European indices traded mixed yesterday, as investors may have stayed careful due to the fresh sanctions imposed on Russia. Wall Street traded in the green, but sentiment deteriorated again in Asia today. In the FX world, the Japanese yen continued to tumble, perhaps due to the widening monetary policy divergence between the BoJ and other major central banks.

EU Shares Mixed, Wall Street Gains, but Asia Slides, Yen Continues to Tumble

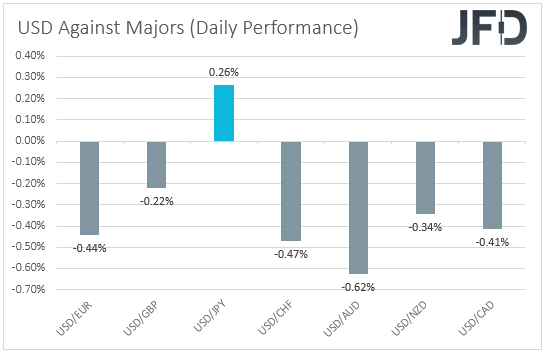

The US dollar traded lower against all but one of the other major currencies on Thursday and during the Asian session Friday. It lost the most ground versus AUD, EUR, and CHF, in that order, while the only currency against which the greenback eked out some gains was JPY.

The strengthening of the Aussie and the weakening of the yen suggest that the financial community continued trading in a risk-off fashion yesterday and today in Asia. However, the strengthening of the Swiss franc points otherwise.

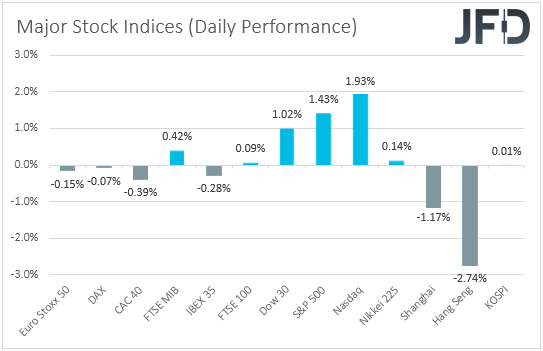

Thus, to clear things around the broader market sentiment, we prefer to turn our gaze to the equity world. That said, the picture is mixed there as well. Major EU indices traded mixed within a ±0.50% range, but Wall Street saw all three of its leading indices closing in positive territory. Sentiment deteriorated again during the Asian session today, with Hong Kong’s Hang Seng losing the most (-2.74%).

Yesterday, most of the preliminary PMI indices from the Eurozone and the UK, came in better than expected, sliding by less than forecast. At the same time, later in the day, the US ones even improved from their February readings. This suggests that the effects of the war in Ukraine on the global economy are not as severe as initially estimated, or they have not appeared yet.

In any case, EU indices were mixed, suggesting that investors stayed skeptical concerning adding more risk to their portfolios. This may have been the case due to the West agreeing to strengthen its forces in Eastern Europe and tighten sanctions on Russia. However, Wall Street participants were not held back, as they decided to take advantage of beaten-down shares of chipmakers and big growth names.

As we already noted, sentiment deteriorated again in Asia. As for our view, it did not change. It remains the same as yesterday, the day before, and the last few days. We still observe a pattern where the slides due to negative headlines are smaller than the advances we get when there are glimpses of hope.

And with most indices, especially the US ones, staying above the key resistance obstacles they overcame a few days ago, we still see decent chances for further advances in the short run. However, we remain reluctant to call for a long-lasting recovery, and this is because the war has not stopped yet. We will reexamine that approach when the conflict is over.

