward and added additional gains +23-pips with 1.0849 high supported by Friday's positive Data and overwhelming political optimism . On the other hand, U.S index prolonged the bearish momentum for the second week in a row, and today the Index gaped downward with -$.042, and bottomed at 99.06 11-Nov-2016 fresh lows.

On Friday, markets were awaiting for the white smoke coming from of Trump's oval office with a positive vote to replace Obamacare health program, but unfortunately, a darker smoke was instead which added more negative weight and pressured U.S Dollar facing its classic rival EURO. Currently the pair is trading 1.0849, with one pip difference to re-reach today's high indicating additional bullish waves for the cable as a reminder of 2016 glorious levels for EUR/USD. In addition to that, Friday's heathcare decision consequences are still to impact USD.

Analysts at ANZ explained that the failure of Donald Trump’s replacement healthcare bill to make it through congress will be viewed by the market as a major setback for the ‘Trump trade’ (although market moves late on Friday were a little surprising).

Fundamentals :

1- EUR- German Ifo Business climate today at 9:00 AM GMT.

2- EUR- M3 Money Supply y/y today at 9:00 AM GMT.

3- EUR - Private Loans y/y today at 9:00 GMT.

4- USD - FOMC member Evans speech at 6:15 AM GMT.

Technical :

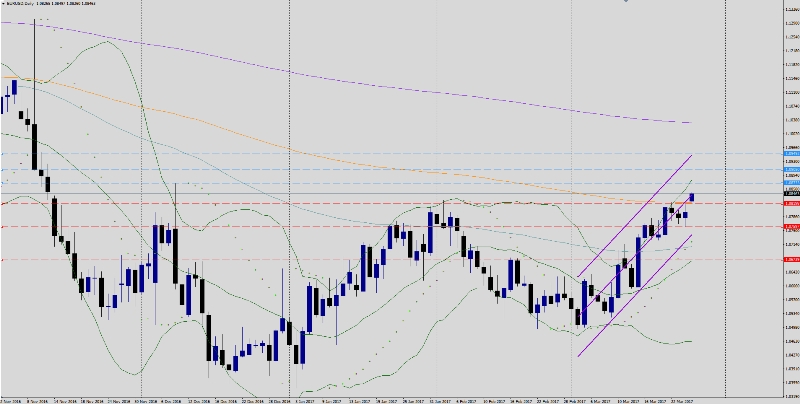

Trend : Bullish

Resistance levels : R1 1.0873, R2 1.0908, R3 1.0949.

Support levels : S1 1.0819, S2 1.0759, S3 1.0673

Remark : Taking the current situation of collapsing, the market posture is bullish and signals for a larger emerging upswing, hinting for a trending drive towards R2 level. Stable action over 1.800+ will encourage follow through rallies. A full retraction of Tuesday's range is needed to flip trade to a correction page, but only a close below S3 level is needed for trend reversal and the market to consider the cable bearish. EU data not be missed today, in addition to that, FOMC member Evans speech today where markets should look for hawkish tilts which might lift or save U.S Index from further declines.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.