The Ensign Group, Inc (NASDAQ:ENSG) reported record adjusted operating earnings of 40 cents per share in fourth-quarter 2017. The bottom line surpassed the Zacks Consensus Estimate of 36 cents. Earnings increased 33.3% year over year owing to higher revenues.

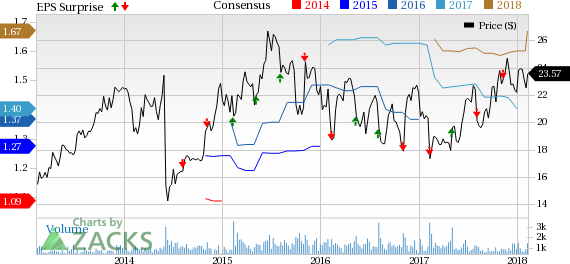

The Ensign Group, Inc. Price, Consensus and EPS Surprise

Net income was 21 cents per share, down 40% year over year.

Operational Update

Total revenues of $487.7 million increased nearly 12.6% year over year in the reported quarter and also beat the Zacks Consensus Estimate of $459 million.

Same store skilled nursing average daily revenue rates grew 4.9% year over year to $309.89 million. Same store managed care skilled nursing average daily revenue rates climbed 4.5% to $450.58 million, year over year.

Total Transitional and Skilled Services segment income was $39.9 million for the quarter under review, up 40.2% from the prior-year period.

Total Assisted and Independent Living Services segment revenues and income were up 13.7% to $35.8 million and 66.3% to $4.3 million, respectively, year over year.

Total Home Health and Hospice Services segment revenues and income were up 27.5% to $39.7 million and 27.7% to $5.8 million, respectively, year over year.

Total expenses rose 16.2% year over year to $461.6 million, primarily due to higher cost of services and general and administrative expense.

Full-Year Highlights

Adjusted operating earnings of $1.40 per share were in line with the Zacks Consensus Estimate.

Total revenues of $1.85 billion increased nearly 11.8% over the level in 2016 and also outpaced the Zacks Consensus Estimate of $1.80 billion.

Quarterly Segment Update

Transitional, Skilled & Assisted Living Services

The segment reported revenues of $403.5 million, up 11.5% year over year. Solid growth in skilled nursing and facilities drove this upside. Notably, the segment accounted for 82.7% of the total revenues in the fourth quarter.

Home Health & Hospice Services

For this segment, total operating revenues were $39.7 billion, up 27.4% year over year. This segment contributed 8.1% to the total revenues.

Other Services

This segment reported revenues of $8.7 million, up 1.3% from the prior-year quarter. This segment accounted for 1.8% of the total revenues.

Financial Update

Total cash and cash equivalents decreased 26.6% to $42.3 million as of Dec 31, 2017 from $57.7 million as of Dec 31, 2016.

As of Dec 31, 2017, long-term debt was $302.9 million, up from $275.5 million at the end of 2016.

Cash from operations in 2017 was $72.9 million, down 1.3% year over year.

Dividend Update

Ensign Group paid 4.50 cents per share, up 5.9% over the past year.

2018 Guidance

Management expects earnings in the range of $1.80-$1.87 per share, up from $1.58 to $1.66.

Revenues are anticipated to remain within the band of $2-$2.06 billion.

Zacks Rank & Performance of Other Insurers

Ensign Group carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other firms in the medical sector having reported fourth-quarter earnings so far, the bottom line of Anthem Inc. (NYSE:ANTM) , Humana Inc. (NYSE:HUM) and UnitedHealth Group Inc. (NYSE:UNH) beat the respective Zacks Consensus Estimate.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Humana Inc. (HUM): Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Anthem, Inc. (ANTM): Free Stock Analysis Report

The Ensign Group, Inc. (ENSG): Free Stock Analysis Report

Original post

Zacks Investment Research