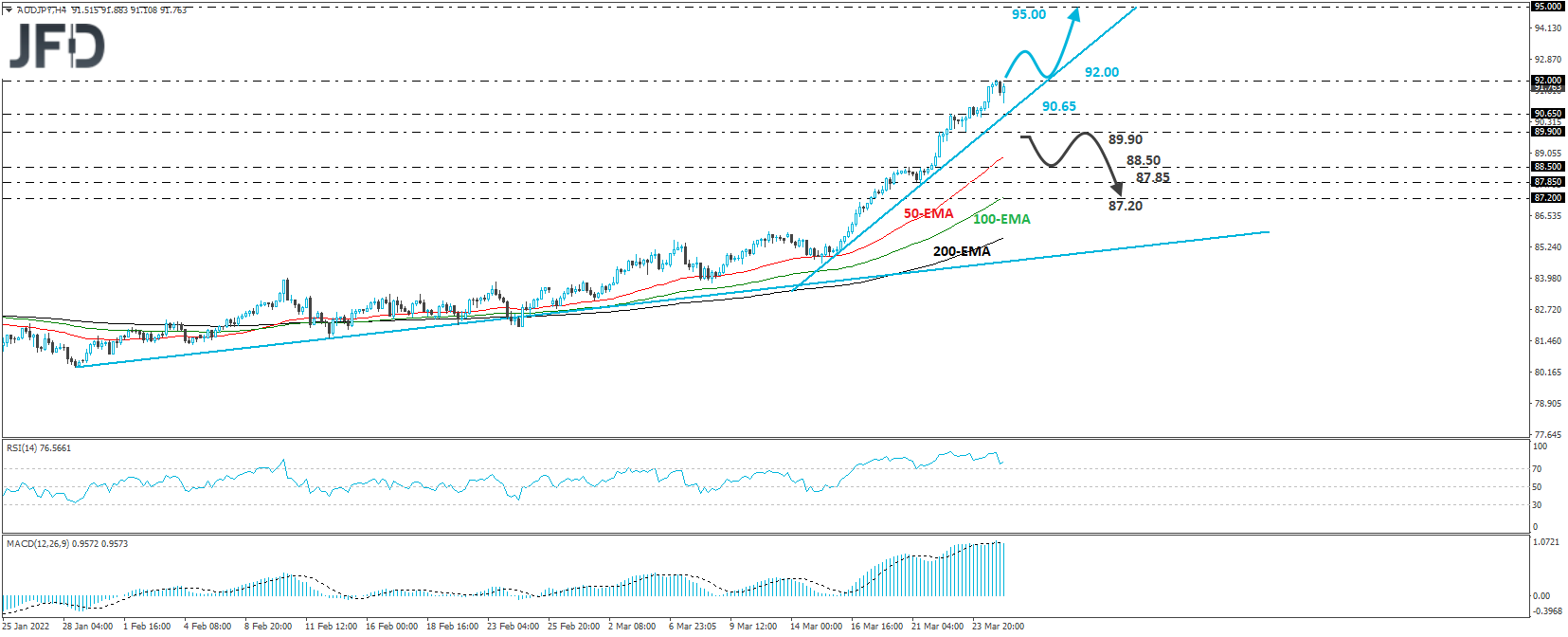

As for the FX world, we will consider AUD/JPY as one of the best pairs to exploit further improvement in market participants’ appetite. Aussie has been supported recently by high expectations over several rate hikes by the RBA this year, the rising commodity prices, and the latest recovery in equities.

On the other hand, the recovery in equities has worked against the yen, which may have also been suffering from the divergence in monetary policy between the BoJ and other major central banks. Even if appetite deteriorates, the monetary policy divergence and rising commodity prices due to fears of supply shortages may keep any losses in this exchange rate limited.

