Market Brief

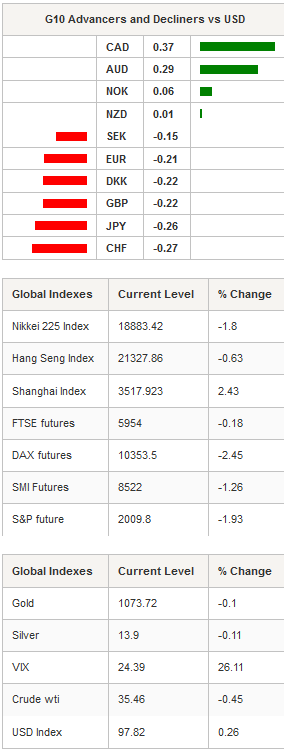

The People’s Bank of China lowered the renminbi for a sixth straight day against the backdrop of a persistent sell-off in equity markets. The central bank set USD/CNY to 6.4495, the highest level since July 2011, while in off-shore markets the pair reached 6.5608 in overnight trading. The weaker yuan helped mainland shares to stay in positive territory, while the sell-off continues everywhere else. The Shanghai and Shenzhen Composite were up 2.46% and 1.89% respectively. In Japan, the Nikkei 225 and the TOPIX were down 1.80% and 1.40%. In Hong Kong the Hang Seng fell 0.63%, while in South Korea the KOSPI erased 1.07%.

EUR/USD has been unable to break above the resistance lying at around 1.1030 as traders adjust their positions ahead Wednesday’s Fed meeting during which Yellen will most likely increased interest rates for the first time since 2006. The euro paired losses in Tokyo but remained in its hourly uptrend channel. A support lies at 1.0945 (50-day moving average), while on the upside, the 20dma standing at 1.0933 will act as resistance.

In the EM, the South African rand experienced a roller coaster ride with USD/ZAR reaching record highs on Friday before returning to 15.05 on Sunday as President Zuma reappointed Pravin Gordhan as Finance Minister. The rand was under heavy selling fire on since Wednesday after Jacob Zuma named David Van Rooyen finance minister in place of Nhlanhla Nene. However, President Zuma couldn’t resist the pressure and reappointed Ghordan who held the position from 2009 to early 2014. USD/ZAR dropped 5.30% and is now trading around 15.0860 as traders try to find their marks amid volatile environment.

On Sunday in Brazil, people gathered in the streets to protest against the government, demanding President Rousseff's impeachment. Even though the protests are adding pressure on Dilma Rousseff, the smaller scale of the demonstrations allowed Rousseff to remain silent on Sunday. The mounting political turmoil is definitely not helping the government to address the fiscal gap and is even dragging out the potential recovery further. The situation should not improve substantially over the first half of 2016 as impeachment proceedings will remain the main focus. USD/BRL closed at 3.8728 on Friday. The Brazilian real is expected to remain under pressure; however the latest developments have not helped clarify this point.

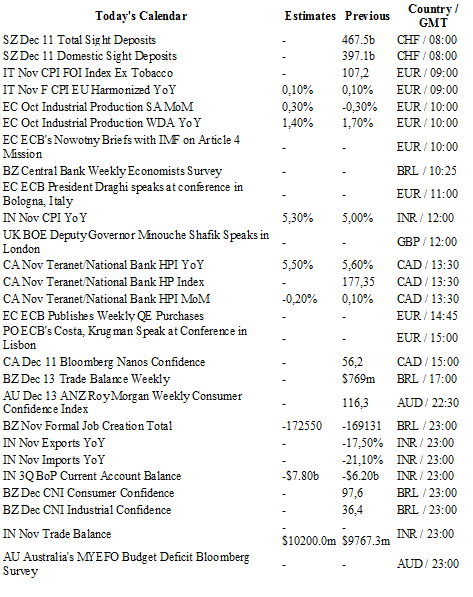

Today traders will be watching industrial production from the euro zone and Draghi’s speech in Bologna; inflation reports from India and Italy; exports and imports from India.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0963

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5336

CURRENT: 1.5180

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 121.29

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9856

S 1: 0.9476

S 2: 0.9259