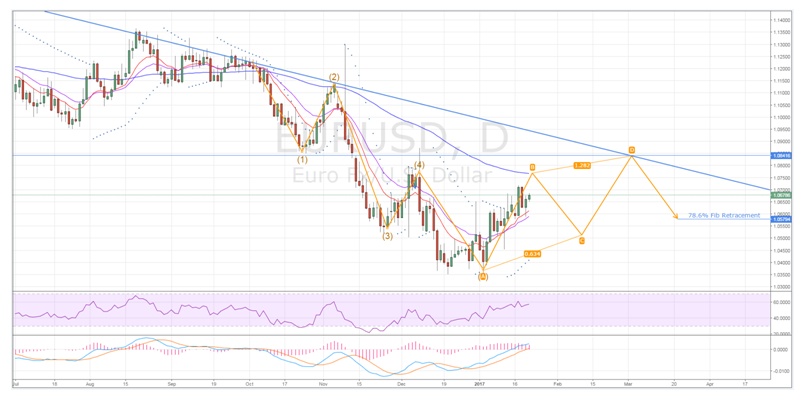

Key Points:

- ABCD wave remains intact despite volatility.

- Parabolic SAR and EMA bias should see the A leg complete.

- 100 day moving average should see the B leg begin in the correct place.

After having a rather torrid week, it’s worth having a check up on the long-term technical forecast for the EUR which was discussed last week. Specifically, given the large sentiment swings experienced by the pair, the corrective ABCD wave pattern could have been compromised which could limit the upside moving ahead.

Looking first at the daily chart, despite the last week or so of volatility, the EUR actually remains broadly in line with the forecasted “A” leg of the ABCD wave. Indeed, the recent spate of sentiment swings has kept the pair traveling towards its inflection point around the 1.0770 mark which should be reached within the next few sessions.

As for the technical signals indicating that the pair retains the momentum to actually complete the current leg, there are more than a few. Namely, the Parabolic SAR remains suggestive of continued bullish momentum, as do the 12 and 20 day moving averages. What’s more, the MACD and RSI oscillators are bullish, and neutral respectively, which indicates that the EUR should still be inclined to rally further.

Additionally, the current position of the 100 day EMA remains consistent with earlier forecasts which should encourage leg “B” to form at the correct juncture. Due to this dynamic resistance, we should see the requisite reversal even if fundamental upsets do occur over the coming sessions. However, the transition of the stochastics in to an overbought status will also begin to encourage the bears to wade back into the fray moving ahead.

From a fundamental perspective, it might at first seem unlikely that we can expect to see the USD weaken substantially given the Fed’s incessant reminders that rates will be raised in 2017. However, much of this rhetoric has now been priced in and announcements from the central bank are beginning to lose their bite. Moreover, the ultimate destination of the ABCD wave would actually be consistent with the process of normalising US rates so the forecast should stand moving ahead.

Ultimately, we can’t discount the impact of the change in the US administration which could result in a rather bumpy few weeks. As a result, we could see further wide swings in price which could obfuscate the ABCD wave. Additionally, the unfolding Brexit drama will likely compound this volatility which could contribute to any potential confusion. However, on the balance of things, there remains a strong chance of this pattern occurring and it is worth following moving ahead.