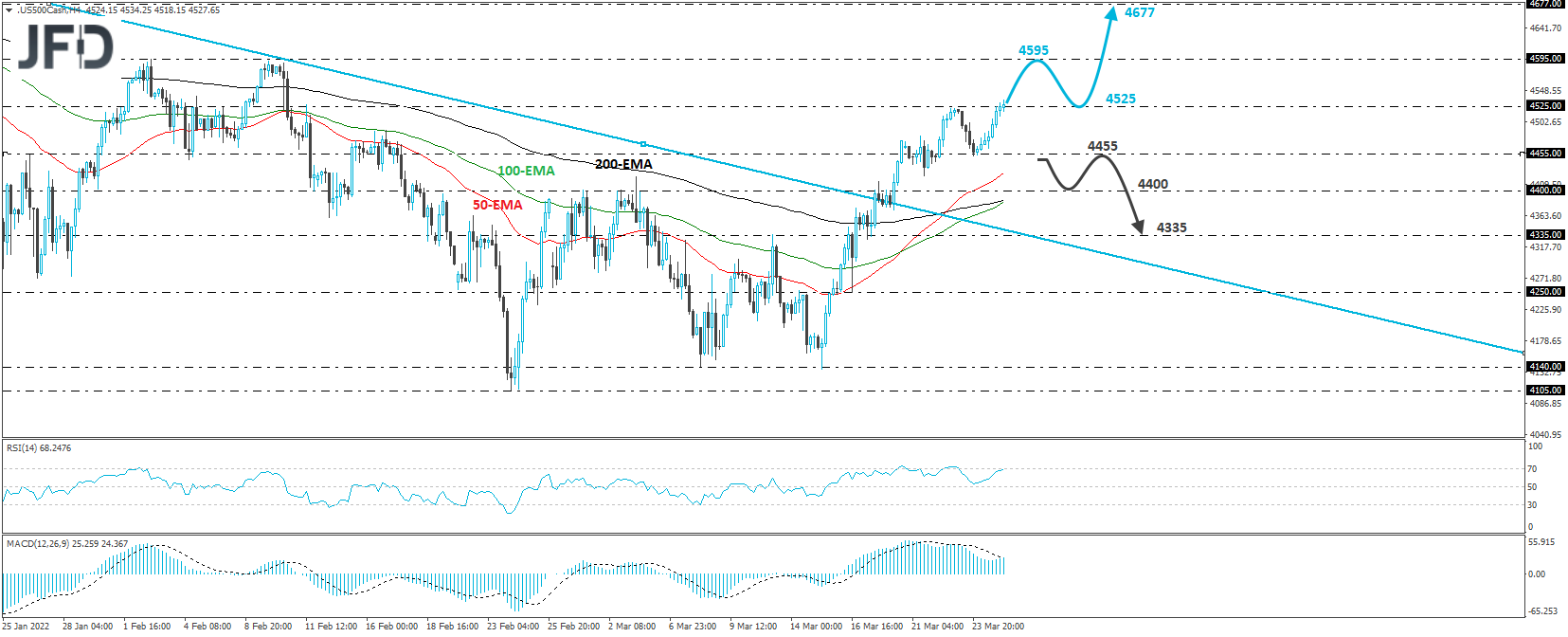

S&P 500 – Technical Outlook

The S&P 500 cash index traded higher yesterday after it hit support at 4455. Today, during the Asian session, it poked its nose above Tuesday’s peak of 4525, where a clearer break will confirm a forthcoming higher high. Given that the index continues to trade above the downside line taken from the high of Jan. 4 and above the key barrier of 4400, we will consider the near-term picture to be still positive.

If the bulls are strong enough to clear the 4525 zone, we could see them climbing towards the 4595 territory, marked by the peaks of February 2nd and 9th. If they manage to overcome it, they may get encouraged to push towards the 4677 zone, defined as resistance by the peak of Jan. 16.

On the downside, a dip below 4455 could signal the beginning of a decent short-term downside correction. The bulls could step aside for a while, letting the bears drive the price towards the 4400 zone, where another dip could extend the fall towards the 4335 hurdle, marked by the inside swing high of Mar. 11 and the low of Mar. 17.

AUD/JPY – Technical Outlook

AUD/JPY has been trading in a rally mode since Mar. 15, distancing itself further from the upside support line drawn from the low of Jan. 28. The rate has been respecting a steeper upside line lately, drawn from the low of Mar. 16, but yesterday, it hit resistance near 92.00 and pulled back.

In any case, the rate remains above that steep upside line, and thus, we see decent chances for the bulls to retake charge very soon. We believe that the bulls could recharge from near the crossroads of the 90.65 level and the aforementioned upside line drawn from the low of Mar. 16, something that could result in another test near 92.00.

A break higher could confirm a forthcoming higher high and set the stage for large advances, perhaps towards the psychological number of 95.00, also marked as resistance by the high of Jul. 1. We will abandon the bullish case and start examining the possibility of a decent correction south upon a dip below 89.90.

The rate will already be below the steep upside line, and the bears may decide to push towards the 88.50 line, marked by the inside swing high of Mar. 21. If they break lower, we could see them challenging the low of that same day, at 87.85, or the 87.20 zone, marked by an intraday swing low formed on Mar. 17.

As for Today’s Events

During the early European session, we already got the UK retail sales for February, but both the headline and core rates came in below estimates. As for the rest of the day, the calendar appears very light, with a couple of central bankers holding speeches. BoE MPC member Catherine Mann and New York Fed President John Williams are among them.