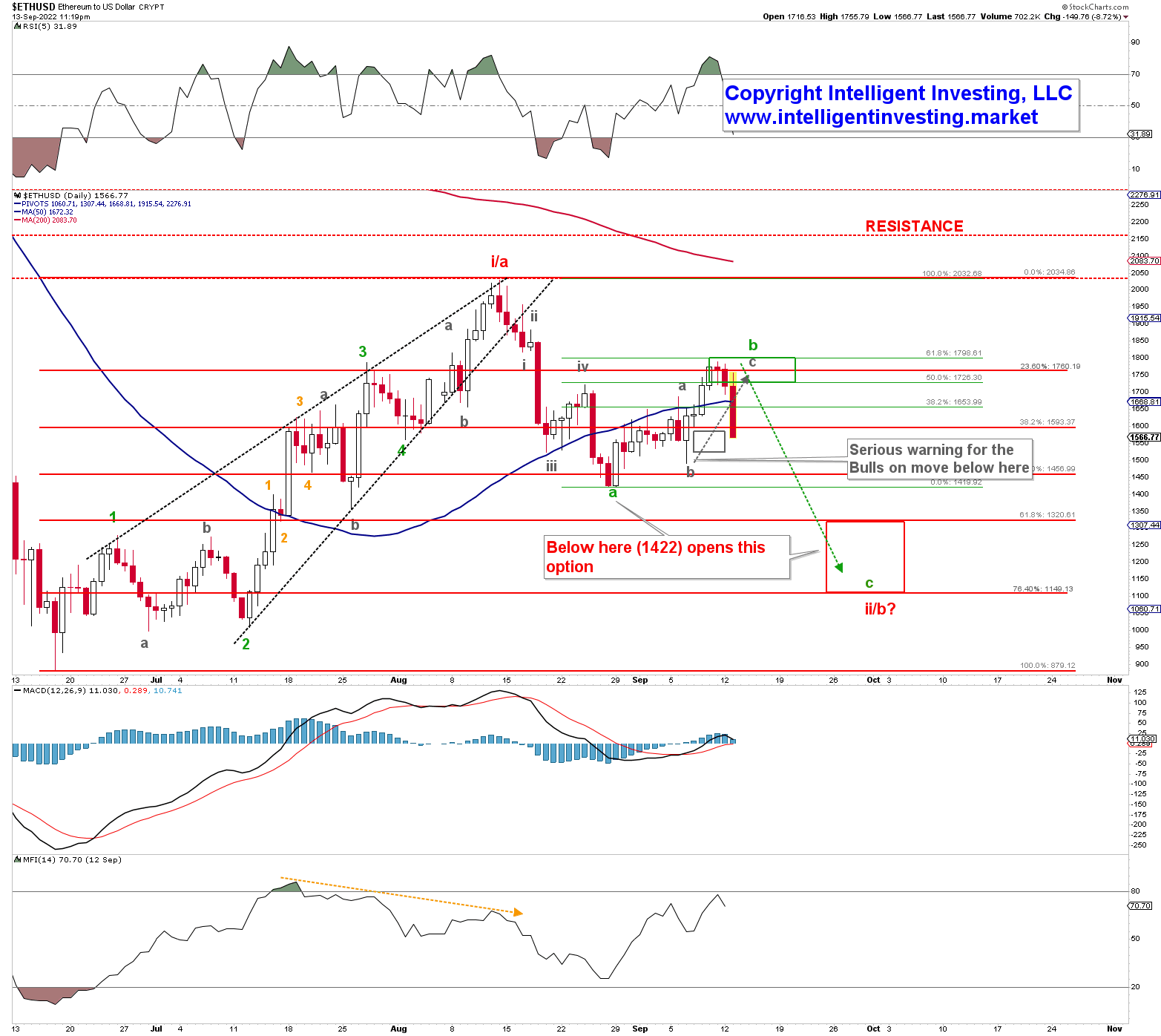

Per my Elliott Wave Principle (EWP) count, Ethereum (ETH/USD) most likely completed a leading diagonal (red) W-i/a from the June 18 low to the August 14 high. It has since been in a corrective price pattern. Corrections always comprise three waves (W-a, -b, -c). These three waves are made up of five (5) or three (3) waves, allowing for the following corrective patterns: 3-3-3 (triangle), 5-3-5 (zigzag), and (3-3-5 (flat). Since that August high, that corrective price action is what we got so far.

The decline into the late August low counts best as five waves lower (green W-a comprises five grey waves (i, ii, iii, iv, v). The rally from that low looks overlapping with three waves: grey W-a, -b, and -c to complete (green) W-b.

Thus, now Ethereum should be in (green) W-c of (red) W-ii/b. This setup will be confirmed on a move below the late-August $1422 low. Meanwhile, the Bulls are on full watch on a move below $1490, which will negate a Bullish setup. Below that (green) W-a low at $1422, and we can set our sights on $1320-1150 for a rather typical/classic 61.80-76.40% retrace of (red) W-i/a to complete W-ii/b. That, in turn, means the next rally, W-iii/c to ideally $3500, will get underway once the current correction is over. Conversely, I will become more Bearish if ETHUSD breaks below $1000, but that is not my preferred EWP-based POV for now.