This article was originally published at TopDown Charts

- Stronger oil prices should link into a better outlook for the traditional energy sector

-

Earnings revisions momentum provides a near-term catalyst while valuation indicators suggest energy equities are relatively cheap

-

The sector has sour sentiment among investors and positioning is light—these contrarian signals support healthy returns in the years ahead

Don’t Count Out Energy Just Yet

It’s been a wild ride for investors in the energy space. The Energy Select Sector SPDR® Fund ETF (NYSE:XLE) rallied from under $30 in the third quarter last year to nearly $60 in June. A 20 percent June-July pullback shook out weak hands while crude oil remains near its rebound highs.

Elevated Oil Price

Crude oil is in consolidation mode in the near term, but a lack of energy capex spending supports a reduced supply outlook amid a global economic recovery which should boost demand. Overall, this macro combination suggests higher oil prices in the coming months and years.

Positive Earnings Revisions

An improving fundamental backdrop in oil prices is coupled with positive earnings revisions in the sector—net earnings revisions are running at the highest rate in more than 15 years for energy firms. Oil & gas companies have become more disciplined with their approach to cash flow of late, which leads to stronger profits. We’ll get another glimpse into the EPS story in the coming days as Q2 reporting season unfolds.

Cheap Relative Valuations

Valuations among energy stocks are attractive, though the exorbitantly cheap levels seen a year ago have vanished. Relative valuations versus the S&P 500 are still favorable. Compared to global (Brent) oil prices at $74/bbl, energy stocks appear cheap, too.

Chart of the Week

The Chart of the Week might be familiar to market-watchers, but we added a twist. 13 years ago oil peaked near $150/bbl and retail gasoline prices in the USA were north of $4. Imagine the headlines if oil suddenly rocketed north of $100—the inflation news articles would be something to behold.

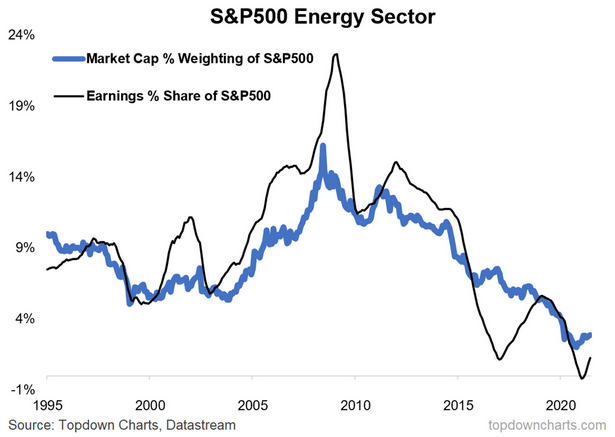

Jump ahead to today, and the S&P 500 energy sector’s weight is under 3 percent; a huge fall from its mid-2008 peak above 15 percent. Our twist to the chart is an overlay of the energy’s earnings contribution percentage to the S&P 500. After peaking near 23 percent during the commodity boom of the mid to late 2000s, it dropped to the low single-digits after the commodity collapse of the mid-2010s and has generally held that meager level.

There has been a slight uptick in recent quarters.

Chart of the Week: S&P 500 Energy Sector Weight and Earnings Contribution

Moreover, investor positioning to the sector is less than 1 percent (as measured by the US energy ETF AUM percentage of all US equity ETFs). (It topped out just shy of 2.5 percent in 2011.)

ESG Capping Flows?

Traditional oil & gas companies rarely receive positive press these days with the rise of ESG investing. Our Weekly Macro Themes report shows a chart of Google Search Trends mentioning “ESG Investing”—up and to the right for years on end. ESG’s hope for a brighter future has cast a dark cloud on oil stocks has depressed oil & gas company valuations, elevating the sector’s expected returns.

Conclusion

We like the earnings outlook for the sector given where oil prices trade and our bullish stance on global capex outside of energy. We already see analysts upping their earnings estimates for oil & gas companies while the relative valuation picture is compelling. Also, soft sentiment and low investor positioning in traditional energy stocks amid a boom in ESG flows continue to keep the sector inexpensive.

Finally, high oil prices provide a tailwind going forward.